As discussed in the previous chapter, economic growth in the region rebounded in 2009-2010. Much of this growth, however, has come as a result of large fiscal and monetary stimulus measures implemented by governments in response to the crisis. Last year’s State of the Region report outlined the strategies employed to rebalance economic growth in the Asia-Pacific. These strategies are the focus of debate for G20 leaders when they meet in Seoul and APEC leaders in Yokohama.This chapter contains the results of a survey of more than 400 opinion leaders from government, business and the non-government sectors (primarily the research community) conducted between 16 September to 16 October 2010. This survey is not one of public opinion, but rather of those who lead opinions. Respondents include senior officials, business leaders, media commentators, and leading scholars/analysts. For the details of all of the questions please see the tables.

Priority Issues for Yokohama When APEC leaders gather in Yokohama for their meeting on November 13-14, they will be faced with a large ongoing agenda for regional cooperation. They will also be meeting just a day after G20 leaders conclude their meetings in Seoul. We asked opinion leaders what they thought the top 5 priorities for APEC leaders should be from a list of 22 possible issues covering the range of work that APEC addresses through its various working groups and committees.

The top 5 five issues were:

- A post-crisis growth strategy for the region

- A Free Trade Area of the Asia-Pacific

- The WTO Doha Development Round

- Financial sector regulatory reform

- The region’s response to climate change

Of the top 5 issues selected by respondents, three are regional in nature – a Free Trade Area for the Asia-Pacific, the region’s response to climate change and a post-crisis growth strategy for the region. The other two, the WTO Doha Round and financial sector regulatory reform are global in nature.

These priorities are little changed from last year’s survey results below with the exception of the Free Trade Area of the Asia-Pacific:

- Continued action on the economic crisis;

- Regulation of the financial sector;

- Restarting the Doha process;

- Climate change and the Copenhagen Deal; and

- Reducing the cost of doing business

Deeper analysis of the findings shows some interesting divergences between respondents from business, government and the non-government sectors. Business and government respondents placed the Free Trade Area of the Asia-Pacific as the top agenda item for APEC leaders while respondents from the non-government sector prioritized the post-crisis growth strategy for the region. Both business and non-government respondents thought that leaders should focus on APEC reform and institutional strengthening instead of the region’s response to climate change.

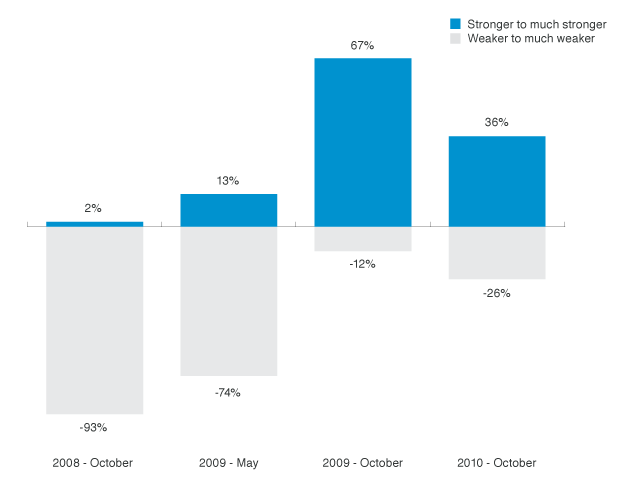

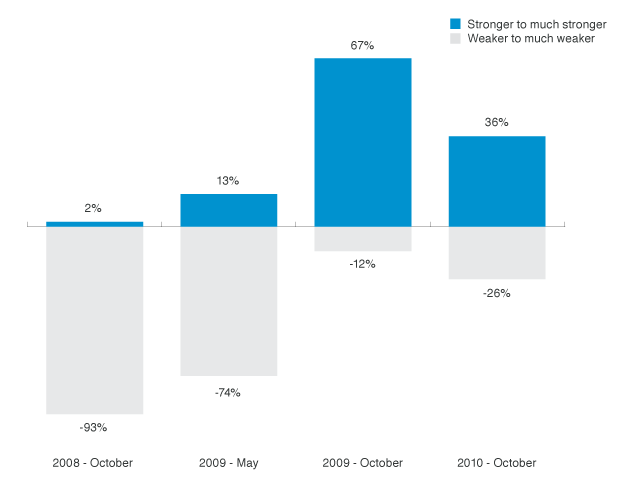

Optimism on the Wane Across the Asia-Pacific region opinion leaders are less optimistic about the prospects for growth over the next year than they were in the last State of the Region survey in October 2009. Respondents were equivocal about their expectations for growth over the next 12 months. Thirty-six percent of respondents expected global growth to be stronger over the next 12 months compared to 26 percent who thought it would be weaker.

