Chapter 2 - Survey of Opinion-Leaders

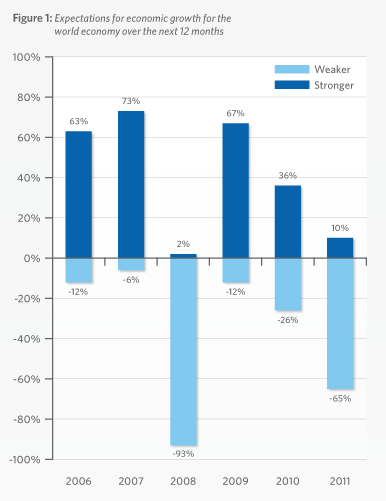

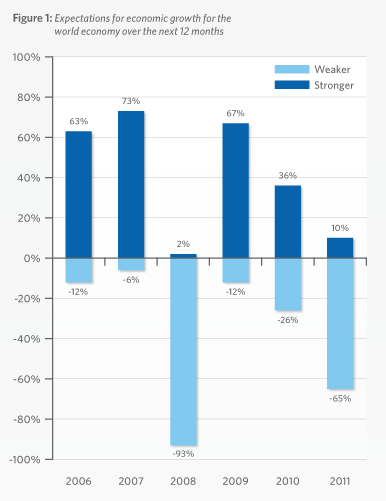

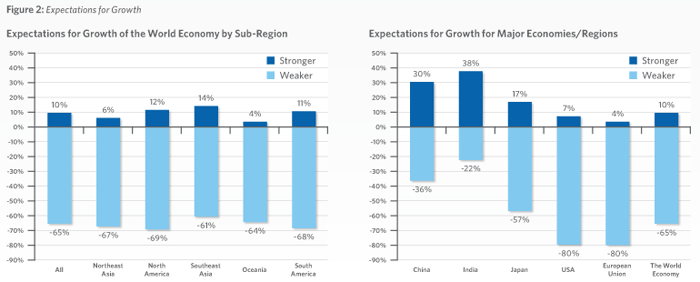

According to our panel of opinion leaders, the expectations for growth are at their lowest since the 2008 economic crisis. Sixty-five percent of respondents believe real GDP growth will be much weaker in the next twelve months compared to the previous year, with only 10 percent who feel economic growth will be stronger. This pessimistic outlook is in stark contrast to most forecasts by leading institutions, including the June update of the International Monetary Fund, which is expecting 3.6 percent real GDP growth for the region. In effect, our panel is predicting another economic contraction in the year ahead, albeit not as severe as in 2008-2009 (see Figure 1 ).

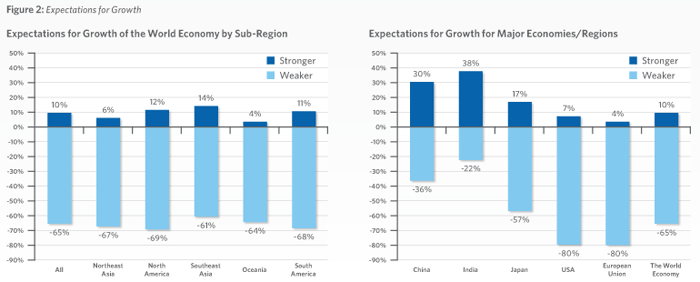

The rising sense of pessimism is consistent across the region, even though the outlook for large emerging market economies is somewhat more positive. Even in the case of China, the number of respondents expecting growth to slow down in China narrowly exceeds those who believe in a rosier outlook. The only economy where the balance of opinion is in favor of stronger growth is India.

The gloomy outlook is most pronounced in the case of the United States and Europe where over 80 percent of respondents expect slower growth in the next 12 months. This finding is not surprising given that the survey was conducted on the heels of the US debt ceiling agreement and following a series of sovereign debt incidents in Europe (see Figure 2).

Top 5 Issues for APEC Leaders’ Meeting

The leaders of the Asia-Pacific region will gather in Honolulu in mid-November against this backdrop of a deteriorating economic outlook and possibly even an unfolding economic crisis. While the immediate challenge of any economic crisis will crowd out consideration of longer term priorities, the top five issues chosen by our respondents for APEC leaders to consider in Honolulu are as follows:

- A Free Trade Area of the Asia-Pacific (FTAAP)

- A green growth strategy for the region

- The WTO Doha Development Round

- Corruption

- The APEC growth strategy

There were significant differences in the ranking of issues by respondents from different sectors. Business respondents, for example, appear to have given up on the WTO Doha round, ranking it 12th out of a list of 23 issues, and instead placing top priority on what is seen by many as “Plan B” – the FTAAP. Respondents from the government placed much higher priority on growth strategies than the business and non-government sectors. Both business and government respondents highlighted regulatory issues as top issues to be addressed by APEC economic leaders.

