State of the Region 2008

Survey undertaken in cooperation with the Asian Development Bank Office of Regional Economic Integration

Section 1: Profile of Respondents

Number of Respondents: 483

Regional Breakdown

| Australia & New Zealand |

48 |

| North America |

80 |

| Northeast Asia |

147 |

| South America |

51 |

| Southeast Asia |

154 |

| Other |

3 |

Sectoral Breakdown

| Government |

85 |

| Business |

127 |

| Academic/Research |

235 |

| Media |

15 |

| Civil Society |

21 |

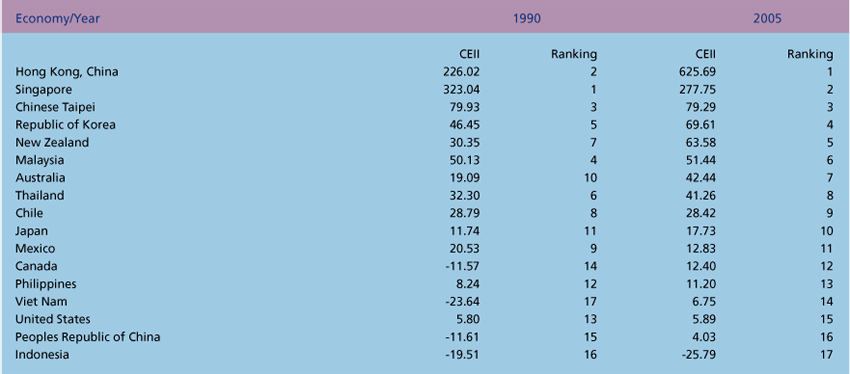

Section 2: Regional Economic Outlook

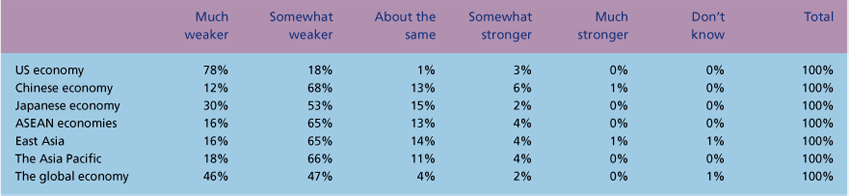

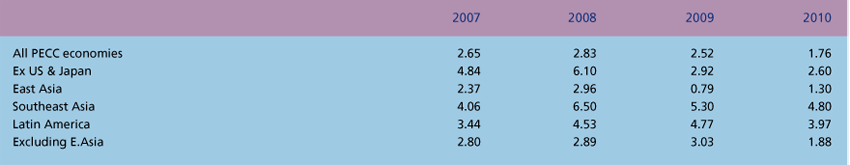

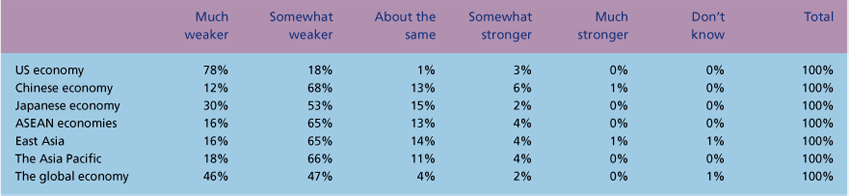

Question 2: What are your expectations for economic growth over the next 12 months compared with the past year?

Responses were overwhelmingly negative indicating that the economic outlook of the Asia Pacific region has changed in the past year, contrasting sharply with the 2007 State of the Region Survey.

Ninety-three percent of respondents expect the global economy to be much weaker or somewhat weaker over the next 12 months. Over 95 percent expect the US economy to be much or somewhat weaker, of which 78 percent answered much weaker. In 2007 only one percent of survey respondents answered that the North American economic outlook to be much weaker and 38 percent answered somewhat weaker. Less than one percent of respondents expect economic growth in any of the regions to be much stronger.

