Peter A. Petri and Michael G. Plummer

© Peter G. Peterson Institute for International Economics. All rights reserved.

SUMMARY

The Trans-Pacific Partnership (TPP) agreement, now in negotiation among nine Asia-Pacific countries, could yield annual global income gains of $295 billion (including $78 billion for the United States) and offers a pathway to free trade in the Asia-Pacific with potential gains of $1.9 trillion. The TPP’s expected template promises to be unusually productive because it offers opportunities for the leading sectors of emerging-market and advanced economies. An ambitious TPP template would generate greater benefits from integration than less demanding alternatives, but it will be harder to sell to China and other key regional partners as the TPP evolves toward wider agreements. The importance of Asia-Pacific integration argues for an early conclusion of the TPP negotiations, without jeopardizing the prospects for region-wide or even global agreements based on it in the future.

INTRODUCTION

The Trans-Pacific Partnership (TPP), currently at an advanced stage of negotiation, began as a small agreement but now has big implications.[1]

The TPP would strengthen ties between Asia and the Americas, create a new template for the conduct of international trade and investment, and potentially lead to a comprehensive free trade area (FTA) in the Asia-Pacific. It could generate large benefits—greater than those expected from the World Trade Organization’s (WTO) global Doha Development Agenda. This Policy Brief reports on our ongoing quantitative assessment (with Fan Zhai) of the TPP and other Asia-Pacific integration efforts.[2]

Since the last major multilateral trade agreements were concluded nearly two decades ago, the action on trade rules has shifted from global to bilateral and regional agreements. In 2000 there were six trade agreements among member economies of the Asia Pacific Economic Cooperation (APEC) forum; today there are 47, with more in the works. Groups of “like-minded” partners appear better able to reach agreements that achieve mutual gains, address wider issues, and mitigate opposition. The WTO reports 319 such agreements now in force worldwide.[3]

Renewed progress on trade and investment rules could prevent backsliding on existing agreements and generate much-needed engines for global economic growth.[4]For now, regional negotiations offer the best options for making such progress.

Against this challenging background, the United States and eight (potentially 11) partners on both sides of the Pacific are working to shape the TPP into a cutting-edge, 21st century agreement. US participation, first proposed by President George W. Bush, has become a centerpiece of President Barack Obama’s trade policy. The negotiation is complicated and ambitious in terms of issues and membership.[5]

If successful, it could stimulate trade by benefiting the competitive industries of both emerging-market and advanced economies. And it could yield an innovative model for consolidating the “noodle bowl” of existing trade agreements.[6]

The TPP is a crucial step on what is becoming a “Trans-Pacific track” of trade agreements. The track already includes the P4 agreement among Brunei, Chile, New Zealand, and Singapore and many bilateral agreements spanning the Pacific. A parallel “Asian track” includes a major cluster of agreements centered on the Association of Southeast Asian Nations (ASEAN), negotiations among China, Japan, and Korea, and proposals for pan-Asian FTAs. The Trans-Pacific and Asian tracks are already stimulating mutual progress. The TPP may have been motivated by past Asian agreements, and it appears to have led to a new investment agreement among China, Japan, and Korea and to the expected launch of free trade negotiations among the three later in 2012.

Free trade agreements often have geopolitical objectives, and the Asia-Pacific tracks are no exceptions. The TPP emerged as a US priority some years ago, but it has recently become identified with the “rebalancing” of US foreign policy toward sustaining a US presence in Asia. Asian agreements, in turn, have aimed to promote the ASEAN Economic Community, improve political relations in Northeast Asia, and define “space” for an emerging China. Much commentary in the press and from academic observers has focused on these political issues and, more often than not, has viewed them from a zero-sum perspective. For example, the TPP has been portrayed as an effort to contain China, “a kind of economic warfare within the Asia Pacific region.”[7]

Meanwhile, some American observers describe Asia-only agreements as attempts to establish Chinese hegemony in the region at the expense of a US role.[8]These harsh perceptions are amplified by interest groups that attempt to influence the negotiations.

Whatever the merits of such political narratives, economics suggests much more constructive interpretations. The TPP and Asian tracks are large, positive-sum projects that promise substantial gains to all participants. Together, they are a dynamic process—an example of competitive liberalization— that could lead to better rules for Asia-Pacific and perhaps global trade. To be sure, the interests of countries diverge in many details. Asian emerging-market economies, for example, prefer to focus liberalization on goods trade and allow extensive exceptions for sensitive products. Advanced countries, in turn, favor comprehensive liberalization and coverage of “new” issues that affect their leading sectors. But importantly, these divergences mainly affect the sharing of what could become a much larger pie.