Respondents from Northeast Asia and South America placed more emphasis on growth strategies than respondents in other regions. Northeast Asian respondents were alone in listing financial sector regulatory reform as a top issue for leaders to address. Respondents from Oceania rated regulatory impediments to business as the top issue for APEC leaders. Southeast Asians and North Americans gave particular emphasis to addressing corruption.

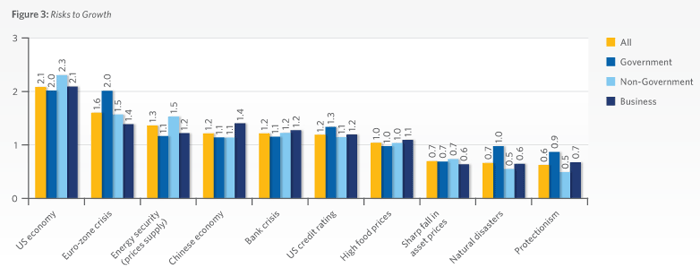

Macroeconomic factors dominate risks to growth

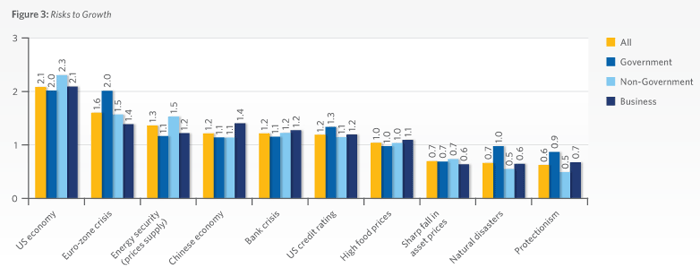

Slow growth in the United States is the top risk facing economies in the region, followed by a possible sovereign debt crisis in the Euro-zone and concerns about energy prices and supply. Macroeconomic risk factors dominate opinion-leaders’ thinking in this year’s survey, with geopolitical and other factors ranking much lower. Almost all of the top ten risks are the same as last year, which suggests that opinion leaders are not confident about the state of the global recovery, even though it is into its second year.

While opinion-leaders from the different sectors generally shared the same views on the major risks to growth in their respective economies, some differences are worth noting. Respondents from the business community rank slower growth in China as a much higher risk than their counterparts in government and the non-government sectors. Business respondents were alone in ranking shortages of available talent and skills as a top-ten risk to growth.

Among the sub-regions of the Asia-Pacific, there was also convergence in views on the major risks. However, Southeast Asians are much more concerned about high food prices, ranking it as the highest risk to economic growth above a slowdown in the US economy. Both Southeast Asia and Oceania rank a shortage of talent/skills as a top ten risk to growth unlike respondents from other sub-regions.

