Masahiro Kawai, Dean and CEO, Asian Development Bank Institute

Ganeshan Wignaraja, Principal Economist, Office of Regional Economic Integration, Asian Development Bank

The inability to conclude the World Trade Organization (WTO) Doha Development Round has spawned a proliferation of bilateral and plurilateral free trade agreements (FTAs) across the globe. While East Asia is a relative newcomer to FTAs, the region has seen a dramatic increase in the number of such agreements in recent years. The explosion of FTAs in East Asia, led by the large economies of Northeast Asia—the People’s Republic of China (PRC), Japan, and the Republic of Korea (ROK)—is tied to the need to support sophisticated production networks through continued trade and investment liberalization, while also serving as a defensive response to the spread of FTAs elsewhere in the world.

A lively debate over the impact of FTAs on business in the region has resulted from their proliferation (see Baldwin 2006, Chia 2010).

Data from East Asian exporters on FTA utilization were lacking prior to an Asian Development Bank (ADB) firm-level multi-country survey conducted in 2007/08. The survey results suggest that FTAs are indeed bolstering trade among firms, despite some concerns expressed over restrictive rules of origin (ROOs), particularly as economic recovery takes hold in the wake of declining trade volumes and nascent protectionism triggered by the recent global economic crisis. Governments can facilitate the increased use of FTAs by actively disseminating information to firms on existing FTAs and adopting best practices in designing future FTAs, including ROOs.

East Asian economies are using FTAs to aggressively pursue their individual and collective trade strategies, leading to the expansion of advanced production networks across the region with hubs in Japan and the PRC. Rather than complicating efforts toward a Doha Round agreement, a region-wide FTA can contribute to laying the foundation for such an agreement.

This brief is set out as follows. It begins by discussing East Asia’s emergence as a global factory and the spread of FTAs. It then examines varieties of national FTA strategies in Northeast and Southeast Asia. The brief goes on to analyze information on FTA use, impediments, and ROOs based on the ADB multi-country survey. Finally, it explores a possible way forward, highlighting short-term measures as well as a region-wide FTA for the medium term.

Global Factory and the Spread of FTAs

East Asia’s ascent from a poor underdeveloped agricultural backwater to a global factory over a 50-year period is widely regarded as an economic miracle (Stiglitz 1996,Lall 2001). By 1990, the region had already accounted for 23% of world exports (largely manufactures) and this figure increased to 26% by 2008. Japan’s industrial rise had a catalytic effect on neighboring economies and the first generation of newly industrialized economies (Hong Kong, China; the ROK; Singapore; and Taipei,China) emerged. A second generation soon followed including Malaysia, the PRC, Thailand, and Viet Nam. A combination of factor endowments, favorable initial conditions, national policies, and firm-level strategies contributed to East Asia’s emergence as a global factory.

FTAs were not initially part of East Asia’s dynamic growth story and were largely absent from the region prior to the 2000s. Instead, outward-oriented development strategies, high domestic savings rates, the creation of strong infrastructure, and investment in human capital were key domestic policy ingredients. A booming world economy hungry for labor-intensive imports from East Asia, falling tariffs in developed country markets, inflows of trade related foreign direct investment (FDI), generous foreign aid flows, and supplies of inexpensive and productive labor all favored outward-oriented growth in East Asian economies. These economies were geographically close to an expanding high-income Japan, while efficient multinational corporations (MNCs) were also seeking to relocate production to less costly economies in East Asia.

Toward the end of the 20th century, this simple story of outward orientation and export success was altered bya change in the nature of East Asia’s international trade policy toward FTAs. Alongside multilateralism, Asian economies began emphasizing FTAs as a trade policy instrument in the late 1990s and the region is today at the forefront of world FTA activity (Baldwin 2006, Kawai and Wignaraja 2009). In 2000, only three FTAs were in effect in East Asia, including the Association of Southeast Asian Nations (ASEAN) Free Trade Area (AFTA), while another 10 were in various stages of preparation. However, in just a decade, the number of FTAs in the region increased more than tenfold. By May 2010, East Asia had emerged at the forefront of global FTA activity, with 45 FTAs in effect and another 84 in various stages of preparation. Underlining East Asia’s commitment to open regionalism, most of these agreements are with partners outside East Asia.