Chart 1: Expectations for growth of the global economy: in October 2008, May 2009, October 2009 and October 2010 (% respondents who thought economic growth for the global economy would be weaker to much weaker and stronger to much stronger)

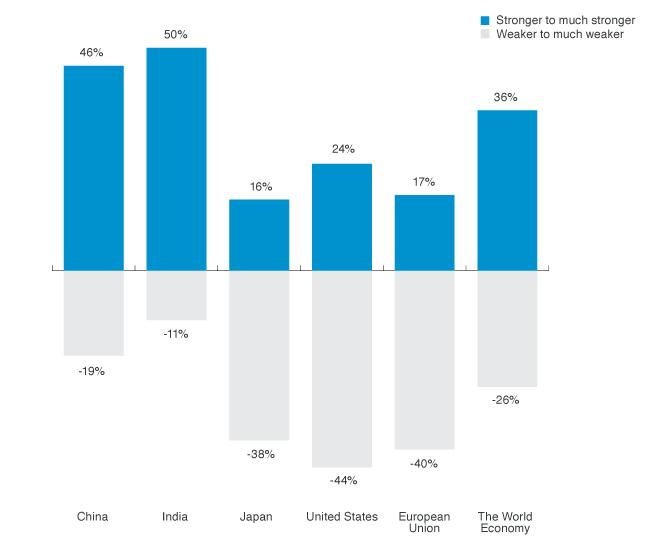

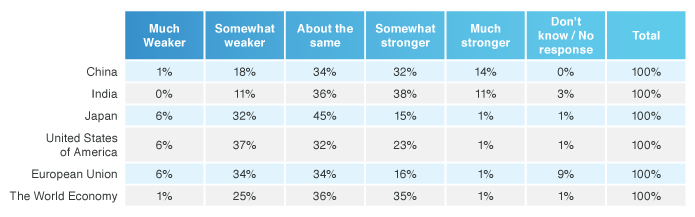

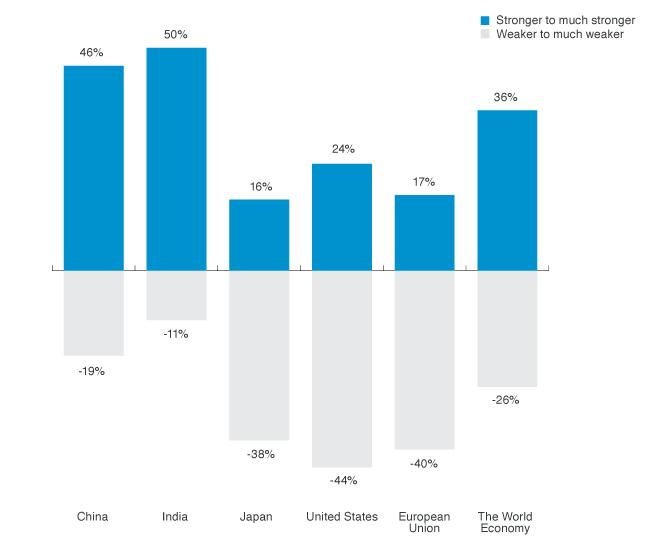

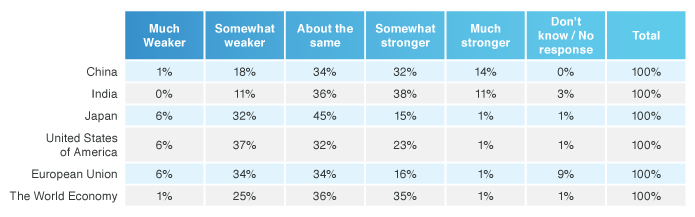

However, what was notable was that respondents around the region are much more positive about the prospects for growth in China and India. In contrast, respondents were pessimistic about the growth outlook for the United States and Japan, with about twice as many respondents expecting “weaker to much weaker” growth in those countries than those who were expecting “stronger to much stronger” growth.

Chart 2: What are your expectations for economic growth over the next 12 months compared to the last 12? (% respondents who thought economic growth in the following economies/regions would be stronger to much stronger)

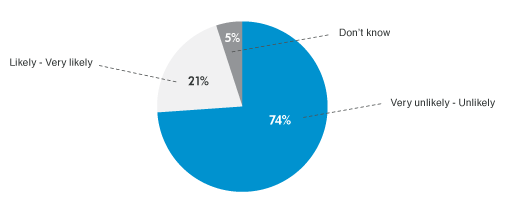

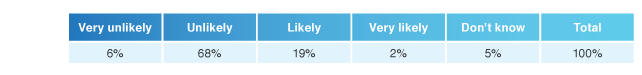

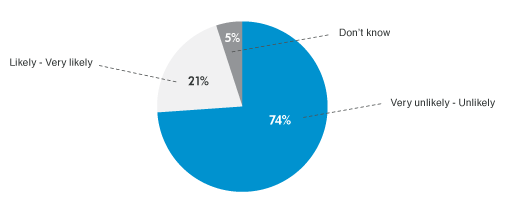

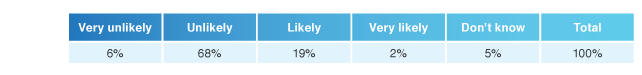

While hopes for a sustained recovery have tempered somewhat in the last year, respondents were nevertheless confident that the world economy would not experience a “double dip” recession. Seventy four percent of respondents said a global recession in the next 12 months was “unlikely” or “very unlikely”.