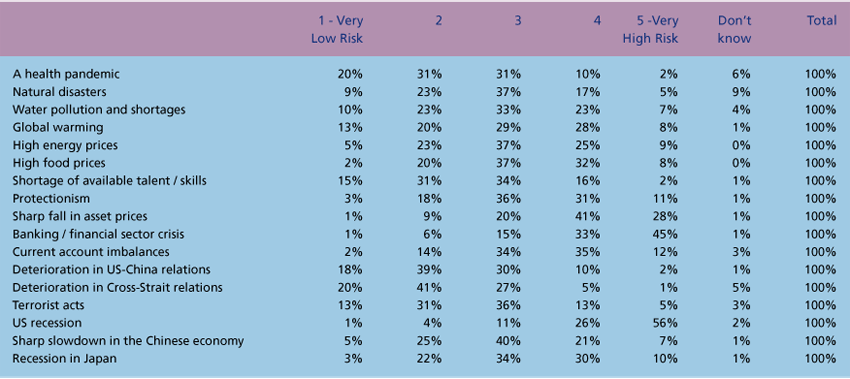

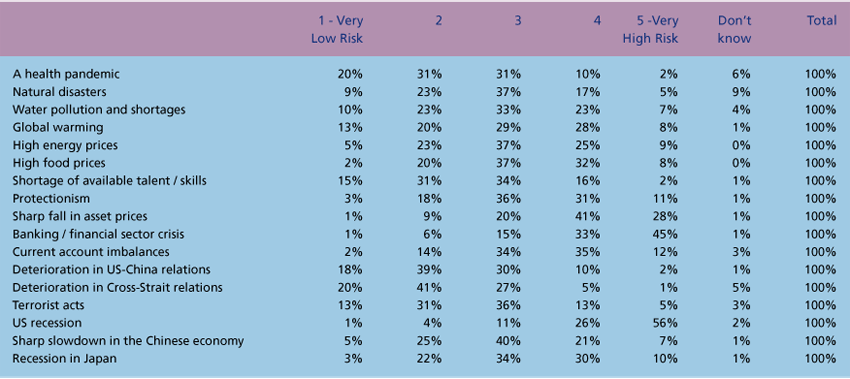

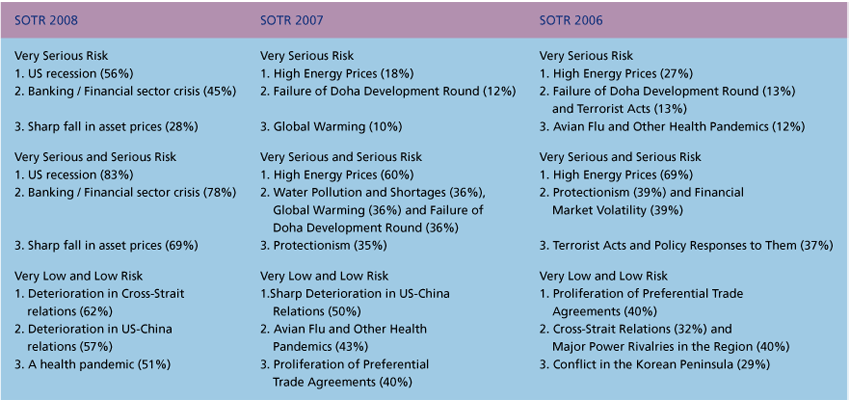

Question 3: How do you rate the following risks to growth for the Asia Pacific over the next 12 months?

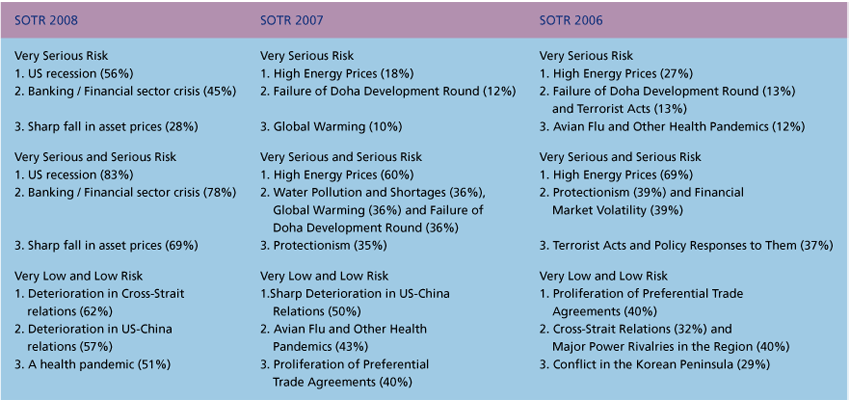

Consistent with the negative regional economic outlook, the risks associated with the global financial crisis are viewed as the most serious. The US recession (83 percent), banking or financial sector crisis (78 percent), and sharp fall in asset prices (69 percent) are considered the top three very serious and serious risks, with mean scores of 4.28, 4.14 and 3.81 respectively.

The results above are considered the top three risks across the five regions, although respondents of Australia and New Zealand viewed a banking sector crisis as the number one risk (85%). In North America, 89% of respondents viewed the US Recession as the top very serious and serious risk, slightly higher than the rest of the regions and the overall.

Deterioration in Cross-Strait relations and US-China relations as well as a health pandemic are considered the lowest risk to the Asia Pacific regional outlook.