Explaining East Asia’s FTA Proliferation

Four main factors underlie the recent spread of free trade agreement (FTA) initiatives in East Asia (see Kawai and Wignaraja 2009, and Chia 2010). First among these is market-driven economic integration through trade, foreign direct investment, and the formation of East Asian production networks and supply chains. An increasing number of East Asia’s policy makers believe that FTAs, if given wide scope, can support the growth of trade and foreign direct investment through the further elimination of cross-border impediments. Thus, FTAs can be regarded as part of a supporting policy framework for deepening production networks and supply chains formed by global multinational corporations and emerging East Asian firms.

Second, European and North American economic regionalism—including the expansion of the European Union into central and eastern Europe as well as the Baltic countries, the creation of a European monetary union, and the success of the North American Free Trade Agreement (NAFTA) and its planned move toward the Free Trade Area of the Americas—has motivated East Asian policy makers. Increasingly, East Asian governments have realized the need to step up integration to (i) improve international competitiveness through the exploitation of scale economies, (ii) strengthen their bargaining power, and (iii) raise their voice on global trade issues.

Third, the 1997/98 Asian financial crisis made it clear that East Asia needed to address common challenges in the areas of trade and investment in order to sustain growth and stability. This need has not yet been fulfilled through regional initiatives to strengthen the international economic system or through national efforts to strengthen fundamentals. Once the largest economies in the region— the PRC and Japan—began to undertake FTA initiatives, however, other economies started to bandwagon on these efforts out of fear of exclusion.

Finally, slow progress in the WTO Doha Development Round negotiations encouraged countries to consider FTAs as an alternative approach. While discussions have continued behind the scenes, prospects for an early Doha deal have diminished. Meanwhile, pro-business Asian countries are emphasizing bilateral and plurilateral FTAs for the continued liberalization of trade in goods and services, as well as the adoption of the Singapore issues—trade facilitation, investment, government procurement, and competition policy—which remain beyond the current scope of the WTO.

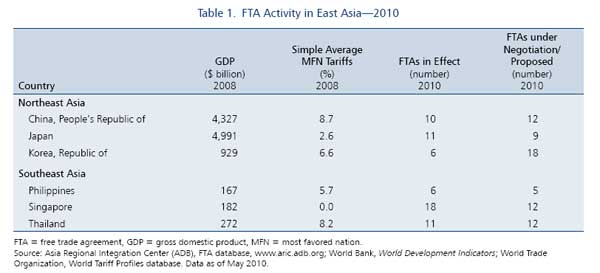

The region’s largest economies are increasingly the leading players in the spread of FTAs. Japan has implemented 11 FTAs; the PRC, 10; and the ROK, 6. And perhaps even more significant, these three economies collectively have some 32 agreements in the pipeline. With the exception of Singapore, the smaller economies of Southeast Asia have only recently been aggressive in forging FTAs, mainly by taking collective action through ASEAN. In addition to previously negotiated FTAs with the PRC, the ROK, and Japan, two ASEAN FTAs (a comprehensive agreement with Australia and New Zealand, and a goods agreement with India) took effect in January 2010 for most ASEAN members and their trading partners.

Varieties of National FTA Strategies

FTA activity in Asia over the last decade has given rise to classic hub-and-spoke trade arrangements (Hufbauer and Schott 2009). The development of FTA hubs and spokes can be attributed to a country’s economic size, per capita income, level of protection, and economic geography, as well as the production network strategies of MNCs. As Table 1 shows, East Asia’s largest and most open economies initiated the proliferation of FTAs and have become key hubs, while smaller neighbors have in some cases emerged as spokes.

Asia’s cost-effective advanced production networks, initially spearheaded by Japan and now increasingly used by the PRC, have led to spectacular global export success over the past several decades and they continue to deepen across the region (Baldwin 2006). Falling regional trade barriers and logistics costs, along with technological progress, underlie this trend. Intraregional trade in Asia has increased significantly, particularly in parts and components, and it will continue to expand further through regional liberalization brought about by FTAs. Rising factor costs in core production locations have been a prime driver. Falling regional trade barriers and logistics costs, as well as technological progress, spurred the decentralization of production networks to the most cost effective locations. Accordingly, East Asia’s intraregional trade increased significantly from 37% of total trade to 52% between 1980 and 2008, led by trade in parts and components (ADB 2008).

