Chapter 1 - EUROZONE & US ECONOMIC WOES: IMPACT ON THE ASIA-PACIFIC*

*Roberto S. Mariano, Professor Emeritus of Economics, University of Pennsylvania

On the heels of the earthquake and tsunami in Japan and flooding in Thailand, the global economy has suffered a succession of setbacks in 2011-2012: unrest in some oil-producing countries; sovereign debt crisis in Greece spreading to other Eurozone countries; sovereign ratings downgrade in the US and some parts of Europe; debt ceiling conflict and continuing anemic growth in the US; and a slow-down in China’s economic engine.

and tsunami in Japan and flooding in Thailand, the global economy has suffered a succession of setbacks in 2011-2012: unrest in some oil-producing countries; sovereign debt crisis in Greece spreading to other Eurozone countries; sovereign ratings downgrade in the US and some parts of Europe; debt ceiling conflict and continuing anemic growth in the US; and a slow-down in China’s economic engine.

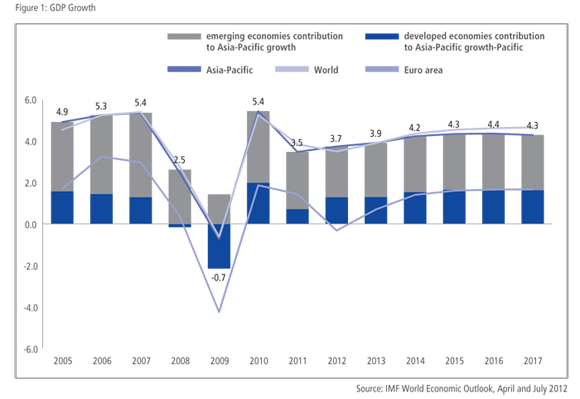

In 2011 economic growth in the Asia-Pacific region as a whole slowed from 5.4 percent in 2010 to 3.5 percent. The forecast for 2012 is for a slight increase to 3.7 percent. However, this small increase may seem to many more like a slowdown given that the forecast for 2012 had been for acceleration to around 4.1 percent. While emerging markets continue to contribute most of the region’s growth – 2.5 percentage points to the region’s total (See Figure 1), it is a declining share.

As developed economies weaken in 2012 and 2013 and as policy stimulus are unwound, growth in Asia is expected to decelerate in varying degrees but will remain strong as a whole. The growth projections of the IMF (WEO Update July 2012) reflect a downgrade relative to earlier forecasts, as a result of the slower growth in the US and the Eurozone. In these projections, the IMF emphasizes that “these forecasts … are predicated on two important assumptions: that there will be sufficient policy action to allow financial conditions in the euro area periphery to ease gradually and that recent policy easing in emerging market economies will gain traction. ... In the U.S., avoiding the fiscal cliff, promptly raising the debt ceiling, and developing a medium-term fiscal plan are of the essence.” (IMF WEO Update, July 16, 2012)

Based on the July 2012 updates, the IMF projections show growth rates of 3.5 percent in 2012 and 3.9 percent in 2013 for the world economy while emerging Asia-Pacific economies as a group are expected to expand by 6.1 percent in 2012 and 6.5 percent in 2013 (See Table 1). Both China and India are expected to post slower expansion in 2012 and 2013 (relative to 2010 and 2011) albeit still at fairly decent rates: 8.0 percent and 8.5 percent for China; 6.1 percent and 6.5 percent for India. In China, net exports, industrial production, and fixed asset investment have declined while government spending on health, education and big infrastructure projects serve to boost the economy. India faces the combined challenges of persisting high inflation and poor demand, both domestic and foreign. Japan and Thailand are expected to recover from poor growth in 2011 due to the impact of the natural disasters that hit these two highly integrated economies last year. A longer discussion on the impact of natural disasters on regional supply chains is in Box 1-1. ASEAN will also be affected by the weak global environment, but, bolstered by domestic demand and reconstruction activities, is expected to grow by 5.1 percent in 2012 and 5.9 percent in 2013 – but with variations across economies in growth patterns and exposures to risks from the Eurozone, the United States, and China developments.