Chart 3: What is the likelihood of another global recession in the next 12 months? Risks to Growth

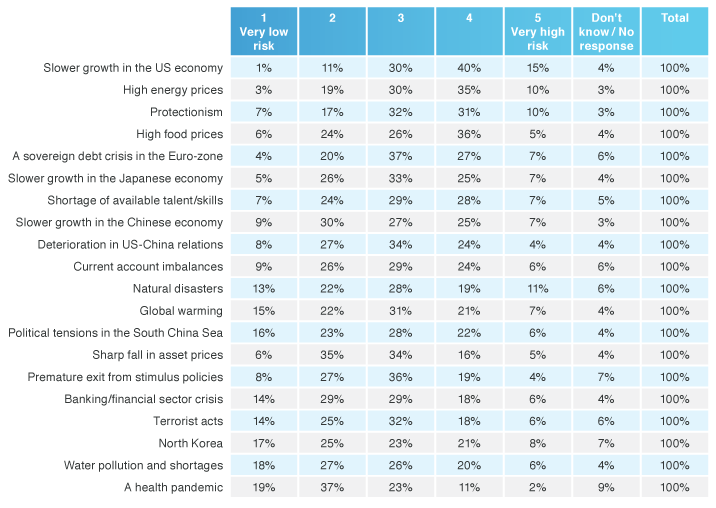

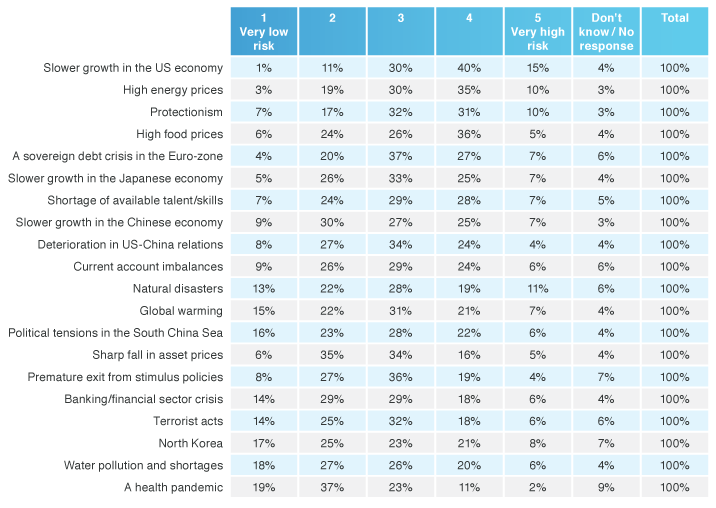

Risks to Growth From a list of 20 items, respondents were asked to rate the top sources of risks to growth for their economies over the next 2-3 years. The top 5 risks were identified as follows: slower growth in the US economy; high energy prices; protectionism; high food prices; and a sovereign debt crisis in the Euro-zone.

Table 1: Risks to Growth (1=very low risk, 5=very high risk)

Balanced and Sustainable Growth and Responses to the Global Economic Crisis A detailed discussion of the challenges to balanced and sustainable growth in the region is found in chapter 1. We tested some of the policy prescriptions for balanced and sustainable growth with survey respondents.

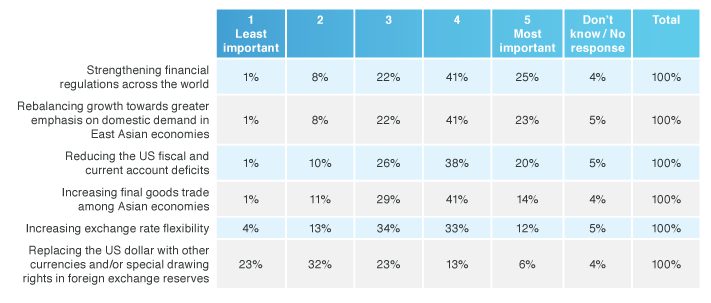

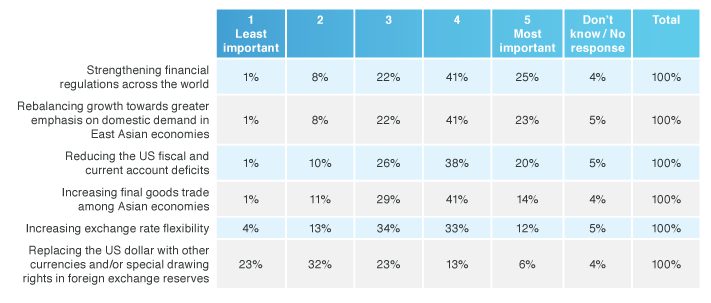

Table 2: Policy Objectives for Achieving Sustained Growth in the Asia-Pacific over the next 5 years(1=least important, 5=most important)

The most important policy objective was the strengthening of financial regulations followed by increasing domestic demand in East Asia and reducing the US fiscal and current account deficits. Of note is the strong consensus around the region on the importance of increasing domestic demand in East Asia. Currency “fixes” were not considered as important, with “exchange rate flexibility” and “replacing the US dollar with other currencies” ranked much lower.