Northeast Asia

Japan has rapidly implemented bilateral economic partnership agreements (EPAs) with 10 countries,1

in addition to an agreement with ASEAN, and it is negotiating agreements with Australia, India, and the ROK. As the region’s first developed economy, Japan also has the strongest base of giant MNCs involved in production networks and supply chains throughout Asia. Toyota and Sony, among others, have been driving the fragmentation of production activity to the most cost effective locations along with just-in-time manufacturing practices. A primary motivation for Japan’s engagement in FTAs is to provide a market-friendly and predictable regional business environment for its MNCs.

The PRC is forming FTAs to ensure market access for its goods, expand outward investment, and solidify its position as a regional hub of advanced production networks. The PRC’s rapid economic rise has given it a pivotal position as a hub of final assembly in global production-sharing arrangements among the region’s largest industries, including electronics and automotives. The PRC accounts for about 12% of world exports and components account for two-thirds of its imports. To this end, the PRC implemented separate FTAs on goods and services with ASEAN and is now finalizing negotiations on an investment agreement.

In addition, the PRC has forged bilateral comprehensive EPAs with Hong Kong, China and the Macau Special Administrative Region of the PRC, and FTAs with Chile and Pakistan. It is also a member of the Asia–Pacific Trade Agreement (APTA). More recently, the PRC concluded FTAs with Singapore and New Zealand in 2008.

By forging FTAs with the world’s largest traders—the European Union (EU) and the United States (US)—the ROK has become even more aggressive recently in its FTA policy than both the PRC and Japan. In part, this reflects the country’s ambition to act as an industrial and investment gateway to Asia. The EU–ROK FTA is expected to be signed later in e2010 and become the region’s most comprehensive WTO-plus agreement. The equally comprehensive US–ROK FTA was signed in June 2007 and is awaiting ratification. The ROK also has agreements with members of APTA and ASEAN, as well as Singapore, within East Asia; and with Chile and the European Free Trade Area (EFTA) countries outside of East Asia.

Southeast Asia

ASEAN, as one of the oldest trade agreements in Asia, is emerging as a major regional hub linking its member economies with the region’s larger economies. Having earlier enacted FTAs with the PRC, Japan, and the ROK, ASEAN recently concluded negotiations on agreements with India as well as Australia and New Zealand. Meanwhile, the ASEAN–EU FTA negotiations, which were launched in May 2007, were temporarily suspended in March 2009. Following a green light from EU member states in December 2009, the EU is expected to pursue FTA negotiations with individual ASEAN member countries starting with Singapore in early 2010.

Singapore is by far ASEAN’s most active economy in terms of its number of FTAs and their geographic coverage. With its strategic location, position as the region’s most open economy, and world-class infrastructure and logistics, Singapore is the regional headquarters for many leading MNCs. Singapore is seeking access to new overseas markets, particularly in the services and investment fields. The country is a founding member of AFTA and it has implemented or concluded agreements with the largest Asian economies—the PRC, India, Japan, and the ROK—as well as economies outside the region, including Australia and the US. The US–Singapore FTA, which has been in effect since 2004, was the first such agreement made by the US in Asia and it is viewed as a model agreement in terms of its scope.

Middle-income ASEAN economies such as Malaysia and Thailand have emerged as regional production hubs for the auto and electronics industries, respectively. As one of the founding members of ASEAN, Thailand has entered into FTAs with Australia, the PRC, India, Japan, and New Zealand.

The Philippines’ first bilateral agreement, with Japan, took effect in December 2008. Yet, with some exceptions, the region’s poorer economies—Cambodia, Lao People’s Democratic Republic (Lao PDR), Viet Nam, the Philippines, and Indonesia—have tended to rely on ASEAN for concluding FTAs with the region’s larger economies. This may reflect weak institutional capacity, a lack of technical and administrative resources, and limited leverage to undertake FTA negotiations in poorer economies. As such, the ASEAN framework offers the possibility of pooling scarce capacity and resources.

How Do Firms See FTAs?

Concerns about FTAs and the ADB Multi-Country Survey Properly designed FTAs keep trade and FDI flowing, even when crises strike. Yet, the plethora of overlapping and complex FTAs in East Asia carries the risk of becoming unwieldy and making business cumbersome. Influenced by Jagdish Bhagwati’s famous remark about a “spaghetti bowl” of FTAs, which was later adapted to describe a “noodle bowl” of Asian FTAs, critics argue that the explosion of deals that include complex rules and variable tariffs has increased transaction costs, particularly for small and medium-sized enterprises (SMEs), which are those that can least afford them (Bhagwati 2008). However, the impact of FTAs on those most directly affected—the region’s export-oriented firms—had not been directly observed prior to the ADB firm-level multicountry survey in 2007/08.