A CONTEST OF TEMPLATES

From the viewpoint of large economies like the United States and China, the benefits from the smaller regional trade agree- ments have less to do with immediate gains than with their influence on the future trading system. Thus, the much- remarked competition between the Trans-Pacific and Asian tracks appears to be a “contest of templates” for organizing future cooperation, not economic warfare between them. From an economic perspective, neither group of countries would benefit from dividing the region into blocks, but each could gain from rules that improve the terms of trade for its strongest sectors. The tracks can be considered moves in a strategic game; they are “disagreement points” in a bargaining process with large positive-sum results.

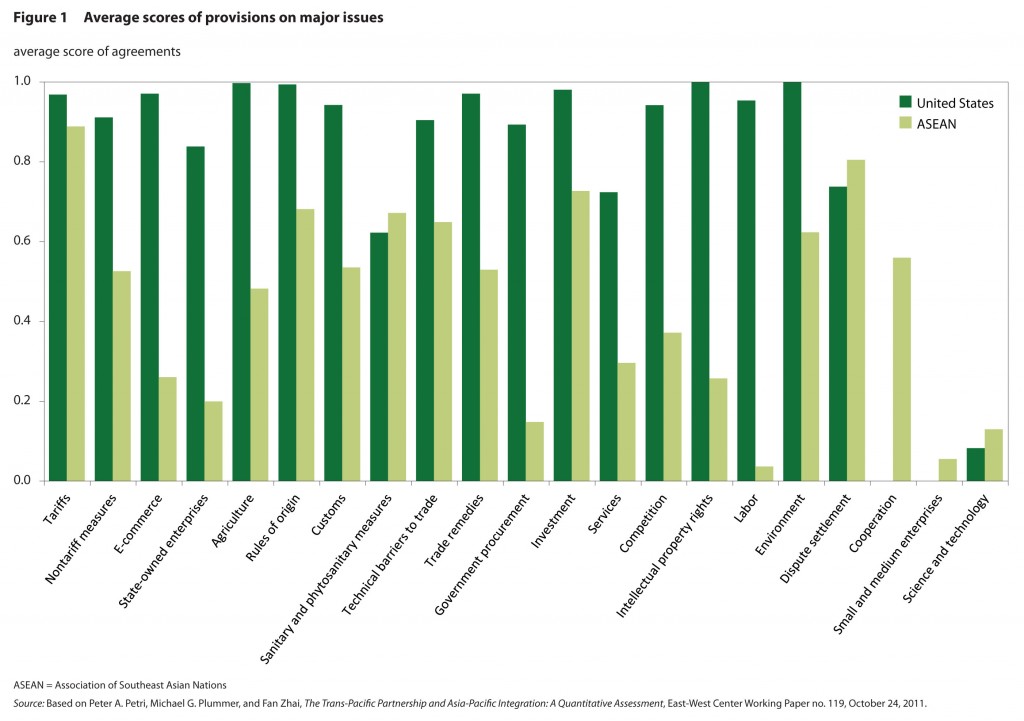

The contrast in templates can be documented. Our research shows that recent US and ASEAN trade agreements have both included large eventual reductions in tariffs (96 and 90 percent of most favored nation [MFN] levels, respectively), but Asian agreements have been slower to take effect and have more exceptions. There are even more marked differences between templates in approaching nontariff barriers. We used detailed information from the text of past agreements to “score” provisions on 21 issues, accounting for the proportion of potential disciplines covered, the depth of such coverage, and the enforceability of provisions. As figure 1 shows, US agreements had higher scores than ASEAN agreements on average, and especially in provisions related to competition, intellectual property rights, government procurement, state- owned enterprises, and labor. ASEAN agreements had higher scores than US agreements in a few areas, including dispute resolution and cooperation (typically provisions on capacity building). Neither set of agreements received high marks on small and medium enterprises and science and technology, areas that are also expected to be covered by the TPP.

What explains these differences? As already noted, Asian templates are negotiated by mainly emerging-market economies with comparative advantages in manufacturing—hence the focus on market access for goods. The templates nego- tiated by the United States reflect the interests of advanced economies in services, investment, and intellectual property, and sometimes agriculture. They also emphasize rules-based approaches that are common in a developed-country institutional setting. Both templates include measures to attract domestic political support, but those too reflect their political setting: Asian agreements focus on cooperation and technology, and US agreements on labor and the environment.