Innovation Critical to Sustained Growth

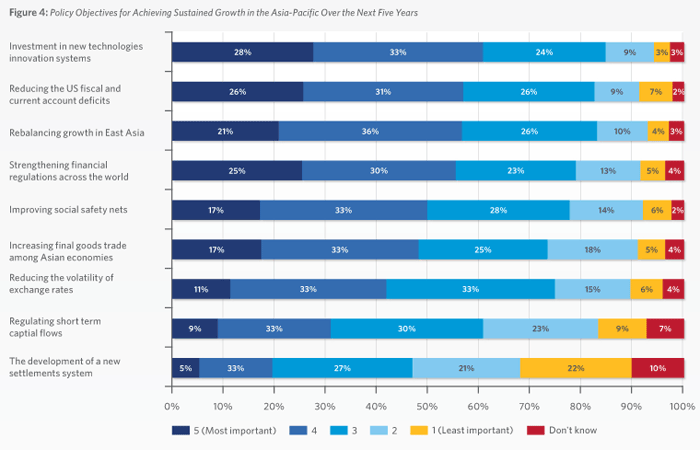

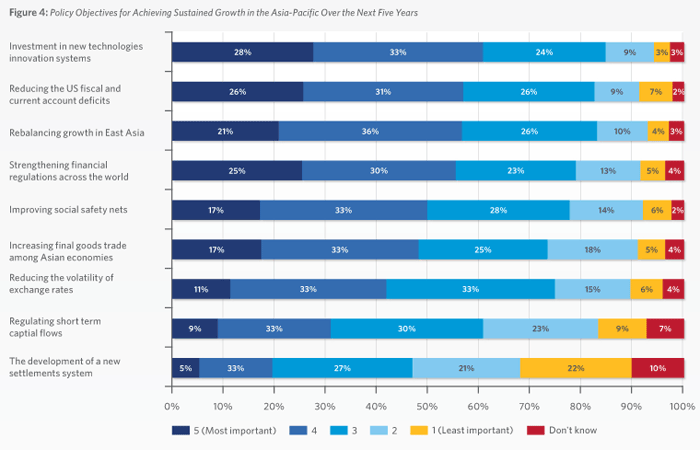

As discussed in chapter one, the Asia-Pacific region needs a period of structural reform to address internal and external imbalances that stand in the way of long-term sustainable growth. This is a theme that APEC leaders have also taken up, and we asked our panel to rank policy objectives for achieving sustained growth in the region over the next five years.

Investment in new technologies and innovation systems was ranked as the most important policy objective for achieving sustained growth, followed by a reduction in the US current account and fiscal balances and the need to rebalance growth in East Asia.

There were significant differences in policy priorities between the sub-regions. Respondents from Northeast Asia and Oceania rated a reduction in the US current and fiscal deficits as the most important policy objective, while Southeast Asians rated increasing final goods trade within East Asia as the most important. North Americans rated increasing domestic demand within East Asia as the most important. Not surprisingly, each sub-region is looking to other jurisdictions for solutions to challenges that they are facing and which are fundamentally regional in scope. There is an opportunity for APEC leaders meeting in Honolulu to take a broader, collective view of the problem, and to embrace solutions that involve all member economies.

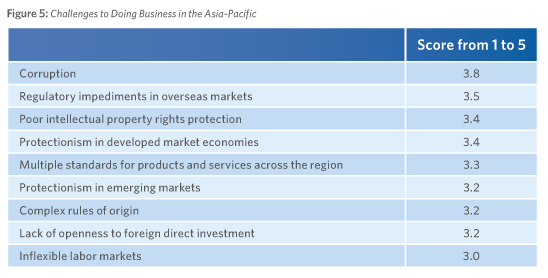

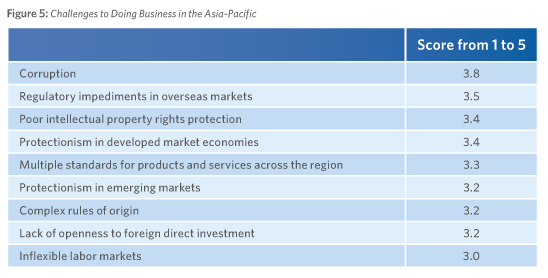

Behind-the-Border Issues Biggest Challenges to Doing Business

Opinion leaders in the region have again emphasized behind-the-border barriers as the most important barriers to doing business in the region. With the steady fall in tariffs over the years, regulatory and other non-tariff barriers are emerging as more significant obstacles to international trade and investment.

The top challenges identified by the panel are as follows:

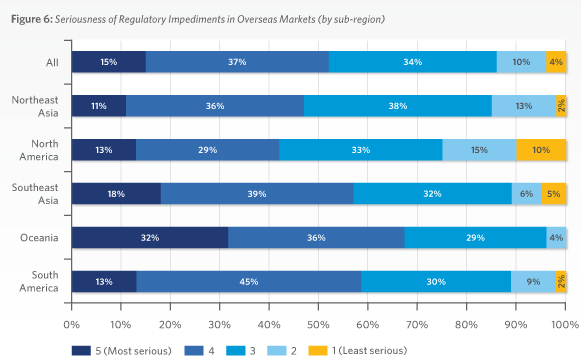

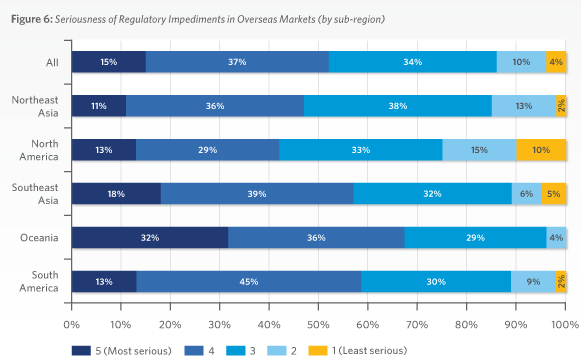

Regulatory Impediments a Region-Wide Concern

These findings resonate with the APEC focus this year on “regulatory coherence” and should provide the impetus and rationale for longer-term attention to this issue.