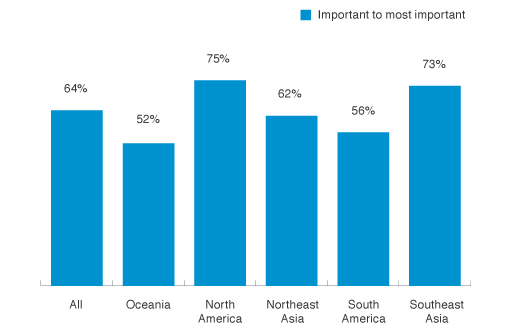

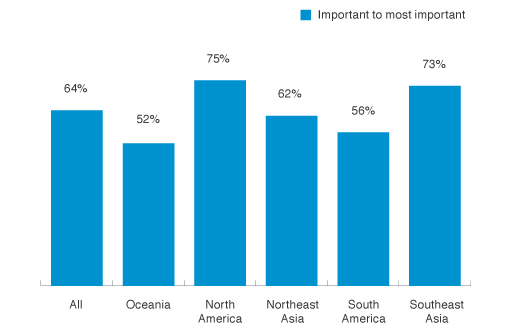

Chart 4: Rebalancing growth towards greater emphasis on domestic demand in East Asian economies(% respondents who rated this as the most important or next most important policy objective for achieving sustained growth in the Asia-Pacific region over the next 5 year)

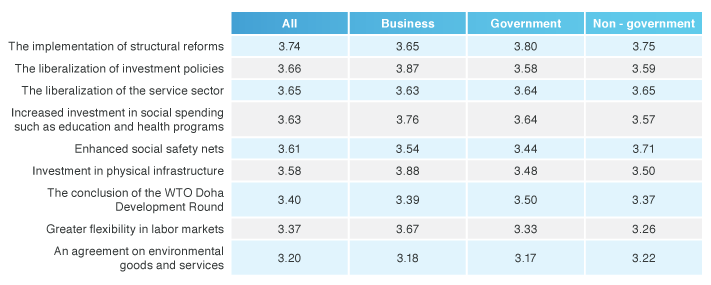

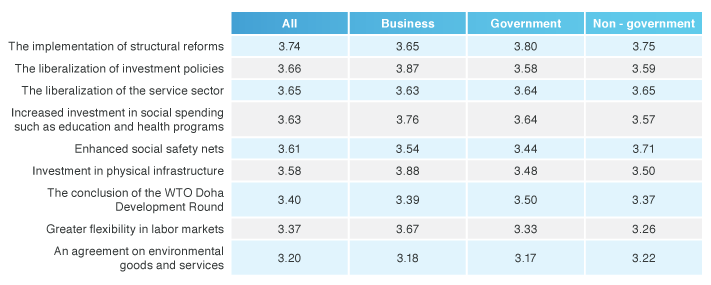

We also asked respondents about the actions that should be taken to rebalance growth in the Asia-Pacific region.

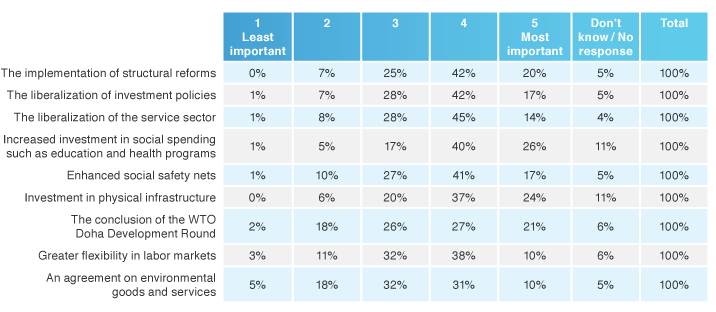

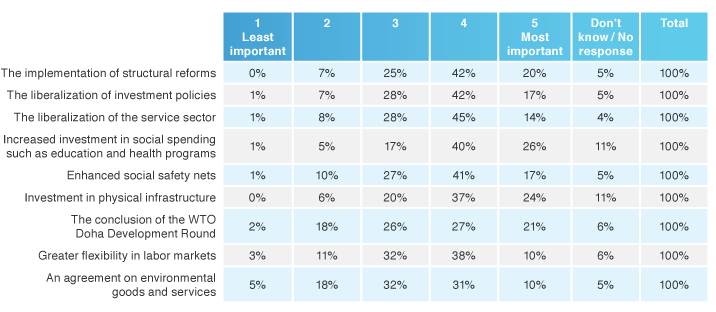

Table 3: Actions to Rebalance Growth in the Asia-Pacific(1=least important, 5=most important)

The implementation of structural reforms ranked as the most important action to rebalance growth followed by investment liberalization, service sector liberalization, and increased spending on social priorities. However, business respondents had a slightly different sense of priorities ranking investment in physical infrastructure as the most important and including flexibility in labor markets as a top action.

The above results validate APEC’s focus on structural reform issues as a key component of the new growth strategy described in chapter 1.