Box 1-1: Disasters and Supply Chains in the Region^

Recent decades have  witnessed an unprecedented increase in production fragmentations and expansion of production networks and supply chains in East and Southeast Asia, made possible by underlying forces of technological advance and trade barrier ease, and driven by pursuit of economies of scale and agglomeration, and greater efficiency and lower costs.

witnessed an unprecedented increase in production fragmentations and expansion of production networks and supply chains in East and Southeast Asia, made possible by underlying forces of technological advance and trade barrier ease, and driven by pursuit of economies of scale and agglomeration, and greater efficiency and lower costs.

The successful functioning of such finely constructed and balanced production networks and supply chains also rests, however, on the premise of there being no major disruptions to the system. Recent experiences indicate that this is, however, not the case. The Great East Japan Earthquake (and the tsunami and nuclear accident that it precipitated) and Thai floods in 2011 both caused enormous disruptions to these networks and supply chains, and extensive damages to the economies concerned. Yet these are by no means “rare” events. Recall the 2008 Sichuan Earthquake in China, the Cyclone Nargis in Myanmar in the same year, and the 2004 Indian Ocean Tsunami still earlier.

Earthquake (and the tsunami and nuclear accident that it precipitated) and Thai floods in 2011 both caused enormous disruptions to these networks and supply chains, and extensive damages to the economies concerned. Yet these are by no means “rare” events. Recall the 2008 Sichuan Earthquake in China, the Cyclone Nargis in Myanmar in the same year, and the 2004 Indian Ocean Tsunami still earlier.

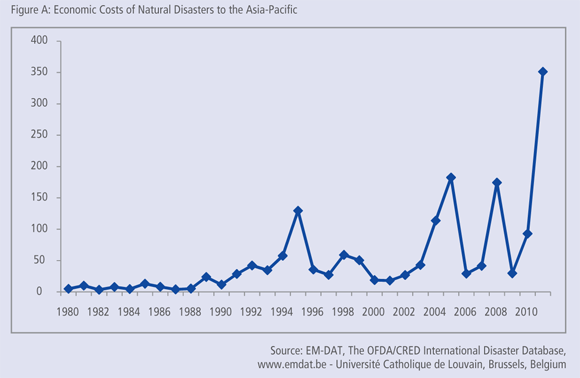

The estimated global economic loss in 2011 due to natural disasters is $363 billion, making it the worst year in the recorded history. Of this, the Asia-Pacific region accounted for $351 billion. Two catastrophic events in the region were responsible for the extent of the losses: the earthquake and tsunami that struck Japan in March 2011, which accounted for $212 billion; and floods in Thailand during June to December 2011, which resulted in a loss of $40 billion. However, the economic—and human—impacts of these disasters could be even larger than these estimates. Through production networks, the impacts of a major disaster in one corner of the region can now be felt across the length and breadth of the networks.

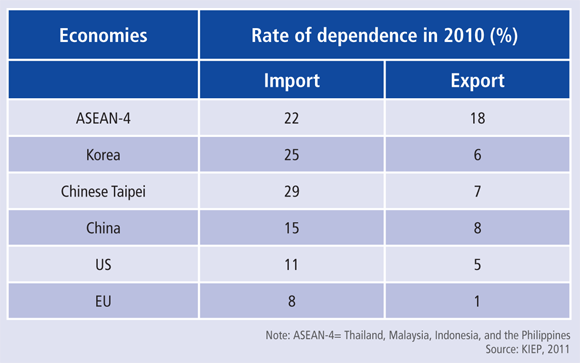

In the Japanese disaster, the most affected Tohoku region represents a significant portion of Japan’s production base, contributing close to 10 percent of general machinery and electrical machinery production and accounting for 6.2 percent of total production capacity, as of 2008. Disruptions caused by the disaster to other economies in the region were mainly related to the degree of dependence of these economies on Japan for parts and materials. Some estimates of such dependence for selected economies in the region are shown in Table A. As can be seen, the ASEAN-4, Korea and Chinese Taipei were among the most dependent economies for parts and materials from Japan.