Since potential gains from trade are especially significant among diverse economies, the ideal template will offer market access for the manufacturing industries of emerging-market economies as well as good rules for the service, investment, and technology sectors of advanced countries.[9]

Asian templates prepare the ground for cooperation by addressing primarily goods liberalization, but the TPP is likely to go further by liberalizing sectors that lead in both types of economies, thus expanding opportunities for trade between them. Advanced economies led the liberalization of goods trade in earlier global rounds and are now seeking similar access for industries in new areas of comparative advantage. The economic case for a comprehensive template is not that it represents US interests (although that will be the argument made in US politics) but that it expands the scope of liberalization and thus potential gains to all participants.

Despite its advantages, a comprehensive agreement among all major Asia-Pacific economies does not appear to be feasible in the current macroeconomic and political context. Thus, China is unlikely to agree now to various concessions—on state-owned enterprises, services, intellectual property, and labor—that the United States would likely demand to open its markets further. The contest of templates is therefore bound to continue until more favorable conditions develop for bridging differences. But conditions could improve over time, and the tracks themselves, as argued below, could facilitate convergence and compromise.

ECONOMIC IMPLICATIONS OF THE TPP AND ASIAN TRACKS

Some detractors of regional agreements, including prominent economists, criticize all such initiatives because they are not multilateral. They implicitly assume that diversion effects— harm to excluded countries—will dominate the benefits of regional trade and investment creation. Most importantly, they underestimate, on one hand, the hurdles facing global negotiations, and on the other, the positive “domino effects” of regional agreements on subsequent negotiations.

To assess these effects, we explored the implications of Asia-Pacific trade agreements using a state-of-the-art model of global trade and investment. We added rich detail on tariff and nontariff barriers and, recognizing that such barriers will not be fully eliminated, estimated realistic reductions based on the provisions of past agreements. We began by generating baseline projections for 2010–2025, assuming plausible growth patterns and the scheduled implementation of all 47 existing trade agreements among Asia-Pacific economies (including, for example, the Korea-US agreement and the ASEAN Economic Community Blueprint).

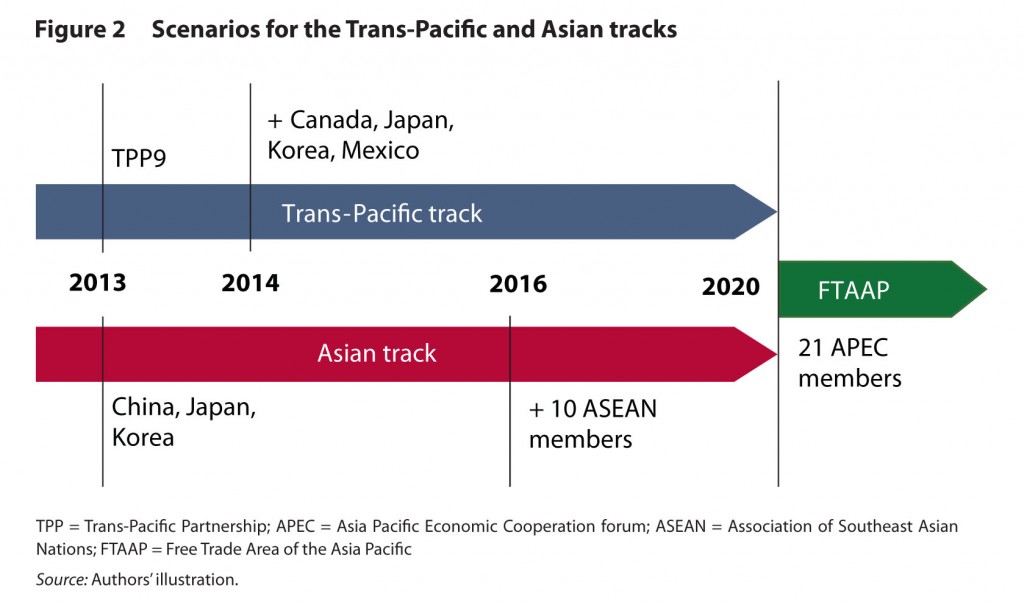

We then simulated future agreements with varied assumptions about their timing, membership, and content. For the TPP track, we assumed an agreement among nine partners in 2013 and the addition of four other countries (Canada, Japan, Korea,[10]

and Mexico) one year later. For the Asian track, we assumed a China-Japan-Korea agreement in 2013 and a pact with the ten ASEAN economies three years later.