Respondents from Oceania were the most concerned about regulatory impediments, followed by South America and Southeast Asia. Respondents from business, government and non-government sectors were uniform in their assessment of the regulatory impediments

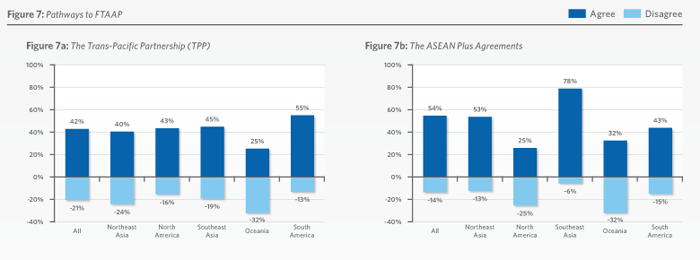

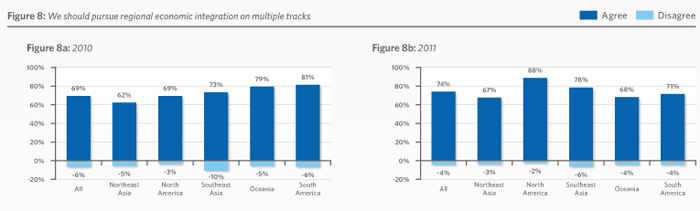

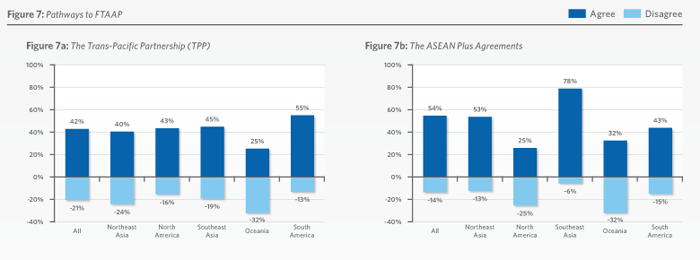

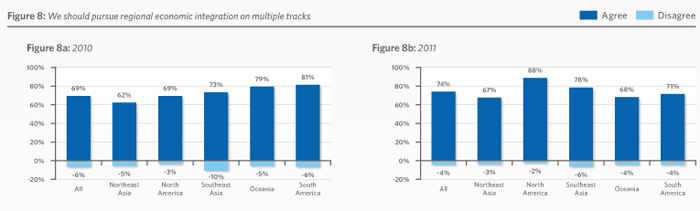

Pathways to Regional Economic Integration

At their meeting in Yokohama last year, APEC leaders said that a Free Trade Area of the Asia-Pacific should be pursued by developing and building on ongoing regional undertakings, such as the ASEAN+3, the ASEAN+6, and the Trans-Pacific Partnership (TPP). This approach was validated by our survey findings last year and is again confirmed by this year’s results.

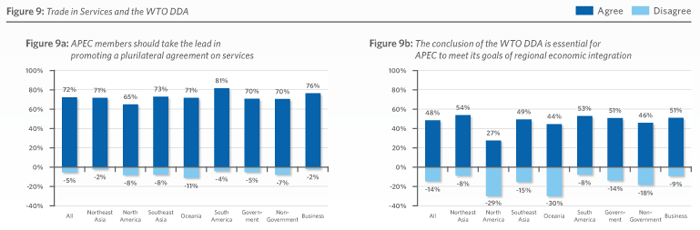

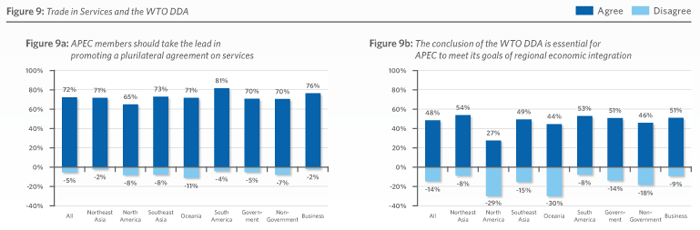

There was very broad support for the suggestion that “APEC members take the lead in promoting a plurilateral agreement on services” with 72 percent of respondents agreeing with the statement and only 5 percent disagreeing. Among the sub-regions, agreement on this suggestion was highest in South America followed by Northeast Asia. There was strong support for this idea from all sub-regions.