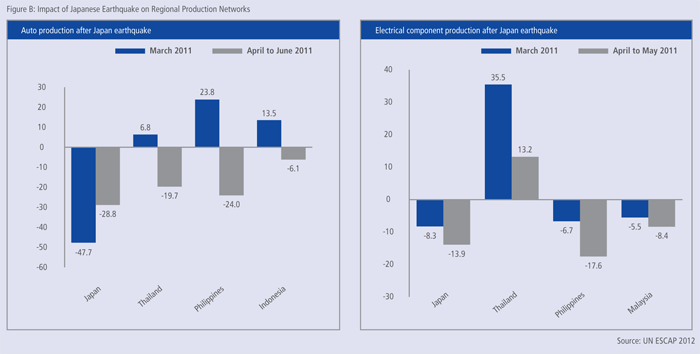

As yet there has not been any systematic study of the implications of the production networks for amplifying the effects of an otherwise local disaster to economies across the region. But the limited evidence that there is does indicate the enormous scale. Thus due to the disruptions in parts and materials following the Tohoku earthquake, not only did overall automotive and electrical production in Japan contract by 47.7% and 8.3%, respectively, in March 2011, contractions were also very much evident in several other economies in the region. For automotive sector, production contractions soon spread to the Philippines (-24%), Thailand (-19.7%) and Indonesia (-6.1%) during April to June 2011. For the production of electrical components, the highest contraction was likewise recorded by the Philippines (-17.6%), followed by Malaysia (-8.4%), during April to May 2011.

Similarly, the disruptions caused by the Thai floods forced the production of the automotive and electrical sector in Thailand to contract by 45.8% and 15%, respectively, during the period from October 2011 to January 2012 (ESCAP, 2012). During January to December 2011, significant declines in exports from Thailand were also recorded in the electronics and electrical appliances industries, which were 47.4% and 21.9%, respectively. The Thai government also revised the GDP growth forecast from 2.6% to 1.0%, as the overall output contracted in the last quarter of 2011, due to the floods.

However, it is important to note that while causing serious economic damages to the Thai economy, one would also expect the supply chain disruptions caused by the Thai floods to result in major production losses in other economies. On average, approximately 19% of manufacturing firms in Thailand take part in global production networks through the use of imported parts and components (Chongvilaivan 2012b). For example, due to the Thai floods, manufacturing production index fell by 2.4% in Japan, led by a contraction in electrical component production of 3.7% during the period October 2011 to January 2012 (ESCAP, 2012b).

The same is true for the electronics and high-tech sectors, where some major Japanese and global firms were also hit hard and faced negative impact in their production.

Thailand is the world’s second largest hard disk drive (HDD) producer after China. The flooding closed two HDD plants of Western Digital Corp. in Thailand, and many other producers such as Seagate, Toshiba and Hitachi were affected by the floods. As a result, the global HDD industry suffered its worst downturn in three years and the world price of HDDs increased significantly.

In view of the increased frequency of natural disaster-related disruptions to the region’s supply chains and production networks, and greater consequences of such disruptions, both of which positively correlate with increased production fragmentation in the region, it is important for both the governments and private sector in the region to adopt effective remedial measures. Among the measures currently being widely discussed and debated aimed directly to increase the resilience of the region’s supply chains and production networks to natural disasters are redundancy and flexibility. The former recommends an appropriate relaxation of the just-in-time approach in inputs managements, while the latter agues for multi-sourcing. Both are likely to have strong cost implications. But this may be the price worth paying in the long run. These specific measures presume given shocks. A more general, and one that would strike at the deeper causes of the fragilities in question, may be an improvement in general disaster risk management programs in the region, which aims to reduce the very scale of possible shocks to the populations and economies concerned for given hazards.

References

Bank of Thailand (2012). Thailand Floods 2011: Impact and Recovery from Business Survey.

http://www.bot.or.th/English/EconomicConditions/Thai/BLP/Documents/ThaiFloodSurvey2011_Eng.pdf

CEIC Data Company Limited (CEIC) (2012). Japan Manufacturing Production Index.

http://www.ceicdata.com/"http://www.ceicdata.com/

Center for Research on the Epidemiology of Disasters (CERD) (2012). International Disaster Database.

http://www.emdat.be/"http://www.emdat.be/

Chongvilaivan Aekapol (2012a). Managing Global Supply Chain Disruptions: Experience from Thailand’s 2011 Flooding.

http://ascc2012.org/images/files/ASCC_Paper_Chongvilaivan.pdf

Chongvilaivan Aekapol (2012b).Thailand’s 2011 flooding: Its Impacts on direct exports and global supply chain disruptions. ARTNet Policy Brief No. 34, April 2012.

http://www.unescap.org/tid/artnet/pub/polbrief34.pdf"http://www.unescap.org/tid/artnet/pub/polbrief34.pdf

Korea Institute for International Economic Policy (KIEP) (2011). Impact of Japan’s Earthquake on East Asia’s Production Network. World Economy Update, Vol. 1, No. 1.