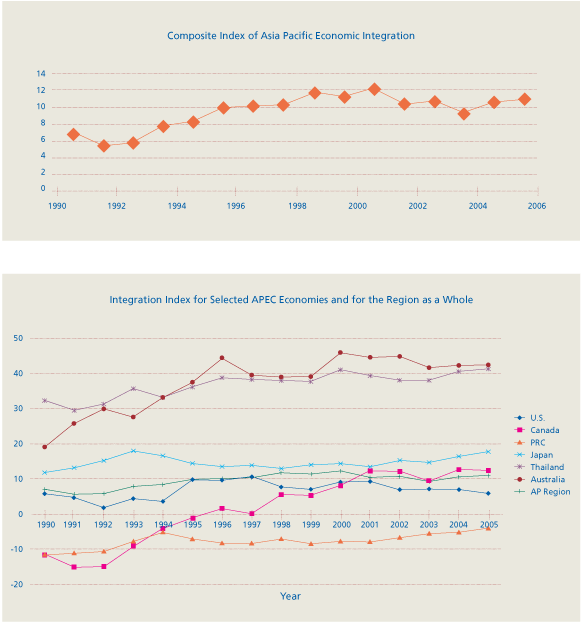

Section 3: Regional Economic Integration

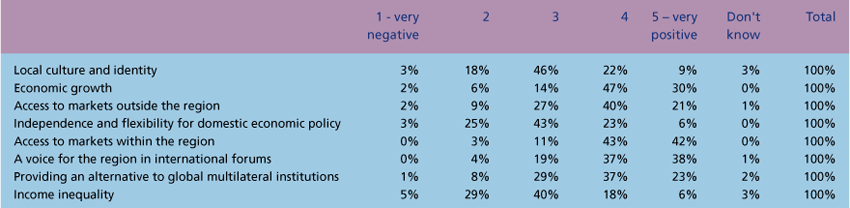

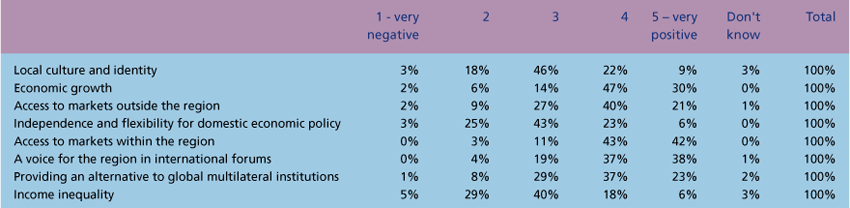

Question 4: What do you think is the impact of deeper regional economic integration on the following issues?

Respondents generally held a positive view of the impact of deeper regional economic integration citing its positive impact on accesses to markets within the region as one of its most important consequences (85%) followed by the positive impact on economic growth (77%).

Of greatest concern was the impact on income inequality with 34% viewing the impact as negative followed by the independence and flexibility for domestic economic policy (28%).

Between the sub-regions there was generally little variance in opinion on the impact of deeper regional economic integration. Respondents from Northeast Asia, however, were much more concerned than the rest of the region on the negative impact on local culture and identity. Thirty-four (34%) of respondents from Northeast Asia rated the impact of deeper regional economic integration as negative on local culture and identity compared to the region as a whole – 21%. Northeast Asia was also the least positive on the impact on economic growth (69%) while respondents from Australia and New Zealand where by far the most positive at 92%.

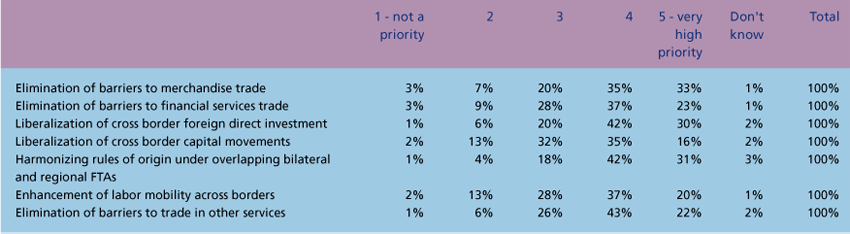

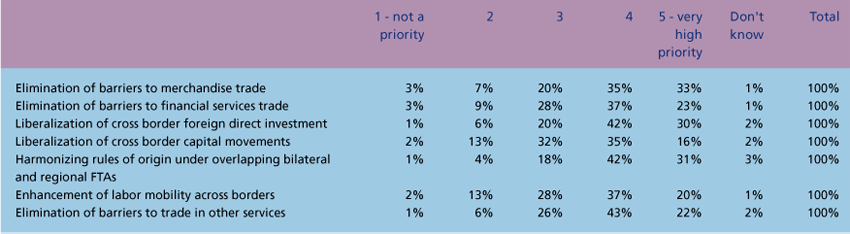

Question 5: Please rate the relative importance of the following liberalization measures for the Asia Pacific region:

The highest priority for the liberalization of trade in the region was given to harmonizing rules of origin under overlapping bilateral and regional FTAs (73%) followed by the liberalization of cross-border FDI. Respondents from South America where the most concerned about rule of origin while North Americans were the least concerned.

There was considerable divergence between sub-regions in their priorities for liberalization, especially views on the importance of the elimination of barriers to trade in services. Respondents from North America and Australia and New Zealand tended to prioritize liberalization of trade in other services while respondents from East Asia placed a much lower priority on this item.

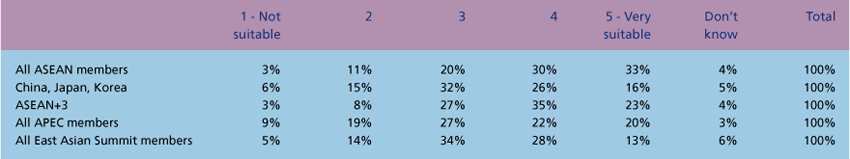

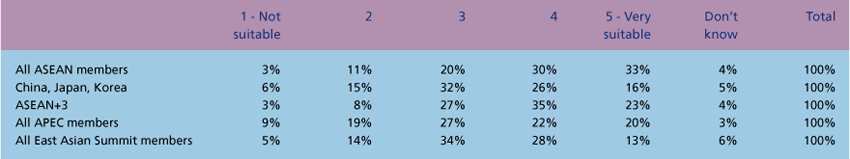

Question 6: How would you rate the suitability of the following groups of economies for the creation of a free trade and investment area?

Respondents favored ASEAN and ASEAN Plus Three when asked what economies would be most suitable for the creation of a free trade and investment area (63% and 58% of respondents thought they were suitable to very suitable for the creation of a free trade area respectively).