In some scenarios, we assumed that the tracks would then lead to a region-wide FTA in 2020. We defined that outcome as an agreement among the 21 APEC economies—essentially the Free Trade Area of the Asia-Pacific (FTAAP) endorsed in several APEC Leaders’ Declarations. As discussed below, region-wide free trade could be achieved by various means, but the FTAAP is a useful prototype. These scenarios are illus- trated in figure 2; many more are discussed in our technical report. In each case, we assumed that an agreement would come into force the year after it was signed and would then take five years to implement. The structures of agreements were based on the average templates of recent agreements involving the United States (TPP track) and ASEAN (Asian track).This tight timeline enables our simulations to capture the full effects of the agreements in a reasonable timeframe.

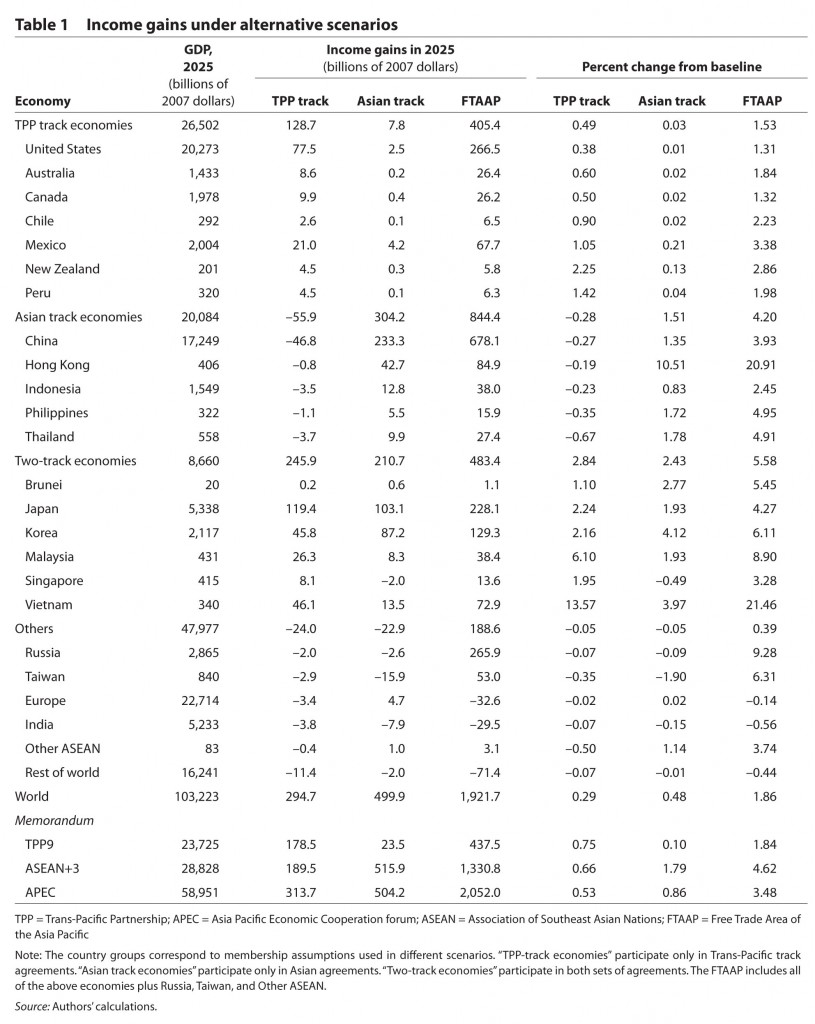

Table 1 reports the income effects generated by the simulations. Both tracks of agreements would generate substantial gains by 2025, especially if they lead to the FTAAP. By 2025, the TPP track would yield global annual benefits of $295 billion, and the Asian track $500 billion. Gains from region- wide free trade would reach $1,922 billion, or 1.9 percent of world GDP. The results also show that Asian agreements, although less ambitious than the TPP, would yield greater gains—they address larger preexisting trade barriers. And they suggest that about 20 percent of the total gains would be associated with foreign direct investment (FDI). All of these numbers are large absolutely and comparatively—for example, Gary Clyde Hufbauer and colleagues recently estimated the benefits from a Doha Development Agenda agreement in the $63 billion to $283 billion range.[11]