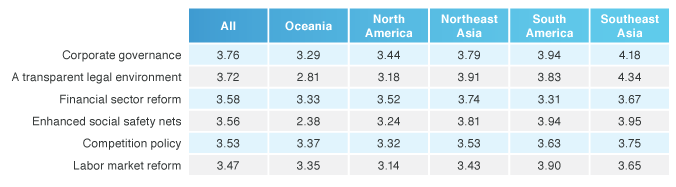

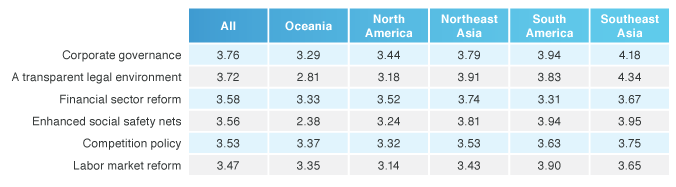

We further asked respondents to rate various components of structural reform in their economies.

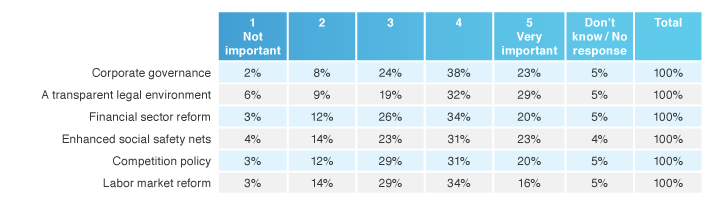

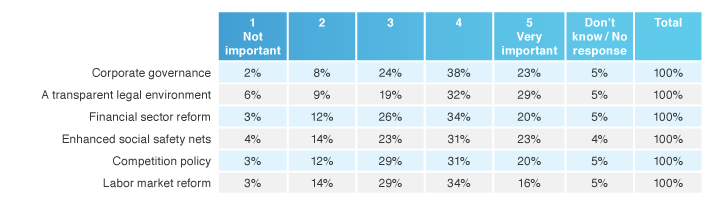

Table 4: Components of Structural Reform (1=not important, 5=very important)

For all sub-sectors of respondents (business, government, and non-government), the top three components were corporate governance; a transparent legal environment; and financial sector reform. However there was considerable variation between sub-regions on the relative importance of each component.

Southeast and Northeast Asians for example ranked a transparent legal environment as the most important whereas North Americans ranked financial sector reform as the most important.

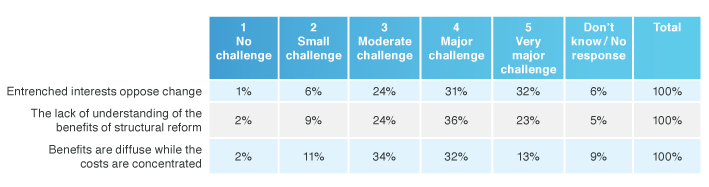

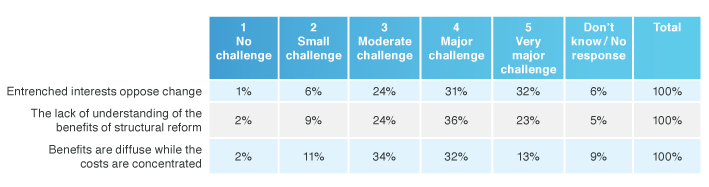

We also asked opinion leaders to consider some of the challenges in implementing structural reform in their economies. Southeast Asians and North Americans ranked the problem of entrenched interests particularly high whereas in Australia/New Zealand and South America, the biggest perceived problem was the “lack of understanding about the benefits of structural reform”.

Table 5: Challenges to Structural Reform (1=no challenge, 2=small challenge, 3=moderate challenge, 4=major challenge, 5=very major challenge)

Regional Economic Integration and Cooperation

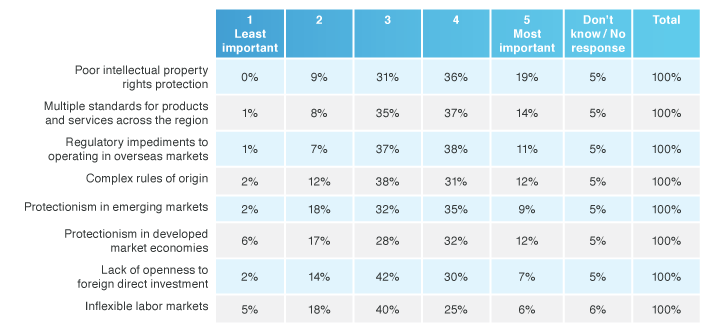

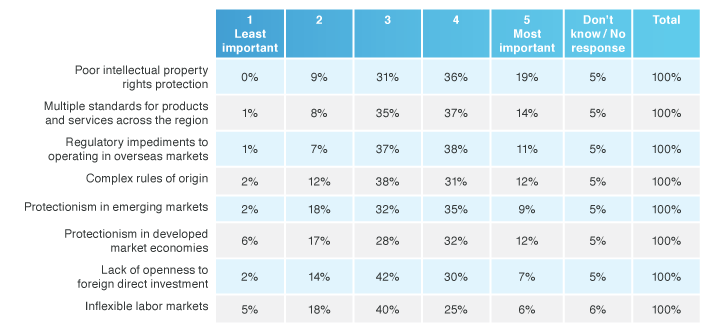

Regional Economic Integration and Cooperation We asked respondents to rate the biggest challenges to doing business in the Asia-Pacific region, drawing on a list of eight issues. Poor intellectual property rights protection was identified as the top issue, with respondents from Northeast Asia and the business community taking a particularly strong view on this issue.