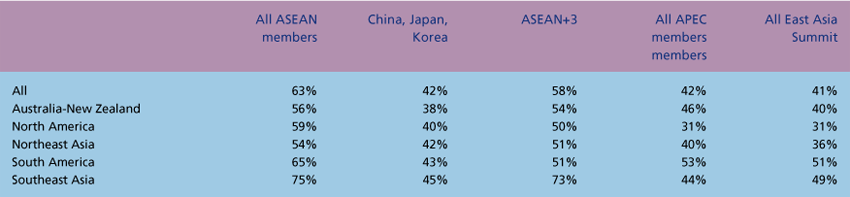

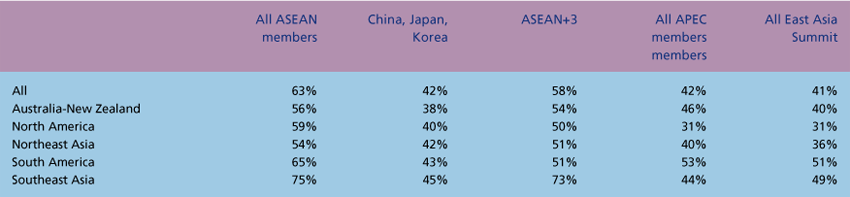

How would you rate the suitability of the following groups of economies for the creation of a free trade and investment area? (% respondents by sub-region who thought the following groupings were suitable to very suitable for the creation of a free trade and investment area)

The five regions represented in the survey have similar perspectives of regional economic integration, rating ASEAN as the best suited grouping for a free trade and investment area. However, there was variation as to the next best suited grouping, with most sub-regions ranking ASEAN+3 second with the exception of South Americans who ranked APEC second. Interestingly North American respondents did not share this view with a significant proportion who thought that the ASEAN+3 grouping was better suited to a creation of a free trade area and still ranked the East Asia Summit membership better suited than APEC’s membership.

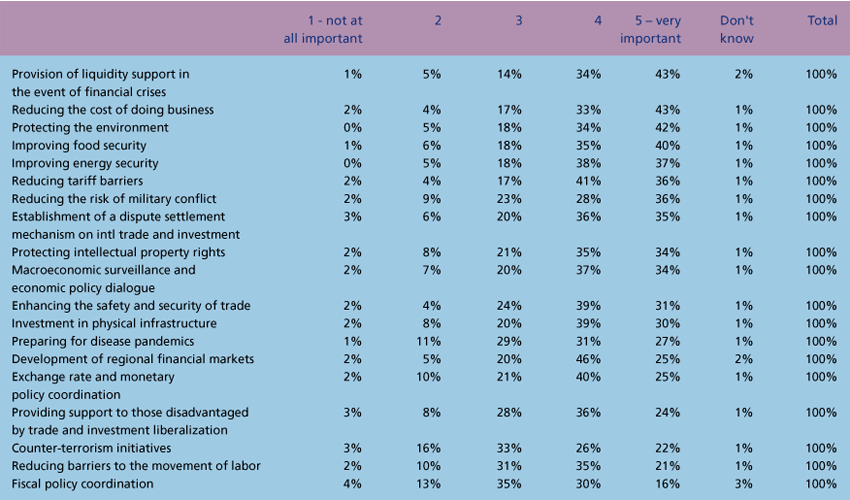

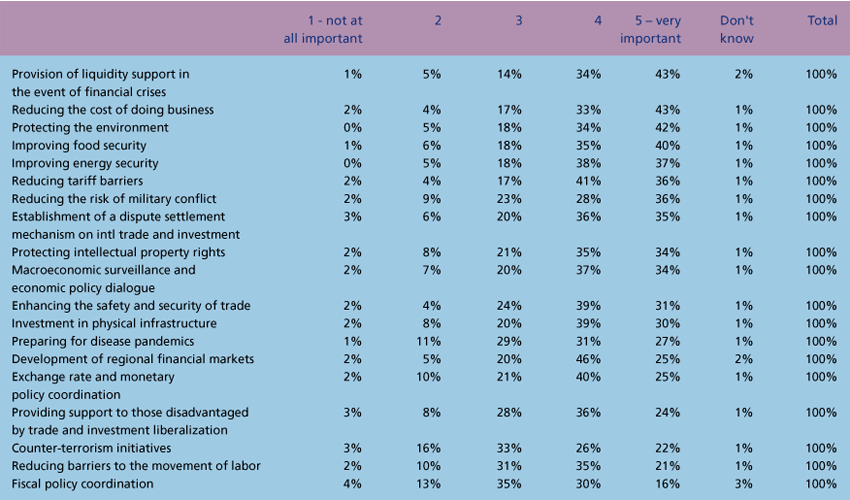

Question 7: Please rate the importance of strengthening regional cooperation in the Asia Pacific region on the following issues:

Given the financial market turmoil it should come as no surprise that the top area for strengthening regional cooperation was provision of liquidity support in the event of financial crises. Tariff barriers ranked second highest followed by the environment, then reducing the cost of doing business, with the top five issues rounded of by energy security and food security equally. Generally, this matches the results in question 12 on priorities for APEC Leaders with the exception of strengthening the APEC institution which does not appear in this list.