Although respondents on the whole tended to agree that “the conclusion of the WTO DDA is essential for APEC to meet its goals of regional economic integration”, this was not a view that was shared across the region. Respondents from North America in fact disagreed with this statement, and there was only lukewarm support from respondents from Oceania. Respondents from Northeast Asia, however, strongly agreed with the idea that a conclusion of the DDA is essential for APEC to meet its objectives.

Energy Security and Prospects for Transpacific Energy Trade

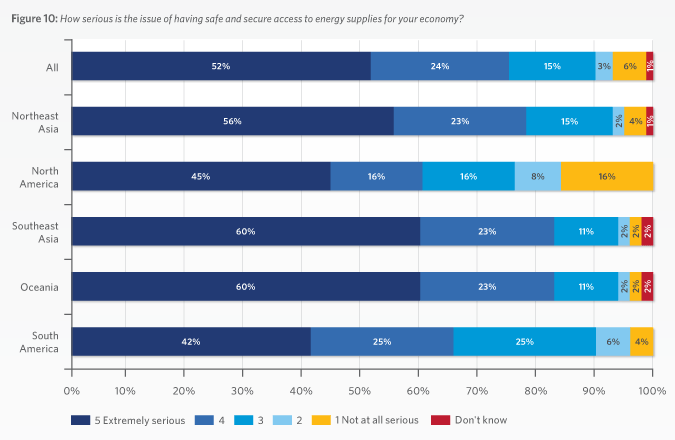

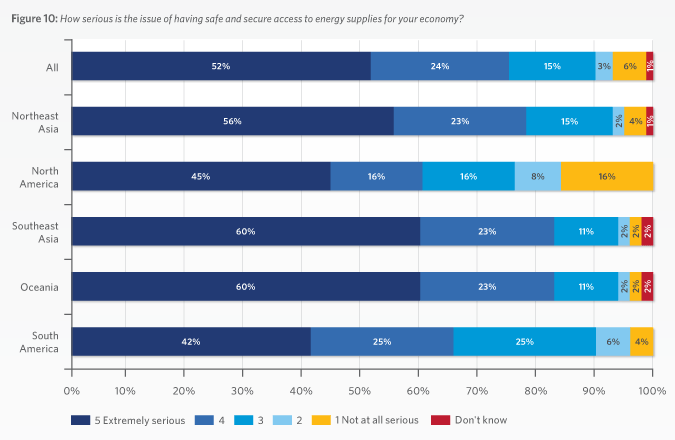

Energy products are among the most traded goods in the region and around the world. However, there is to date very little transpacific trade in energy, despite growing concerns – especially in East Asia – around energy security. Indeed, as a risk to growth, energy issues have consistently been ranked in the top 5 since our survey of opinion-leaders was initiated. Over 50 percent of respondents rated safe and secure access to energy supplies as an extremely serious issue for their economy, with particular concern expressed by respondents from East Asia.