Table 6: Challenges to doing business in the Asia-Pacific (1=least important, 5=most important)

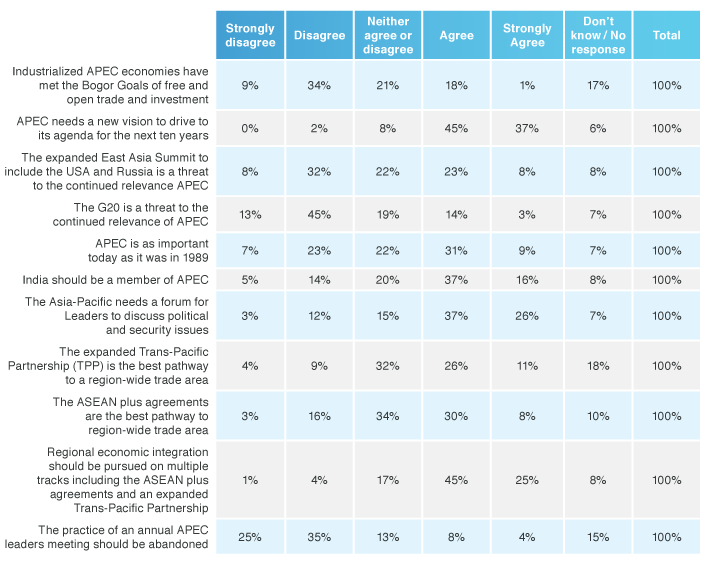

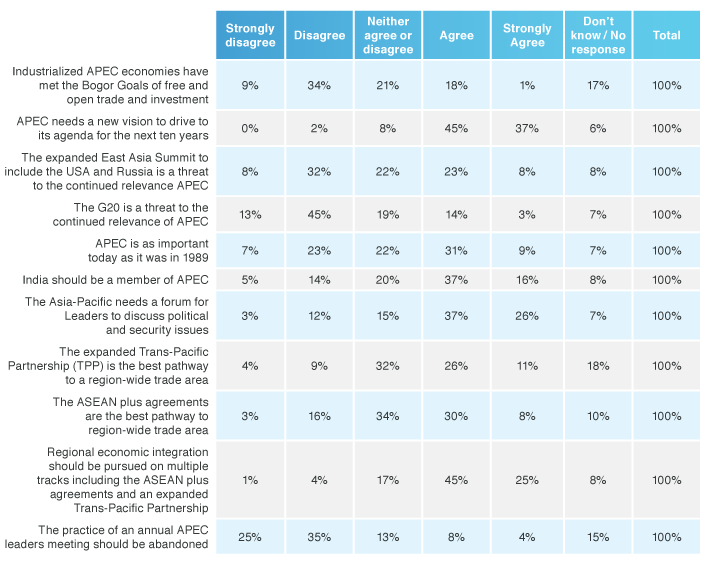

This year marks the first of the Bogor target dates, when industrialized APEC member economies are supposed to have achieved “free and open trade and investment”. We posed a number of questions related to the APEC’s regional integration and cooperation agenda. As in the previous two SOTR reports, we also present in chapter 3 an updated measure of regional economic integration in the Asia-Pacific region, using a specially constructed index of integration.

In spite of the considerable achievements made in the region in lowering tariffs and non-tariff barriers, opinion leaders are unconvinced that the industrialized economies have met the Bogor Goals of free and open trade and investment.

Chart 5: Bogor Goals and New Agenda

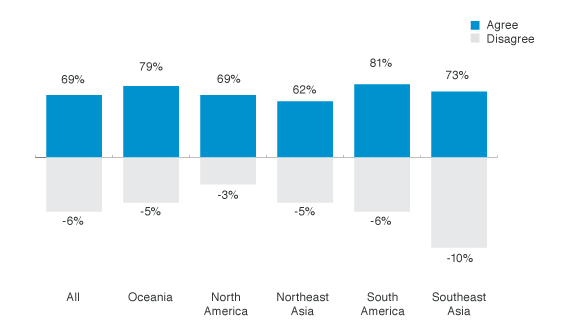

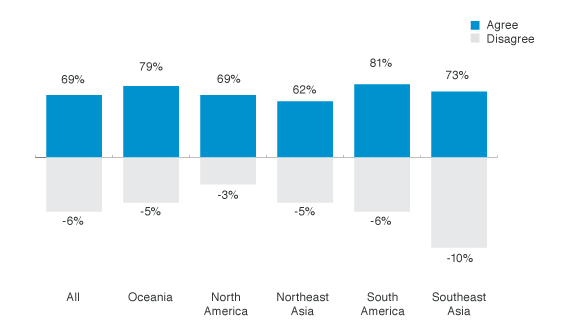

While there was little agreement that the Bogor Goals have been met, there was, in contrast, near unanimous agreement that APEC needs a new vision to drive its agenda for the next 10 years. Likewise there was also wide support for the region to pursue economic integration on multiple tracks including the “ASEAN plus” agreements and the Trans-Pacific Partnership.