Section 4: Regional Institutions

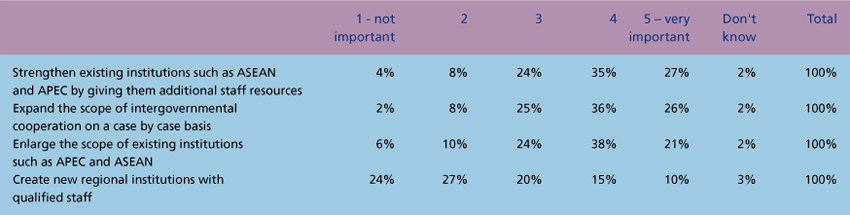

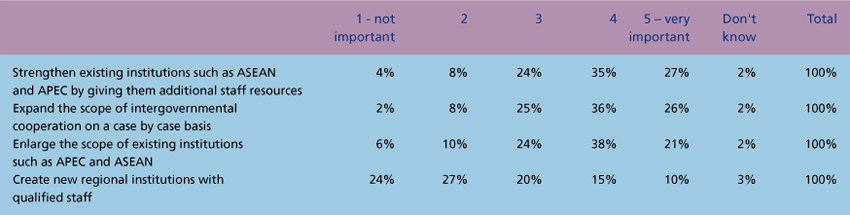

Question 8: How would you rate the importance of the following measures for enhancing regional cooperation?

Respondents strongly favored strengthening existing institutions rather than creating new ones to enhance regional cooperation. The most favored route for enhancing regional cooperation was to give existing additional staff resources to existing institutions such as APEC and ASEAN (62%). Opinion-leaders were largely skeptical about creating new institutions with less than 25% of respondents rating this as an important measure.

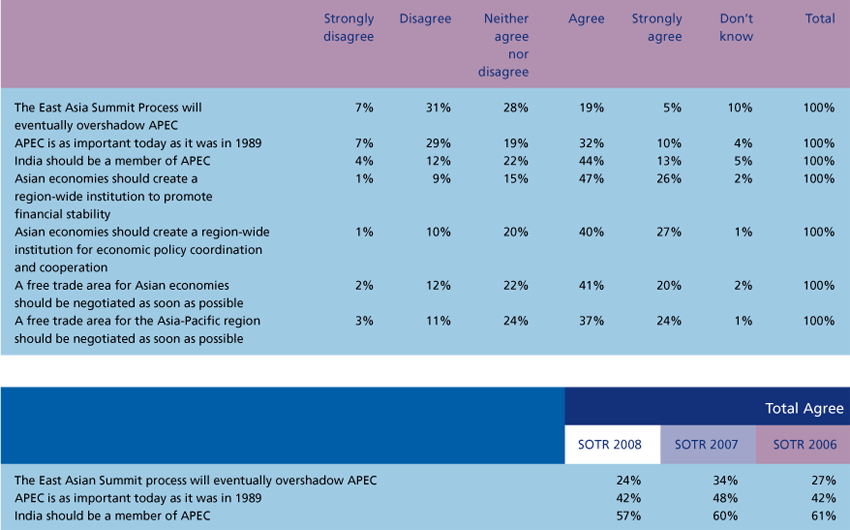

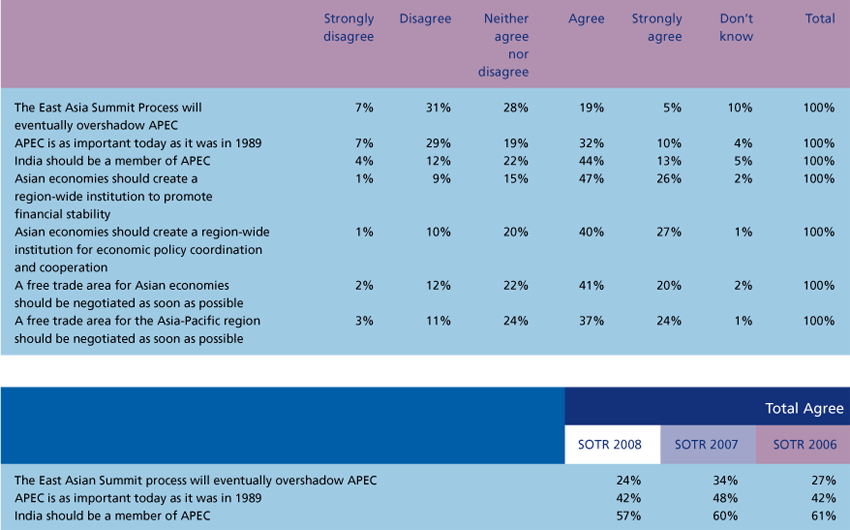

Question 9: Please indicate your agreement of disagreement with the following statements:.

Overall 72 percent of responses agreed or strongly agreed that Asian economies should create a region-wide institution to promote financial stability, 67 percent for economic policy coordination and cooperation, and 62 percent that a free trade area for Asian economies should be negotiated as soon as possible. Furthermore, 57 percent agree that India should be a member of APEC.

The three questions that are comparable across the three years of the survey show little difference in the responses, with slightly fewer respondents see the East Asian Summit as a threat to APEC.

Slight differences present themselves when viewing the role for regional institutions across regions. There was high support from South American respondents with 86 percent agreement that a free trade area for the Asia Pacific region should be negotiated, but only 63 percent of South American respondents agree that an FTA should be created for Asian economies. Of North American respondents, 55 percent strongly disagree or disagree with the statement that APEC is as important today as it was at its start in 1989, while 70 percent agree that Asian economies should create a region-wide institution to promote financial stability. In contrast, 52 percent of Australian and New Zealand respondents agree or strongly agree that APEC is as important today as it was at its start in 1989, while 44 percent think Asian economies should create a region wide institution to promote financial stability. Of Northeast Asia respondents, 51 percent disagree that the East Asian Summit will eventually overshadow APEC.