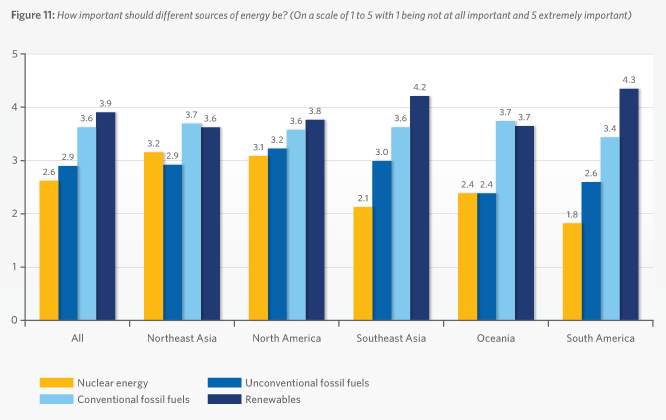

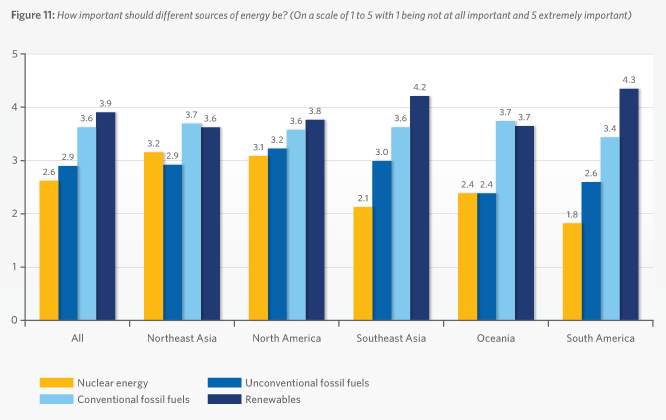

When asked about energy use in the future, respondents on the whole identified renewable energy sources as the most important source. There were, however, wide disparities among sub-regions, with respondents from Northeast Asia and Oceania placing more emphasis on conventional fossil fuels than other energy sources. Northeast Asians also continue to see nuclear energy as a more important energy source than unconventional fossil fuels, whereas other sub-regions believe unconventional fossil fuels should be a more important source of energy for their economies.

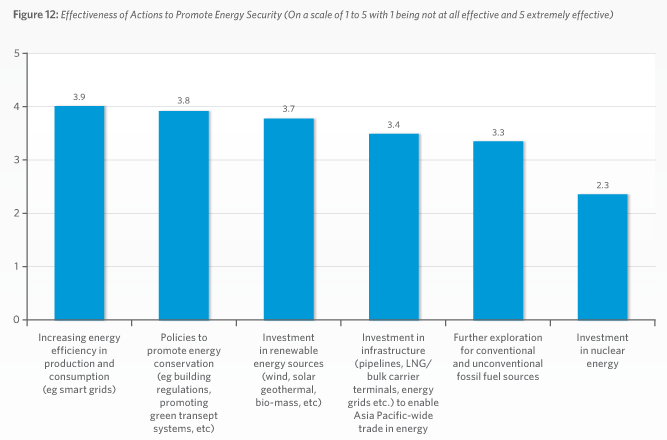

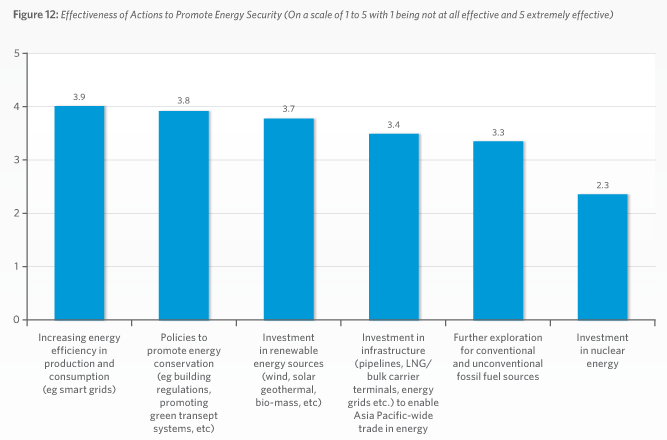

In terms of addressing energy security concerns, demand-side solutions such as increasing energy efficiency and promoting conservation were generally ranked as more effective than supply side responses such as further exploration and developing new sources of energy.

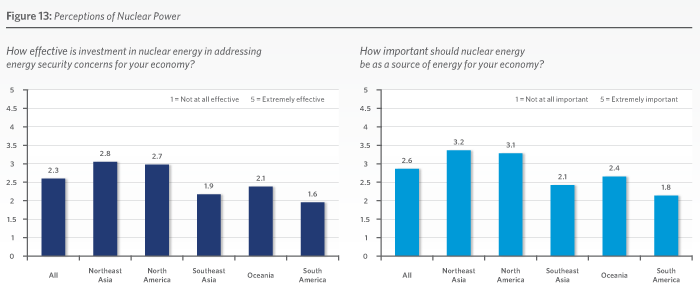

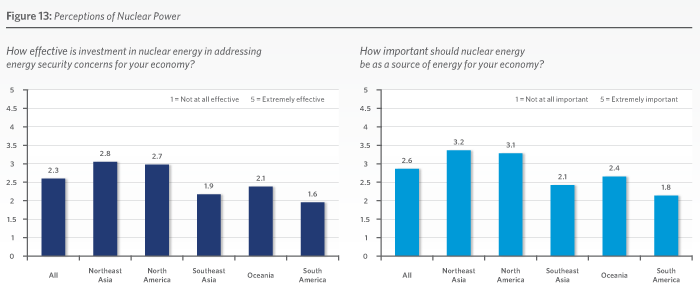

Nuclear Energy Post-Fukushima

The future of the nuclear power industry has been cast into doubt following the Fukushima nuclear disaster in the wake of the tsunami that hit northeast Japan in March 2011. Respondents on the whole ranked investment in nuclear energy lowest in terms of an effective energy security strategy, but views vary widely by sub-region. Northeast Asia and North Americans see nuclear power as a more important source of energy than other sub-regions, with Southeast Asians the least inclined to support this option.