Ministry of Economy, Trade and Industry (METI) (2011). Japanese Industry-Lasting Change in Manufacturing Industry. March 2011.

Nissan (2011). Report on the Impact of Flooding in Thailand on Nissan Operations (Report #3), 4 November 2011.

http://www.nissan-global.com/EN/NEWS/2011/_STORY/111104-01-e.html

Toyota (2011). Toyota Vehicle Production Adjustments Due to Floods in Thailand, 4 November 2011.

http://www2.toyota.co.jp/en/news/11/11/1104.html

United Nations International Strategy for Disaster Reduction (2012). United Nations International Strategy for Disaster Reduction Secretariat (UNISDR).

United Nations, Economic and Social Commission for Asia and the Pacific, and others, (2012a). Thailand Post-Disaster Needs Assessment and Sustainable Recovery.

United Nations, Economic and Social Commission for Asia and the Pacific, and others, (2012b). Economic and Social Survey of Asia and the Pacific.

http://www.unescap.org/pdd/publications/survey2012/

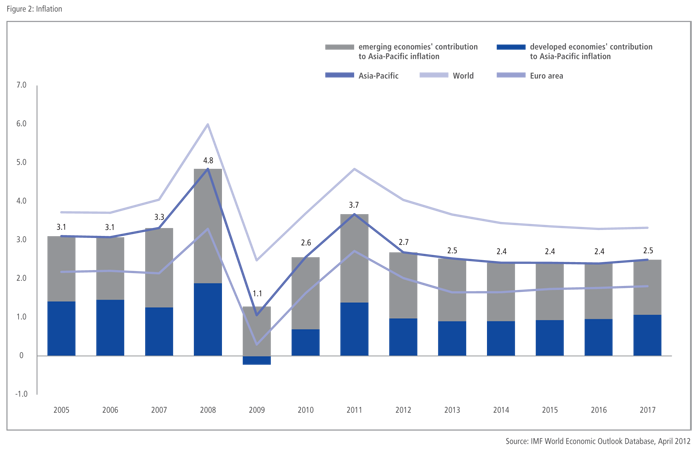

Less Concern over Headline Inflation

Concerns over headline inflation had continued to be high at this point in time last year. However, these concerns have dissipated as worries switch back to growth. However, food prices are once again on the rise, mostly as a result of poor harvests expected in the United States. Policy responses to the poor harvests will once again be watched closely.

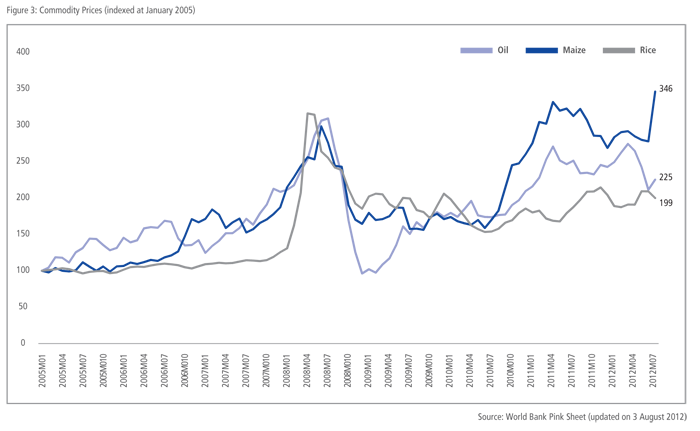

Unlike in 2008, the food price rises are unrelated to energy prices (See Figure 3). Critically for the Asian part of the region, the price spikes in maize are not yet being transmitted to rice.