APEC is as important today as it was in 1989

A free trade area for the Asia-Pacific region should be negotiated as soon as possible

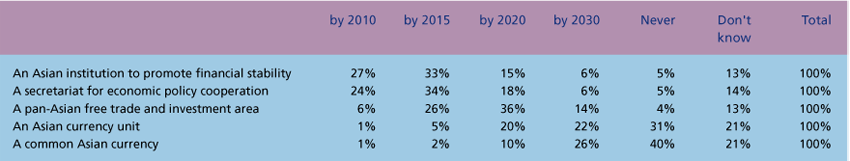

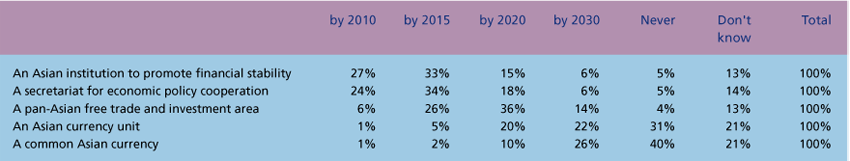

Question 10: When do you think the following regional institutions will be created?

There does not appear to be strong agreement on a timeframe for any of the institutions. A majority of respondents thought that an Asian institution to promote financial stability, a secretariat for economic policy cooperation and a pan-Asian free trade and investment area would be created by 2020 (75%, 76% and 68% respectively). However, respondents were much less sure about the creation of an Asian currency unit or an Asian common currency with 40 percent of total respondents indicated that a common Asian currency will never be created and 31 percent that an Asian currency unit will never be created.

Section 5: APEC

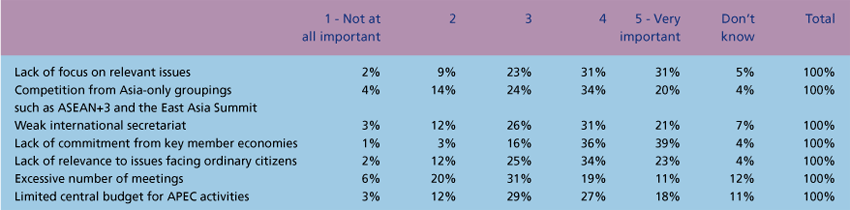

Question 11: What are the most important challenges facing APEC?

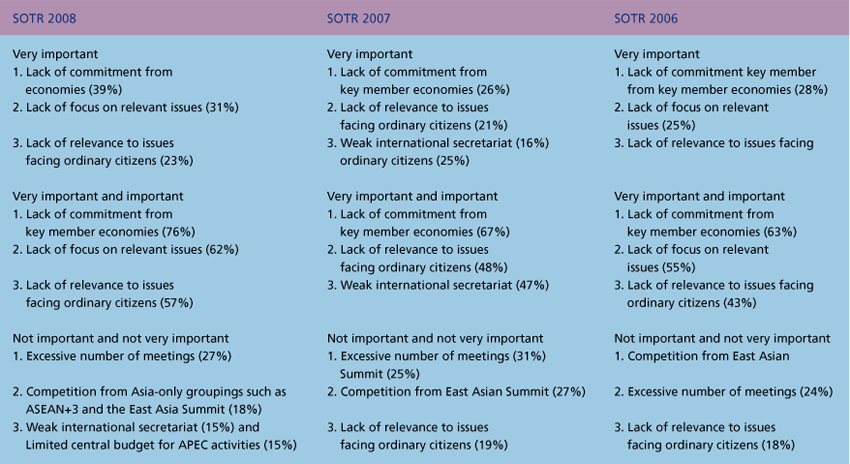

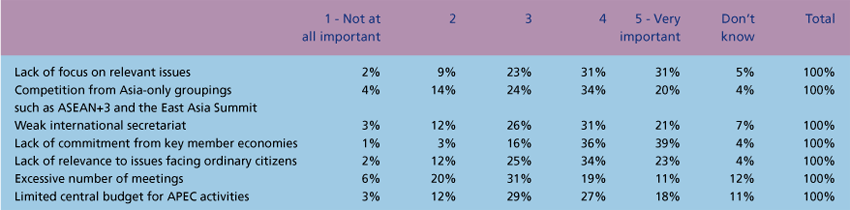

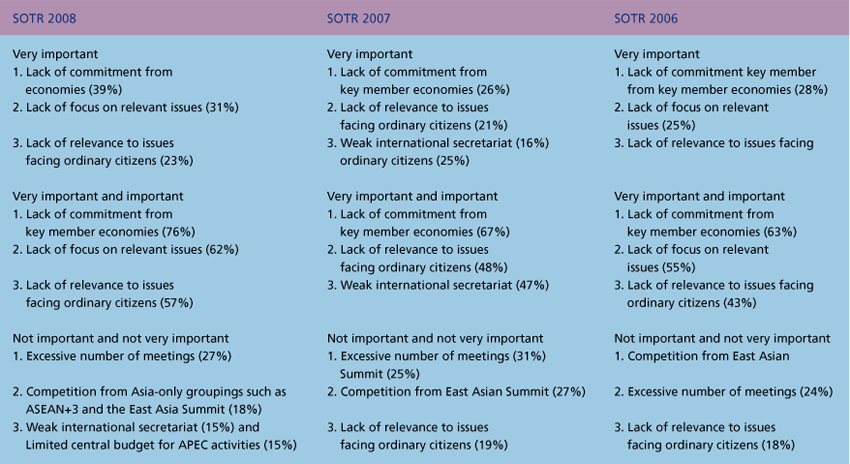

When asked what the most important challenges facing APEC, 76 percent of survey respondents viewed a lack of commitment from key member economies as a very important or important challenge. Lack of focus on relevant issues and lack of relevance to issues facing ordinary citizens are also viewed as the top challenges.