Chart 6: Regional economic integration should be pursued on multiple tracks including the ASEAN plus agreements and an expanded Trans-Pacific Partnership (% respondents who agree/disagree)

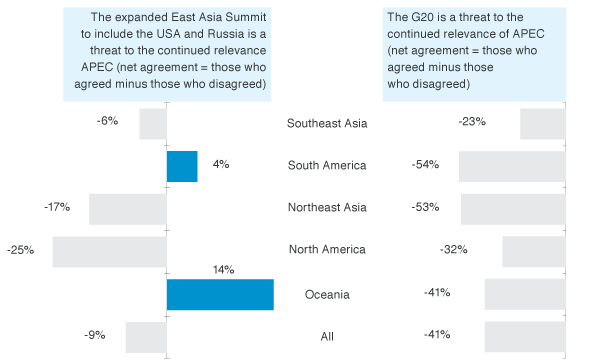

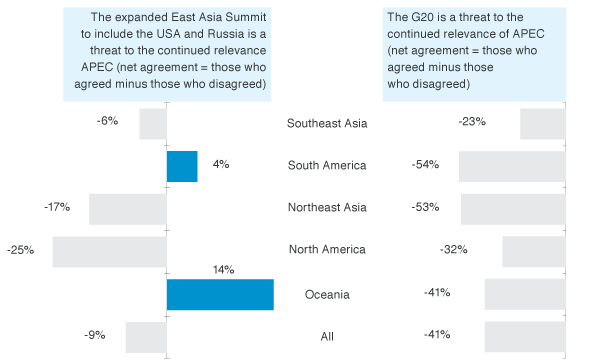

Prior to the economic crisis, the APEC Leaders’ Meeting was the only annual event where leaders of world’s three biggest economies – the United States, China, and Japan – would meet on a regular basis. With the institutionalization of the G20 leaders process and the expansion of the East Asia Summit to include Russia and the United States, APEC has lost this monopoly. We asked opinion leaders whether they thought the expanded EAS and the G20 were ‘threats’ to APEC’s continued relevance.

Chart 7: Regional and Global Institutions

Regional opinion leaders did not see these developments as threatening APEC, with the exception of respondents from Australia & New Zealand and South America who expressed concerns about the expansion of the East Asian Summit for the future relevance of APEC.

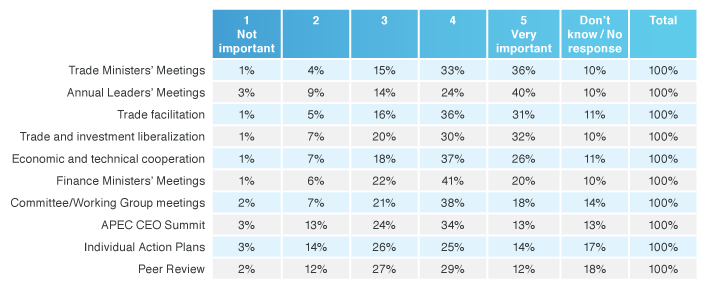

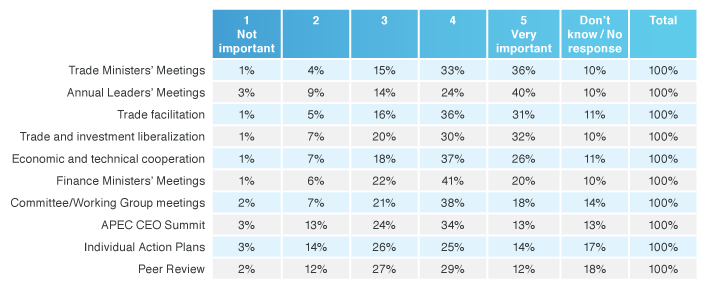

Importance of APEC Activities We also asked respondents to consider the importance of various APEC activities. The Trade Ministers’ Meeting ranked as the most important followed by the Leaders’ Meeting. The individual action plans and peer review process – which are in many ways seen as signature APEC activities based on the principle of concerted unilateral liberalization — were ranked as the least important.