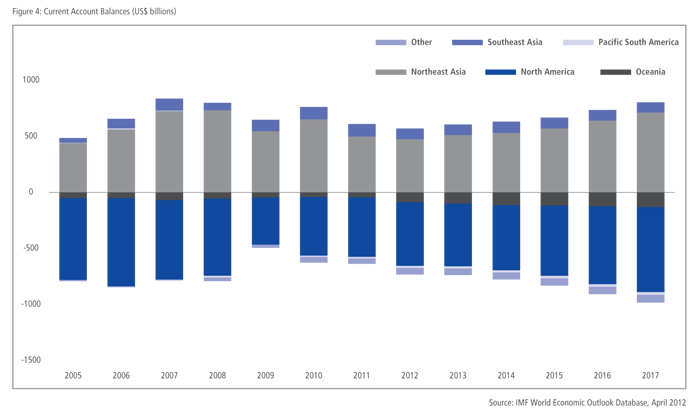

Current Account Imbalances

Current account imbalances in the region decreased significantly during the crisis from 2008-2009. Of concern would be if the imbalances began to reemerge, however, at least over the next few years the situation seems stable, especially as a percentage of GDP. In percentage terms the imbalances, particularly for the United States, peaked at close to 6.0 percent of GDP in 2006, for Northeast Asian economies they reached a peak in 2007 but have been reduced sharply during the crisis period. China’s current account surplus looks to settle within a range of 2.3 to 4.3 percent, well off their highs of 10 percent of GDP in 2007-2008.

The Eurozone Debt Crisis and the Asia-Pacific

As the Eurozone crisis continues to unfold, Asia-Pacific economies face the consequent issues of trade declines and highly volatile capital flows. Shocks from the crisis would spill over to Asia-Pacific economies through the following major transmission channels:

- Merchandise trade

- Financial flows

- FDI

- Portfolio investments

- Official development assistance

- Trade in services

- Business process outsourcing

- Tourism

The severity of the impact would vary across economies depending on the degree global linkages, especially with the Eurozone and the United States, and each economy’s internal economic health and ability to implement policy measures to withstand the shocks.

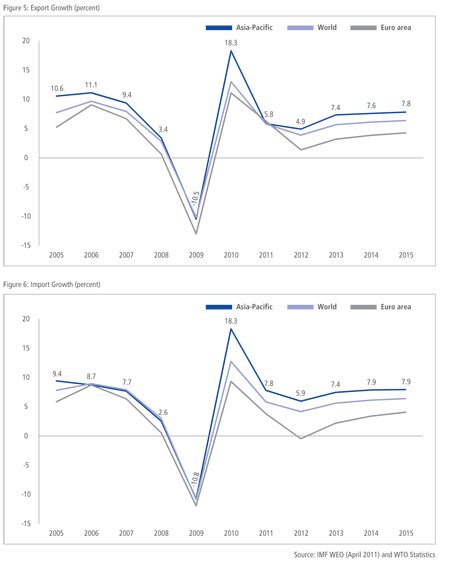

Exposure through Trade Channel  Global export growth is expected to slow to 3.9 percent from last year’s 5.8 percent, while imports will likewise slow to 4.2 percent from 5.8 percent. The Euro area’s imports are expected to contract by 0.5 percent, the only major area of the world expected to go into negative territory, unlike in 2009 when global trade contracted sharply.

Global export growth is expected to slow to 3.9 percent from last year’s 5.8 percent, while imports will likewise slow to 4.2 percent from 5.8 percent. The Euro area’s imports are expected to contract by 0.5 percent, the only major area of the world expected to go into negative territory, unlike in 2009 when global trade contracted sharply.

The Asia-Pacific region is set to follow the global trend with a substantial slowdown in export growth from 5.8 percent in 2011 to 4.9 percent in 2012 before bouncing back to a 7.4 percent in 2013. Imports will follow the same pattern, with import growth to slow from 7.8 percent in 2011 to 5.9 percent this year and a rebound to 7.4 percent in 2013.

Exports to the European Union

The big uncertainty in the picture is what will happen if the situation in the Eurozone gets worse. One clear channel of contagion is the export sector. To gauge the possible impact on the region’s exports we take a longer time frame of 10 years of exports, recent numbers are skewed as they include the crisis period during which exports to the EU from the region dropped sharply.