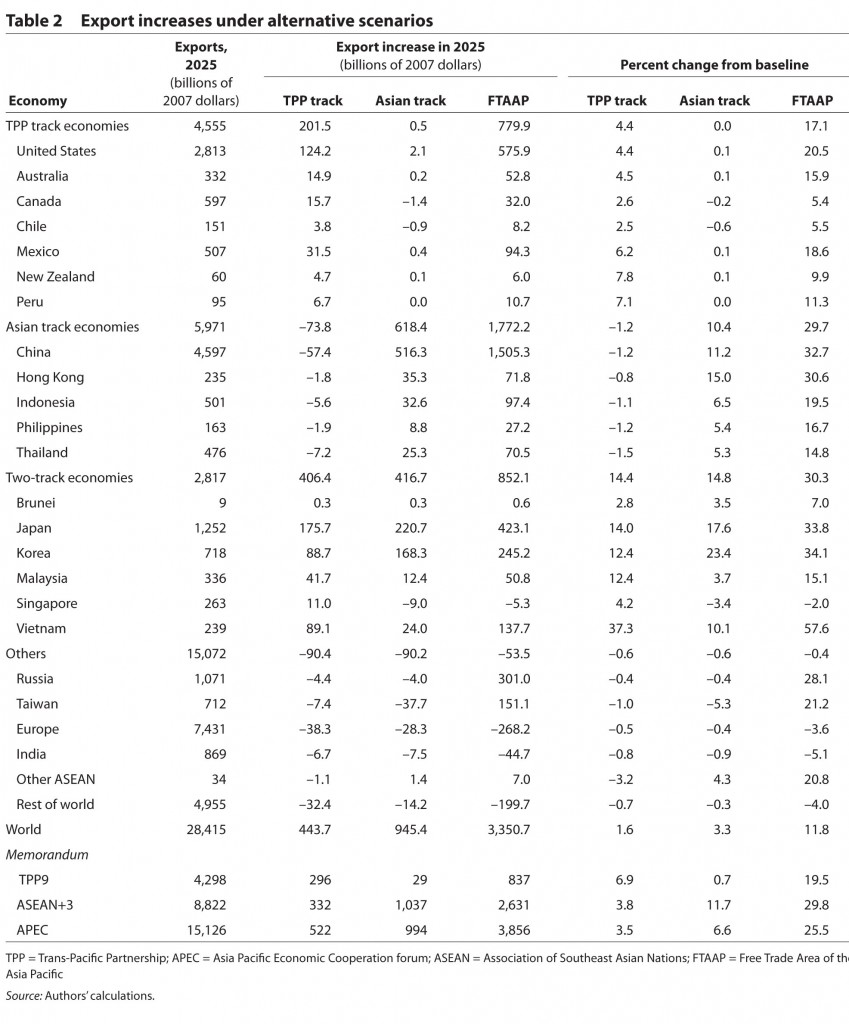

Table 2 reports the trade changes generated by the simulations.[12]

Both tracks would increase trade substantially, but the effects of an FTAAP are especially striking, leading to a 12 percent increase in world trade. As the world’s second-largest exporter after Europe, China would be most dramatically affected, with results ranging from modest trade diversion under the TPP, in which China is not assumed to participate, to large export increases from initiatives in which it does. While an Asia-Pacific wide FTA would lead to great increases of Asia-Pacific trade, it would also generate enough trade diversion from Europe, India, and the rest of the world to raise the prospects for a global initiative.

All of these estimates are uncertain, of course, subject to many assumptions about the content of future agreements and the model itself. The results reported here are based on assumptions that seemed to us most reasonable—for example, unlike most other studies, we assume that FTA tariff preferences will not be fully utilized—but experiments with alternative choices suggest substantial variations. The results are relatively large, since they are based on a model that recognizes the heterogeneity of firms within each economy.[13]

Simulations that limit the application of this new theoretical structure[14]produce income gains that are 41 percent lower. The difference between the benefits of region-wide free trade under the Asian and TPP templates is 44 percent; this seems to us to be a reasonable estimate, but its size illustrates the importance of assumptions about the content of agreements. Variations in other parameters, for example affecting FDI estimates, can easily change estimates by +/–5 percent.[15]The results offer strong support for US interest in Asia-Pacific free trade. The United States is estimated to gain $78 billion annually on the TPP track and $267 billion with region-wide free trade. These benefits are driven in part by exports, which would increase by $124 billion (4.4 percent over the baseline). Export gains would come mainly in advanced sectors including business and financial services and in agriculture and food. Manufacturing exports would increase, but overall the United States would become more import-dependent in manufacturing to offset its expanding service export surplus. We estimate that one-third of US gains would be driven by the investment provisions of the TPP; outward FDI stocks would increase by $169 billion (1.9 percent over the baseline) and inward FDI stocks would increase by $47 billion (1 percent over the baseline). Even with these large absolute changes, given the scale of the US economy the benefits would be more modest compared with GDP (0.4 percent on the TPP track and 1.3 percent from region-wide free trade). Also, under the phasing and membership assumptions used in this study, the benefits would build up gradually; the percentage gains in 2015 and 2020 would be about one-tenth and one-half as large as those estimated for 2025, respectively.