Table 7: Importance of Various APEC Activities (1=not important, 5=very important)

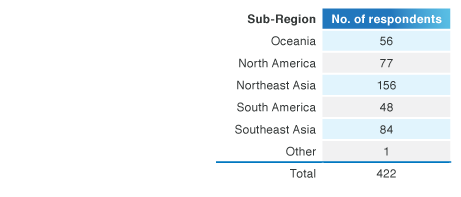

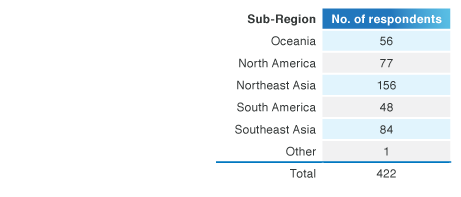

Annex BRespondent Profile

Annex BRespondent ProfileThe panelists were selected by PECC’s member committees from academe, business, government, and civil society on the basis of their level of knowledge of the Asia-Pacific region. The criteria given for the selection of panelists were as follows:

GovernmentPanelists should be either decision-makers or senior advisors to decision-makers. As a guide, the government respondents last year included a number of former and current Ministers, Deputy and Vice-Ministers, Central Bank Governors and their advisors for Asia-Pacific issues, current APEC Senior Officials, and a number of former APEC Senior Officials.

BusinessPanelists should be from companies who have operations in a number of Asia-Pacific economies or conduct business with a number of partners from the region, this might include each economy’s current ABAC members as well as past ABAC members.

Non-Government: Research Community / Civil Society / MediaPanelists should be well-versed in Asia-Pacific affairs, being the type of individuals whom the governments, businesses, and the media would tap into to provide input on issues related to Asia-Pacific cooperation. These include presidents of institutes concerned with Asia-Pacific issues, heads of departments, senior professors, and correspondents covering international affairs.

For this survey we define those sub-regions as:

- Oceania: Australia and New Zealand

- North America: Canada, United States and Mexico

- Northeast Asia: China, Japan, Hong Kong (China), Korea, Mongolia, Russia and Chinese Taipei

- South America: Chile, Colombia, Ecuador and Peru

- Southeast Asia: Brunei, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam

Growth Agenda and Economic CrisisWhat are your expectations for economic growth over the next 12 months compared to the last year?

Growth Agenda and Economic CrisisWhat are your expectations for economic growth over the next 12 months compared to the last year? What is the likelihood of another global recession in the next 12 months?

What is the likelihood of another global recession in the next 12 months? How do you rate the following risks to growth for your economy over the next 2-3 years?

How do you rate the following risks to growth for your economy over the next 2-3 years?(Please use a scale of 1-5, with 1 representing a very low risk and 5 a very high risk)

Please rate the importance of the following policy objectives for achieving sustained growth in the Asia-Pacific region over the next 5 years.

Please rate the importance of the following policy objectives for achieving sustained growth in the Asia-Pacific region over the next 5 years. (Please use a scale of 1-5, with 1 representing the least important and 5 the most important)

Please rank the following actions in terms of their importance to rebalancing growth in the Asia-Pacific region.

Please rank the following actions in terms of their importance to rebalancing growth in the Asia-Pacific region.(Please use a scale of 1-5, with 1 representing the least important and 5 the most important)

Please rate the importance of the following components of structural reform in your economy.

Please rate the importance of the following components of structural reform in your economy.(Please use a scale of 1-5, with 1 representing not important and 5 very important)

Please rate the following in terms of the challenge that they pose to structural reform in your economy.

Please rate the following in terms of the challenge that they pose to structural reform in your economy. Regional Cooperation and IntegrationWhat are the biggest challenges to doing business in the Asia-Pacific region?

Regional Cooperation and IntegrationWhat are the biggest challenges to doing business in the Asia-Pacific region?(Please use a scale of 1-5, with 1 representing the least important and 5 the most important)

Please indicate your agreement or disagreement with the following statements.

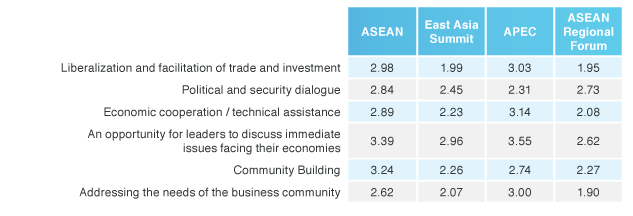

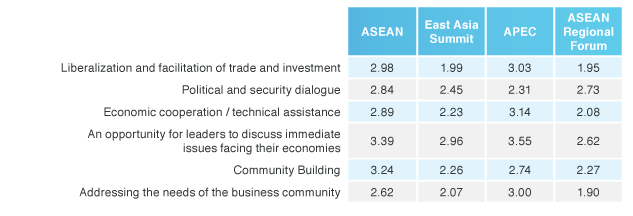

Please indicate your agreement or disagreement with the following statements. Please rate the following regional groupings in terms of their effectiveness in the following areas, using a scale of 1-5.

Please rate the following regional groupings in terms of their effectiveness in the following areas, using a scale of 1-5.(1 – not effective, 5 – highly effective, DK – don’t know)

APECPlease rank the importance of APEC activities in the following areas.

APECPlease rank the importance of APEC activities in the following areas. (Please use a scale of 1-5, with 5 representing very important and 1 not important. Please select DK if you are not sure)

What do you think should be the top 5 priorities for APEC Leaders to discuss at their upcoming meeting in Yokohama?

What do you think should be the top 5 priorities for APEC Leaders to discuss at their upcoming meeting in Yokohama?(Please select only five (5) issues, using a scale of 1-5, please write 1 for the issue you think is most important, 2 for the next most important issue and so on)