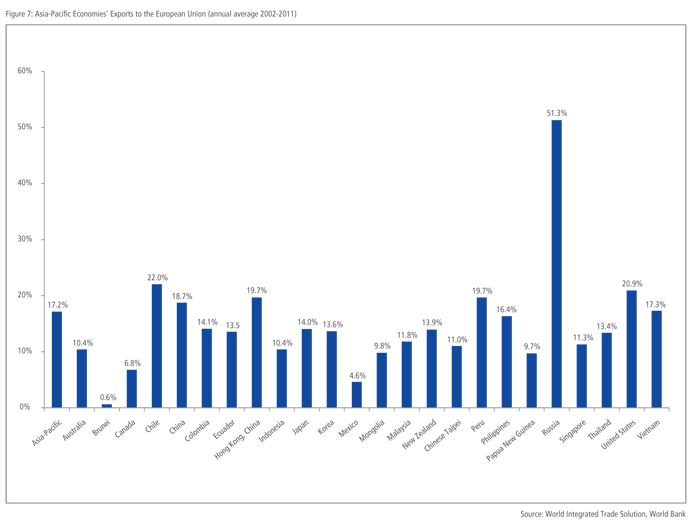

Over the past 10 years, the European Union has accounted for, on average, almost a fifth of the region’s total exports. However, some economies are more exposed than others. This year’s APEC host, Russia, is much more deeply connected to the European market than the rest of the Asia-Pacific. However, the EU is a main trading partner for many regional economies, especially, Chile, China, Hong Kong, India (not in the Figure), Peru, the United States and Vietnam.

In 2009 when the world went into recession, exports from the Asia-Pacific region saw a significant drop in exports to the European Union. As the Eurozone crisis deepens, the impact on the region, depending on how events play out may mirror what we saw in 2009.

In 2009, exports of the region to the EU dropped by 27 percent, this drop affected different sectors and different economies to varying degrees.

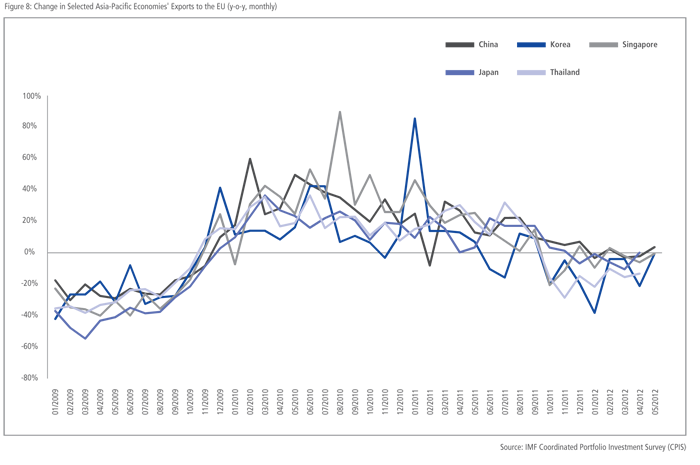

Higher frequency data from the World Trade Organization (WTO) for a few selected economies indicates that while things are indeed getting worse, at their current trajectory they are unlikely to match the troughs of 2009. Monthly export data for China, Korea, Singapore, Japan and Thailand for the first 4-5 months of the year show that year-on-year exports to the EU are declining but not to the same extent that they did in 2009.

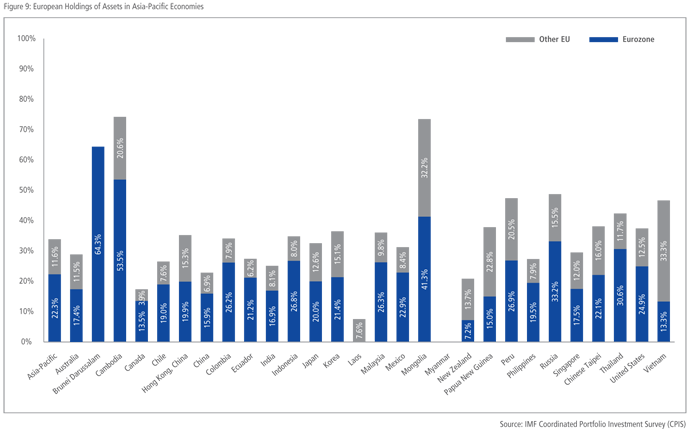

As with exposure through export linkages, exposure of economies in the region through the financial channel also significantly varies. Data paucity is a problem but the IMF Coordinated Portfolio Investment Survey provides a geographic breakdown of:

- Portfolio investment

- Equity securities

- Debt securities

- Long-term debt securities

- Short-term debt securities

Some care should be taken as there are many gaps in the data. For our purposes, where data has not been available, the total investment has been assumed to be zero. However, this may not be the case. On the whole, roughly 30 percent of financial assets in the Asia-Pacific are held by partners either in the Eurozone or from the EU as a whole.