A prevalent view is that East Asia has low FTA utilization rates, with the agreements being viewed as discriminatory and a drain on scarce trade negotiation capacity in developing countries. To test this hypothesis, the ADB study sought the views of and experience with FTAs from 841 manufacturing firms based in the PRC, Japan, the ROK, the Philippines, Singapore, and Thailand (for more details, see Kawai and Wignaraja 2011).2

The multi-country survey’s participating firms were from the electronics sector (33%), followed by the automotive (21%) and textile and garments (17%) sectors. The remaining firms were exporters of chemicals and pharmaceuticals, metals and machinery, and processed foods. SMEs (100 or fewer employees) comprised 33% of the survey sample, “large” firms (101–1,000 employees) made up 44%, and “giant” firms (more than 1,000 mployees) comprised the remaining 22%.3

Firms were selected from a sample frame that comprised exporters from key industries in each economy, using a simple random sampling method. Each country-level survey used a core questionnaire containing questions elating to enterprise characteristics, FTA use, impediments to FTA use, perceptions of multiple ROOs, and sources of institutional support. All interviews were conducted in person or over the phone.

Net Benefits of FTAs

The survey results show that businesses in the region tend to view FTAs as a benefit rather than a burden, and that they use them to expand trade to a far greater degree than had been previously thought. The benefits of FTAs include wider market access and preferential tariffs that make it easier to import intermediate materials needed for finished goods. The multiplicity of ROOs, which are the criteria required to determine the national source of goods for a variety of purposes (e.g., quotas and labelling), may add some administrative and transaction costs. But the large majority of exporters do not view ROOs as a significant hindrance to business activity. Meanwhile, bilateral and plurilateral FTAs are seen as having countered protectionist tendencies amid the recent economic uncertainty. These agreements also provide a valuable stepping stone toward broader trade liberalization in support of economic recovery.

Higher Use of FTAs

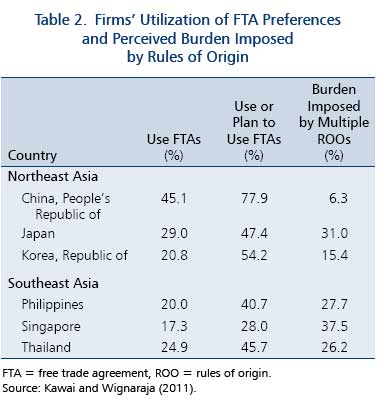

The percentage of surveyed firms utilizing FTA preferences was higher than expected: about 28% of respondents were using FTA preferences, while another 25% had plans to do so. When taking into account firms’ plans to use FTAs, in addition to their current use, the greatest FTA activity by far was observed in the PRC (Table 2). Next was the ROK, followed closely by Japan, demonstrating once again that the larger economies of Northeast Asia are leading efforts to take advantage of FTAs as a means to expand trade. Within ASEAN, firms in the Philippines and Thailand are among the highest actual and planned users of FTAs, while firms in Singapore make relatively limited use of FTAs.

The higher level of FTA use in the PRC could be attributed to the aggressive buildup of new and expanding production networks that have required a channeling of resources across the region. The relatively high levels of actual and planned FTA use in Japan may be explained by (i) the presence of giant manufacturing firms that serve as anchors for regional production networks and (ii) networks of private sector industry associations and public trade support institutions that provide services to help business adapt to FTA guidelines. On the other hand, the ROK, which only entered into its first FTA in 2004, may simply be ramping up its FTA activities.

Thailand’s top rank among ASEAN members in the use of FTAs is likely the result of the country’s emergence as a regional production hub in the automotive sector, high rates of export-oriented FDI, and the government’s reliance on FTAs as a tool of trade policy. The low rate of FTA use by firms in the Philippines and Singapore may be due to several factors. For example, Philippine exports are concentrated in electronics, which already have low most favored nation (MFN) tariff rates. Singapore, even with its high-export orientation and large number of FTAs, may find less need for FTA use given its open trading system and low tariff margins.

What Explains Non-Use?