Survey respondents do not consider excessive number of meetings, competition from Asia-only groupings or a weak international secretariat and limited central budget as important or very important challenges. Regional responses to the question were also similar, with each region considering a lack of commitment from key member economies as the most important challenges facing APEC. Over the past three years of survey data, the percentage of respondents citing “lack of commitment from key member economies” as an important or very important challenge for APEC has increased from 63 percent in 2006 to 67 percent in 2007 and 76 percent this year.

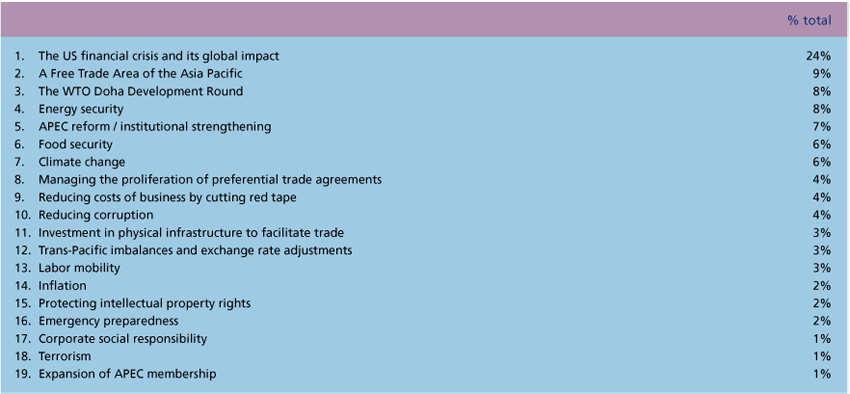

Question 12: What do you think should be the top five priorities for APEC Leaders to discuss at their upcoming meeting in Lima?

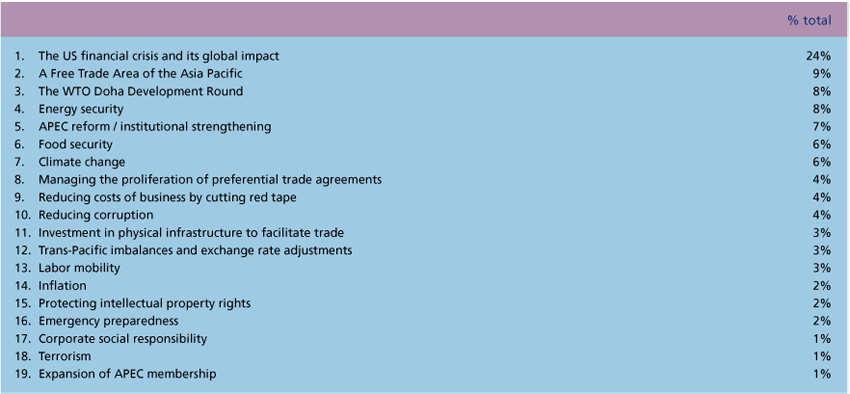

By far the top priority for the APEC Leaders’ meeting was the US Financial Crisis and its global impact, followed by the Free Trade Area of the Asia Pacific, the WTO DDA, energy security, and APEC reform. That the ongoing financial crisis should be top should come of no surprise, however, that the proposed FTAAP has now overtaken the WTO as priority area of discussion demonstrates increasing skepticism over the likelihood of a breakthrough in the global trade talks being reached. Moreover, only respondents from the nongovernment sector still ranked the WTO DDA negotiations as a higher priority than the FTAAP. Amongst the sub-regions only one, Australia-New Zealand ranked the WTO above the FTAAP.

Climate change, such a big issue for the Sydney Summit last year still ranked highly but is down in the list of priorities. While it is still a top 5 issue for most of the sub-regions including Northeast Asia, North America and Australia-New Zealand, only Southeast Asia and South America did not have climate change as a top 5 priority issue.