A prolonged Eurozone crisis and a U.S. slowdown also would have serious implications on financial flows and financial markets in Asia- Pacific. Through trade, investment, and financial linkages, strong capital flows already have surged into emerging market economies, because of the weak growth prospects in the US and the Euro area, allowing central banks in the region to build up their international reserves. But there is a downside risk – such strong inflows can spawn destabilizing imbalances in the credit and asset markets. And there are additional costs involved. Central banks suffer financial losses from holding more currency assets than foreign currency liabilities when the domestic currency appreciates. Central Banks also incur costs in their sterilization efforts to mop up the liquidity associated with a foreign exchange transaction. Further, continuing or worsening conditions in the Eurozone and the U.S. may cause risk appetite to shift and capital reversal could set in in emerging markets, with ensuing tight global credit and liquidity and increased financing costs.

In this context, how deleveraging and quantitative easing in advanced economies affect emerging economies has been a topic of intense discussion. One view is that a quantitative easing program would have positive contributions to emerging markets as long as the emerging market economies let their local currency appreciate. The quantitative easing program will help restore confidence in global financial markets, drive global trade and investment, and restore the global economy on a growth trajectory. However, there may be negative consequences as monetary easing creates interest rate differentials and directs capital flows towards attractive emerging economies. For example, following the first phase of quantitative easing in November 2008 and the second in 2010 in the U.S., there was a significant increase in US capital outflows in 2010 and 2011 to emerging Asia, where growth prospects and interest rates were higher. In a global environment with strong appetite for higher yields, such flows could lead to currency appreciation pressures, and catalyze asset price bubbles and higher inflation. Thus government financial/economic planners need to craft the appropriate stabilizing policy measures that would maximize the benefits of the capital inflows and, at the same time, mitigate against abrupt reverse outflows as well as inflationary pressures. Such policies could be formulated keeping in mind the quantitative easing programs in advanced economies can affect emerging markets through at least three channels: portfolio rebalancing, exchange rate, and trade.

As to the first channel, if quantitative easing lowers long-term bond yields in advanced economies, investors could turn to emerging market assets of similar maturities for higher risk-adjusted returns. This would push up asset prices, lower long-term interest rates in emerging markets economies, thus easing financial conditions in emerging markets. Thus, a sizeable quantitative easing could boost global liquidity and positive interest rate differentials favoring emerging markets may persist and fuel further capital inflows and higher consumer and asset prices. In the exchange rate channel, quantitative easing may cause appreciation pressures on emerging economies’ currencies. Emerging economies’ central banks may choose to accumulate reserves to prevent a sharp appreciation, but such sterilization efforts can be costly. Otherwise, capital inflows could result in excess liquidity, inflation pressures, and financial market imbalances. As to the trade channel, quantitative easing can make trade credits more accessible at lower cost, potentially increasing spending in developed economies and boosting demand for emerging market exports. But at the same time, this may also cause an appreciation of emerging market currencies.

Policy Tools and Programs for Managing Capital Flows in Asia

Many of the emerging economies in Asia are in a reasonably strong position with enough policy space to manage a decent growth in the face of the recession in Europe and the slowdown in the U.S. and China. Nevertheless, there are downside risks arising from possible further deterioration before recovery as well as from surging capital inflows.

Growth and interest rate differentials favoring emerging markets and accommodative policies in the advanced economies can encourage large capital flows to emerging markets, requiring adequate measures on the part of emerging economy policymakers to address pressures for currency appreciation, excess liquidity, and domestic inflation. Growth of domestic liquidity and credit activity must be ample enough and in line with the economy’s growth trajectory. But excessive liquidity and unnecessary credit growth could lead to higher inflation, asset price misalignments, and financial instability.

The policy measures and programs would involve a combination of regulatory reforms, structural improvements and a pragmatic and responsive approach to monetary and macroeconomic policy. With an eye towards developing an effective toolkit for managing capital flows, programs need to be instituted, if not yet in place, towards improved monitoring and understanding of the nature of foreign exchange inflows, exchange rate flexibility, and management of reserve accumulation and associated liquidity. At the regulatory and structural levels, further financial sector reforms can be instituted to deepen financial markets and enhance the foreign exchange regulatory framework, and additional macroprudential measures may be needed to ensure the health of the banking system. In many emerging markets in Asia, there also is an urgent need for further personnel capacity building in relevant government agencies in the technical and practical aspects of macro-monetary policymaking and stabilization programs. Finally, in this current environment of globalized finance, it is encouraging to note that more direct regional cooperation has now been institutionalized among economies in Southeast and East Asia towards coordinating efforts to deepen financial markets and head off financial/economic crises in the region.

For detailed data, please refer to Annex A.