Every other economy participating in one or both tracks can also expect substantial gains. Small economies and those with large initial barriers would gain the most. The greatest absolute gains on the TPP track are estimated for Japan ($119 billion) and reflect in large part inward foreign investment afforded by the liberalization of Japan’s service and other investment sectors. The greatest absolute gains on the Asian track would accrue to China ($233 billion) because it is large relative to Asian partners and because its regional final goods exports initially face considerable protection. The largest percentage gains on the TPP track are estimated for Vietnam (14 percent), which would become a much-expanded manu- facturing hub in textile, garment, and other industries, and on the Asian track for Hong Kong (11 percent), due to its role as a service and investment center.

Finally, the results indicate that these benefits are mainly the result of trade creation, not trade diversion from excluded countries. Some trade diversion is evident on both tracks (the largest losses are projected for China and the rest of the world on the TPP track and for Taiwan and India on the Asian track), but the great majority of gains is due to new trade and investment. In nearly all cases, the losses that result from diversion are also small relative to the affected economy’s GDP.

What the model does not capture are the intangible effects of renewed momentum toward global economic integration. The consequences could include enhanced investor confidence and better macroeconomic performance around the world; increased competition and cooperation leading to faster productivity growth and more innovation; and even improved political relationships. It is impossible to put probabilities or values on these large effects, but they could easily overwhelm the direct effects reported above. The importance of secondary effects is arguably reflected in the acceleration of world growth and convergence toward market economics following major waves of liberalization in the past.

DYNAMICS ON THE TRACKS

Once in motion, the tracks should develop momentum. Each will generate incentives for enlargement and stimulate progress on the other. The mutual development of the tracks, in turn, will create incentives for consolidation. The tracks appear to be incentive-consistent: Each forward step is rewarded by gains and justifies further steps.

In the early stages of the Trans-Pacific and Asian tracks, most gains would be generated by preferential access granted to smaller partners in the large markets of the United States and China, respectively. This would mean, for example, solid benefits for countries like Vietnam, Malaysia, and Peru in the case of the TPP. The gains would be more muted initially for the United States and China. However, as larger partners such as Japan and Korea join each track, the benefits expand also for China and the United States.

In the intermediate stages several countries are likely to join both tracks. Under our assumptions, these include Brunei, Japan, Korea, Malaysia, Singapore, and Vietnam, but Australia, Indonesia, New Zealand, the Philippines, and Thailand may eventually emulate them. The incentives to join the tracks will grow as they get larger, and competition between the tracks will encourage concessions to get others on board. Signing on early will be attractive, since it will give countries more influence on their terms of participation. By the end of this middle stage—in 2020 under our assumptions—most Asia-Pacific economies should have preferential access to most Asia-Pacific markets. Given such privileged positions, Japan and Korea, for example, would have gains equal to 91 and 90 percent, respectively, of the total potential gains from region-wide free trade.

The final stages of this “game” would leave the United States and China among the few countries without preferential access to both of their large markets. For them, the grand prize would be a consolidated agreement, offering nearly four times the benefits that they can obtain from the Asian and TPP tracks alone. At the same time, other economies will have little incentive to push for consolidation, so leadership at the final stage will have to come from China and the United States. Much will therefore depend on their cooperation, which could take many forms—a bilateral FTA, a region-wide FTAAP, or even wider initiatives that include Europe and a new global trade round.

The route to full regional integration is hard to divine, but it would be very profitable. An Asia-Pacific FTA[16]

would yield annual benefits of $1.3 trillion to $2.4 trillion (1.5 to 2.7 percent of world GDP) depending on the template used to achieve it. As already noted, these gains are much larger than estimates for the Doha Development Agenda because the expected liberalization commitments are much greater. The high estimates are defined by the TPP template, requiring near-complete tariff reductions and strict disciplines on nontariff barriers. The low estimates assume an Asian template; our intermediate estimate ($1.9 trillion in table 1) is based on an average of the two. Each template favors (at least in terms of percentages) its members, but the size of the pie, not how the slices are cut, is what really matters. Even Asian economies would gain more from regional integration based on the TPP template.