The majority of East Asian firms do not currently use FTA preferences. Several factors explain this non-use of FTA preferences: a lack of information, small preference margins, delays and administrative costs associated with ROOs and other administrative procedures relating to FTAs, and nontariff measures (NTMs) imposed by FTA partners. Impediments to FTA use vary by country. In the PRC, for instance, more than 45% of responding firms (102 firms) indicated a lack of information on FTAs as the biggest impediment, followed by low margins of preference (14%). In the ROK, low margins of preference (36%) and a lack of information (34%) were the major reasons—while delays and administrative costs linked to ROOs and NTMs were considered less important. In the Philippines, a lack of information was overwhelmingly the most important impediment (70%), followed by delays and administrative costs, and ROOs (31%). Addressing these impediments could lead to even higher potential use of FTAs in the future.

Restrictive Rules of Origin?

ROOs are devices to determine which goods will enjoy preferential tariffs in order to prevent trade deflection among FTA members. ROOs are a potentially challenging aspect of Asian FTAs and were identified by some survey participants as a hindrance to wider FTA use because they raise transaction costs for firms in general as well as SMEs, which have less ability to meet such costs, in particular.

Evidence from the survey suggests that multiple ROOs impose only a limited burden on firms in East Asia (Table 2). Of the 688 firms that responded to the question on this issue, 138 firms (20%) said that multiple ROOs do significantly add to business costs. Meanwhile, the bulk of the sample firms did not think that ROOs were a problem at present.

The aggregate figure masks interesting country-level variations in perceptions. Singaporean firms had the most negative perceptions of multiple ROOs (38%), while the PRC’s firms had the least negative perceptions (6%). Between these two extremes were Japanese, Philippine, Thai, and Korean firms. No clear divide exists in the attitudes toward ROOs between firms based in Northeast and Southeast Asia. It appears instead that differences in the perception of ROOs among the region’s firms are more dependent on national FTA strategies, industrial structures, and the quality of institutional support at the country level.

The survey also suggests that larger firms in Asia have somewhat more negative perceptions of multiple ROOs than do SMEs, which was an unexpected finding. However, large established firms tend to have multiple export markets and thus need to change their business plans in response to FTAs. Therefore, they are more likely to complain about multiple ROOs. In contrast, smaller firms tend to have a single export market and hence do not have as much basis for complaint. Meanwhile, variations in perception exist across countries and firm sizes, but there does not seem to be much variation in perceptions across economic sectors. Finally, most firms want to be able to choose between ROOs included in FTAs and support having alternative ROOs for the same products.

A Possible Way Forward

FTA-led regionalism seems here to stay in East Asia for at least three reasons. First, the large economies of Northeast Asia—the PRC, Japan, and the ROK—are at the forefront of efforts to use FTAs to pursue their respective regional and global trade strategies. Meanwhile, ASEAN members are increasingly entering into FTAs as a means to expand trade and increase their participation in East Asia’s advanced production networks. Second, the stalled WTO Doha Round of trade negotiations means that FTAs are a vehicle to support the deepening of production networks through trade and investment liberalization. And finally, even if the Doha Round were to be concluded in 2011, FTA activity would continue as many of the “new age” agreements go well beyond what is on the negotiating table and deal with investment, competition, intellectual property, and public procurement (the so-called Singapore issues).

New evidence from the ADB firm survey suggests that the spread of FTAs in East Asia has brought net benefits, including keeping intra- and inter-regional trade flowing, particularly at a time when world trade had collapsed. The firm survey also suggests higher levels of FTA use in East Asia than previously thought. And it seems that more FTA use in East Asia can be expected in the future. Closer cooperation between government agencies and business associations is necessary to improve FTA use. A pragmatic approach would also include applying best practices to the design of future FTAs and proactively providing businesses with information on tariff schedules, ROOs, and other FTA provisions.

The finding of a limited burden imposed by multiple ROOs does not mean that policy makers should be complacent about the issue. As the number of concluded agreements increases, it is possible that multiple ROOs may become more of a problem for firms. Supportive measures—such as encouraging a rationalization of ROOs and upgrading their administration—are needed to mitigate the negative effects of the Asian noodle bowl in the future. Widespread gains are possible from pursuing a simplified approach to ROOs in East Asia involving harmonized ROOs, the cumulation of value contents, and coequality of ROOs. Likewise, the adoption of international good practices in ROO administration would be useful. This may include the introduction of a “trusted trader program,” as is the casewith the North American Free Trade Agreement (NAFTA), that would allow qualified applicants to self-certify their own certificates of origin; a switch to business associations issuing certificates of origin for a fee; the increased use of information technology-based systems of ROO administration; and training programs for SMEs.