<< Previous

Next >>

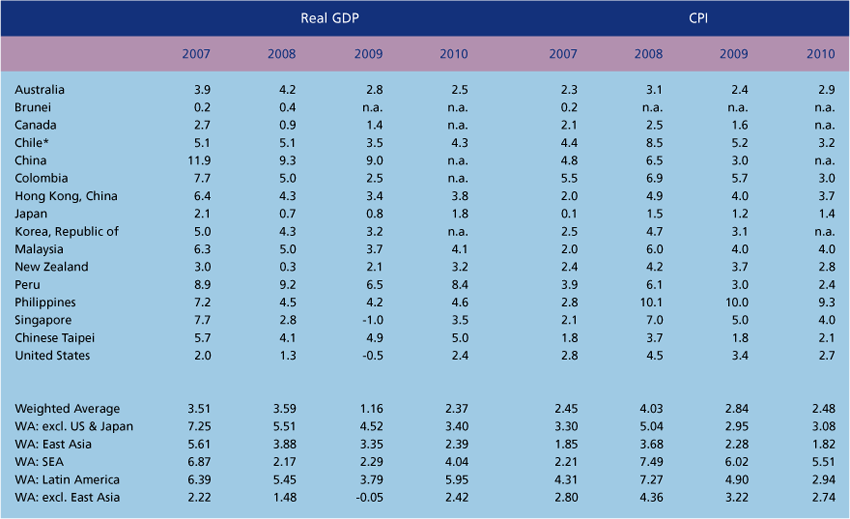

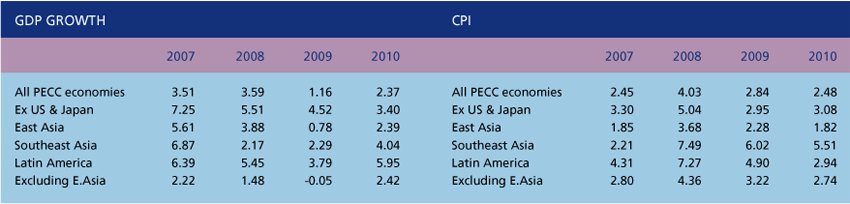

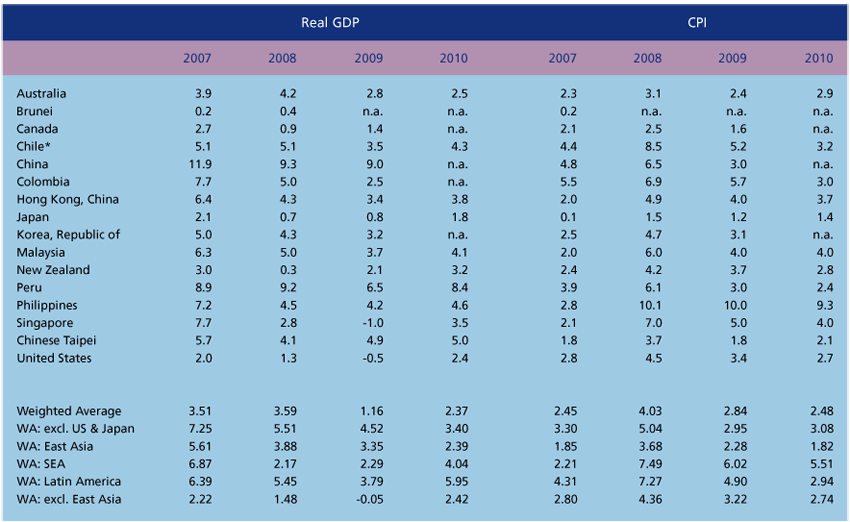

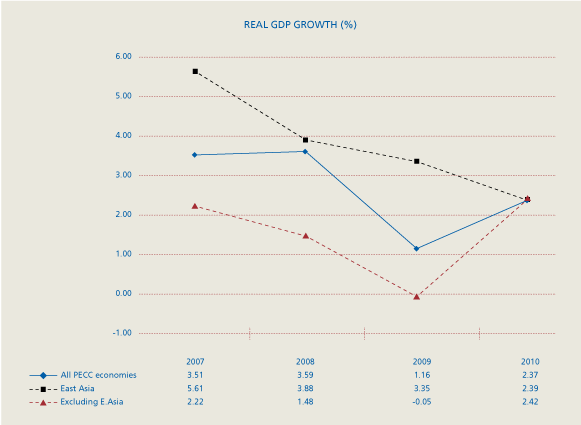

The US sub-prime mortgage crisis has turned into an international financial crisis but it is not yet certain that the ensuing global downturn will result in a severe recession in Asia. Asian economies have been hit as hard as industrialized economies by a sharp decline in financial asset prices and by the credit crunch. However, economic growth in greater China and parts of Southeast Asia remains positive, and many Asian governments have fiscal and monetary tools at their disposal to mitigate any further deterioration in their economies. This is not to say that there has been a “decoupling” of Asia from western industrialized economies. Indeed, the export outlook has dimmed considerably for major Asian economies, and the effects of falling export demand have already led to sharp employment losses. But Asian economies have relatively strong banking systems and large foreign reserves, which puts them in a much better position than in the 1997- 98 financial crisis. Even so, downside risks weigh heavily in the current forecast, which is predicated on the positive impact of the US and other liquidity injections taking effect in the first half of 2009, resulting in a modest recovery.

The US sub-prime mortgage crisis has turned into an international financial crisis but it is not yet certain that the ensuing global downturn will result in a severe recession in Asia. Asian economies have been hit as hard as industrialized economies by a sharp decline in financial asset prices and by the credit crunch. However, economic growth in greater China and parts of Southeast Asia remains positive, and many Asian governments have fiscal and monetary tools at their disposal to mitigate any further deterioration in their economies. This is not to say that there has been a “decoupling” of Asia from western industrialized economies. Indeed, the export outlook has dimmed considerably for major Asian economies, and the effects of falling export demand have already led to sharp employment losses. But Asian economies have relatively strong banking systems and large foreign reserves, which puts them in a much better position than in the 1997- 98 financial crisis. Even so, downside risks weigh heavily in the current forecast, which is predicated on the positive impact of the US and other liquidity injections taking effect in the first half of 2009, resulting in a modest recovery.