Thus, region-wide free trade appears to be the logical endpoint of the two Asia-Pacific tracks. In a decade or so, the benefits of consolidation will have become clearer for business, especially in China and the United States. By 2020, it may be also easier to agree on a template. As Chinese per capita incomes rise, markets will increasingly manage its complex economy. Both China and the United States will have adjusted to the new realities of the world economy and gained experience (and hopefully trust) in dealing with each other. Much will still depend on geopolitics, but the economic case for region-wide integration will be clear and compelling.

POLICY IMPLICATIONS

In sum, the TPP and Asian negotiating tracks promise substan- tial, widely distributed benefits. These benefits will depend on whether the tracks proceed to region-wide integration and on the template used—objectives that will be hard to achieve and suggest difficult tradeoffs. There are large risks that the tracks will fail or head off in irreconcilable directions. Leaders and negotiators will have to reach the right balance between scope and quality, and they will have to prevent acrimony in the early stages of the tracks that could block region-wide integration later. Negotiators may know when to compromise, but this fragile process will be also tested by special interests and blogs that clamor for attention with extreme positions.

Four salient implications emerge. First, much is at stake in reaching an effective, early agreement among TPP partners— whether 9, 12, or ideally more. In the foreseeable future, improvements in the global trading system will depend on the TPP and Asian tracks, and for now, with 12 intensive rounds of negotiation already completed, the TPP is setting the pace.

Second, the negotiations have to reflect two strategic objectives: high standards and full Asia-Pacific economic integration. The goal is an ambitious template that applies widely to the regional trading system. An operational target might be an agreement that “leads by a decade”—one with disciplines both strong and inclusive enough to be acceptable to any reform-minded economy in the region in 10 years. Given the multiplicity of special interests, achieving this result will depend on leadership from heads of government.

Third, a new, collegial dialogue that connects the Trans- Pacific and Asian tracks of negotiations would be of great value. Such a relationship could encourage the substantive overlap of the tracks and reduce political frictions between them. It could affect whether the tracks learn from each other and adopt common “best practices.” Formats might include technical exchanges, discussions among senior officials, or an Eminent Persons Group. APEC’s and the WTO’s technical offices could also facilitate dialogue: They have expertise on technical issues and can offer nonbinding consultation and advice.

Fourth, since the tracks could lead to friction between the United States and China, at least for a while, attention also needs to focus on a third track—direct cooperation between the two countries on trade and investment. The Strategic and Economic Dialogue (S&ED) offers avenue for such initiatives, and the political climate appears to be improving for them. The process could begin with issues where compromises are now possible—an example is the relaunch of investment negotiations in the May 2012 S&ED. Future work could focus on issues such as subsidies, government procurement, export controls, China’s market economy status, services liberalization, and intellectual property. Over time, these efforts could address all major building blocks of regional agreements and chip away at differences. They should make region-wide FTA negotiations increasingly feasible.

An integrated Asia-Pacific economy and good rules for trade and investment are important for the United States, the Asia-Pacific region, and the world. The Trans-Pacific and Asian tracks, and especially the TPP, represent pathways to integration. There is reason to hope that their coherent development will help to achieve this integration to realize APEC’s Bogor Goals of free trade and investment in the Asia-Pacific and perhaps export its template to the world.

Copyright Peterson Institute for International Economics. Reposted with permission. Please see the full article on the PIIE website.

[1]The negotiations originated in the Trans-Pacific Strategic Economic Partnership (so-called P4) agreement among Brunei, Chile, New Zealand, and Singapore. They now include Australia, Malaysia, Peru, Vietnam, and the United States. Canada, Japan, and Mexico have also indicated interest in the agreement but their participation in the negotiations is uncertain at the time of this writing.

[2]The results reported here are based on a model described in Peter A. Petri, Michael G. Plummer, and Fan Zhai, The Trans-Pacific Partnership and Asia-Pacific Integration: A Quantitative Assessment, East-West Center Working Paper no. 119, October 24, 2011. That study will be updated shortly in publications by the Peterson Institute for International Economics and the East-West Center. As anticipated in the 2011 version, we expanded the scope of our preliminary estimates to include (a) foreign direct investment effects and (b) the effects of trade liberalization on the “extensive margin” of trade, that is, exports by companies not involved in international markets before liberalization. These and other changes have increased estimated benefits. The efforts to refine the model’s assumptions and database continue and may lead to further revisions of the estimates.