In the medium term, the consolidation of overlapping FTAs into a region-wide agreement would enhance the region’s business environment and possibly even contribute to breaking the impasse over the stalled Doha Round. The merits in forming a large region-wide FTA to consolidate the plethora of bilateral and plurilateral agreements, and to address the Asian noodle bowl problem is increasingly recognized in East Asia. One practical way forward might be to take thebest features from each East Asian FTA and design a “boilerplate regional agreement” that is both comprehensive in scope and consistent with WTO rules.

ASEAN—with the region’s oldest FTA—is emerging as an integration hub for a region-wide FTA in East Asia. Australia–New Zealand, the PRC, India, Japan, and the ROK are in the process of implementing their respective FTAs with ASEAN. With key ASEAN+1 agreements under way, the ongoing policy discussion in East Asia is focusing on three region-wide proposals to guide future policy-led integration in the region: (i) an East Asian FTA (or ASEAN+3 FTA), (ii) a Comprehensive Economic Partnership Agreement (or ASEAN+6 FTA), and (iii) an APEC-wide FTA building a Transpacific Strategic Economic Partnership Agreement (or TPP). An optimal solution would be to adopt a sequential approach to develop a region-wide FTA (see Kawai and Wignaraja 2008 and 2010). This would initially involve an East Asian FTA, if India were slow to liberalize, that would later be expanded into a Comprehensive Economic Partnership Agreement.

Subsequently, the Comprehensive Economic Partnership Agreement could be connected with the US and other APEC members, and it could be used to forge a partnership with Europe. While the economic logic favors a sequential approach, geopolitics may shape the ultimate outcome and actual sequence.

The formation of such a region-wide FTA may make it easier to achieve a deep WTO Doha Round trade deal as many of the concessions on agriculture and industrial goods might already be incorporated into the regionwide agreement. It would also spur the growth of Asian trade and investment through a larger regional market, the realization of economies of scale, and technology transfer, thereby facilitating a rebalancing of the region’s growth. Further, it would offer insurance against rising protectionist sentiments that pose a risk to Asia’s trade and economic recovery.

Brunei Darussalam, Chile, Indonesia, Malaysia, Mexico, Philippines, Singapore, Switzerland, Thailand, and Viet Nam.

Longer versions of the individual country studies are available at www.adbi.org/research.free.trade.agreements.asia/

Nine firms taking part in the survey did not provide information on their respective sizes.

References

Asian Development Bank (ADB). 2008. Emerging Asian Regionalism: A Partnership for Shared Prosperity. ADB.

Baldwin, R. 2006. Multilateralizing Regionalism: Spaghetti Bowls as Building Blocks on the Path to Global Free Trade. World Economy 29 (11). 1451–1518.

Bhagwati, J.N. 2008. Termites in the Trading System: How Preferential Agreements Undermine Free Trade. Oxford: Oxford University Press.

Chia, S.Y. 2010. Regional Trade Policy Cooperation and Architecture in East Asia. ADBI Working Paper 191. Tokyo: Asian Development Bank Institute.

Hufbauer, G.C. and J.J. Schott. 2009. Fitting Asia-Pacific Agreements into the WTO System. In R. Baldwin and P. Low, eds. Multilateralizing Regionalism: Challenges for the Global Trading System. Cambridge: Cambridge University Press. pp. 554–635.

Kawai, M. and G. Wignaraja. 2008. EAFTA or CEPEA: Which Way Forward? ASEAN Economic Bulletin 25 (2). 113–139.

Kawai, M. and G. Wignaraja. 2009. Multilateralising Regional Trade Arrangements in Asia. In R. Baldwin and P. Low, eds. Multilateralizing Regionalism: Challenges for the Global Trading System. Cambridge: Cambridge University Press. pp. 495–549.

Kawai, M. and Wignaraja, G. Forthcoming 2010. Regional Trade Agreements in Integrating Asia. In M. Kawai, J.W. Lee and P.A. Petri, eds. Asian Regionalism in the World Economy: Engine for Dynamism and Stability. Cheltenham, UK: Edward Elgar.

Kawai, M. and G. Wignaraja, eds. Forthcoming 2011. Asia’s Free Trade Agreements: How is Business Responding? Cheltenham, UK: Edward Elgar.

Lall, S. 2001. Competitiveness, Technology and Skills. Cheltenham, UK: Edward Elgar.

Stiglitz, J. 1996. Some Lessons from the East Asian Miracle. World Bank Research Observer 11 (2). 151–177.