[3]See the WTO website, www.wto.org (accessed on March 19, 2012).

[4]As argued by the famous “bicycle theory,” liberal trade regimes are inherently unstable and require new initiatives to stay open. See C. Fred Bergsten and William R. Cline, Trade Policy in the 1980s, Washington: Institute for International Economics, 1982, 71.

[5]The possible details of the agreements are discussed in our technical paper. See also Claude Barfield, “The Trans-Pacific Partnership: A Model for Twenty-First-Century Trade Agreements?” AEI International Economic Outlook no. 2, June 2011; and Deborah Elms and C. L. Lim, The Trans-Pacific Partnership Agreement (TPP) Negotiations: Overview and Prospects, RSIS Working Paper no. 232, February 21, 2012.

[6]The full consolidation of preexisting agreements within the TPP is not likely to be completed at this stage, but importantly TPP negotiators are committed to establishing common rules of origin and full cumulation of inputs originating within the region.

[7]Anthony Rowley, “What the TPP Is Really About,” Business Times (Singapore), February 2, 2011.

[8]Aaron L. Friedberg, “Hegemony with Chinese Characteristics,” National Interest, July-August 2011.

[9]Gary Clyde Hufbauer, Jeffrey J. Schott, and Woan Foong Wong argue that the lack of such symmetry helps to explain why the Doha Development Agenda received little support in advanced economies. See Figuring Out the Doha Round, Policy Analyses in International Economics 91, Washington: Peterson Institute for International Economics, June 2010.

[10]Korea has not expressed official interest in joining the TPP so far. Korea has good access to the US market through the Korea-US Free Trade Agreement and its immediate priority is to gain similar access to the Chinese markets through a bilateral or trilateral agreement. At the same time, senior Korean policymakers have indicated their continuing interest in the TPP and Korean membership is probable in the medium term.

[11]These estimates are not directly comparable to the present results because they are not scaled to the economy of 2025; in percentage terms they range from 0.1 to 0.5 percent of world GDP (see Hufbauer, Schott, and Wong, op cit). Some larger estimates are also reported in Ian F. Fergusson, World Trade Organization Negotiations: The Doha Development Agenda, CRS Report RL32060, Congressional Research Service, Washington, January 18, 2008.

[12]Since the implementation of the simulated trade agreements could take 15 years or more, we use a long-term, “full employment” specification of the model. This means that the trade balance is unaffected by trade policy and benefits appear as higher incomes rather than increased employment. Depending on economic conditions in 2025, the agreements could mean higher employment rather than just higher incomes (given an underemployment environment in 2025), or greater inflation (given an overemployment environment).

[13]The modeling framework is based on recent developments in heterogeneous-firms trade theory, in contrast to the country-differentiated-goods approaches of past studies. This theoretical structure helps to correct the systematic underestimation of benefits that emerges in retrospective studies of the actual and projected effects of substantial free trade agreements. For a full description of the model, see Fan Zhai, “Armington Meets Melitz: Introducing Firm Heterogeneity in a Global CGE Model of Trade,” Journal of Economic Integration 23, no. 3, September 2008, 575–604.

[14]The results reported here include the reduction of fixed cost barriers to trade, which stimulates considerable “extensive margin” trade by firms that do not initially trade. Smaller effects are derived when only variable-cost barriers are reduced, as in conventional models.

[15]The many results generated by the model cannot be fully described here or even in our detailed technical paper. A website is planned for sharing additional information about assumptions and results.

[16]The study defines this as an agreement among the 21 APEC economies, which include all members of both tracks, plus Russia, Papua New Guinea, and Taiwan. For computational convenience we also included four small Southeast Asian economies that are not APEC members today: Cambodia, Laos, Myanmar, and Timor-Leste.

Peter A. Petri is a visiting fellow at the Peterson Institute for International Economics, the Carl J. Shapiro Professor of International Finance at the Brandeis International Business School, and a senior fellow at the East-West Center in Honolulu, Hawaii. Michael G. Plummer is the Eni Professor of International Economics at the Johns Hopkins University, SAIS-Bologna, and a senior fellow at the East-West Center. They thank the East-West Center and the Peterson Institute for International Economics for supporting this work and C. Fred Bergsten, Gary Clyde Hufbauer, Jeffrey J. Schott, and participants at presentations of earlier results for valuable comments.