Reducing Greenhouse Gas Emissions

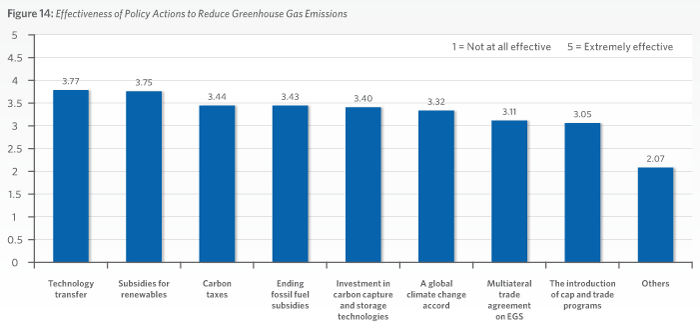

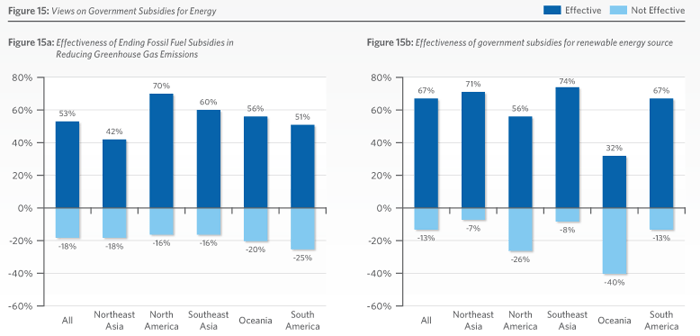

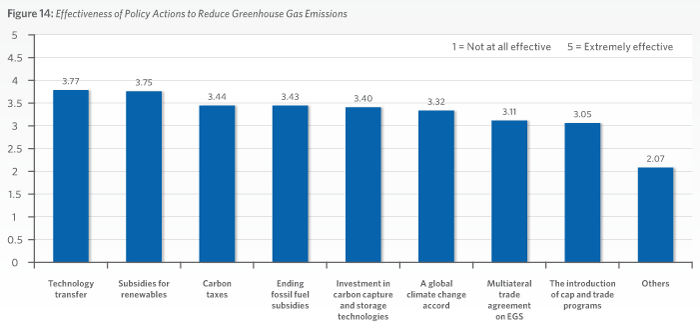

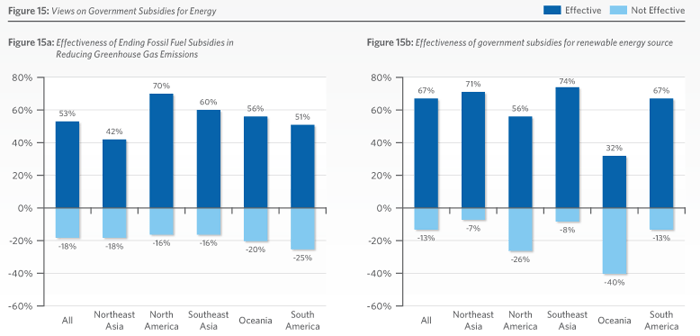

Since 2007 when APEC placed climate change on its agenda, there has been intermittent discussion on measures to reduce greenhouse gas emissions. APEC and G20 leaders have already agreed to phase out fossil fuel subsidies to encourage lower consumption. This policy was one of the top five measures identified by respondents as key actions to reduce greenhouse gas emissions. The other four priorities were technology transfer from developed to emerging economies; government subsidies for renewable energy sources; the introduction of carbon taxes; and investment in carbon capture and storage technologies. There is significant diversity in the ranking of GHG reducing policies among the sub-regions, with respondents from Oceania generally not in favor of government subsidies for renewable energy and limited support as well from North American respondents.

Regional Institutions

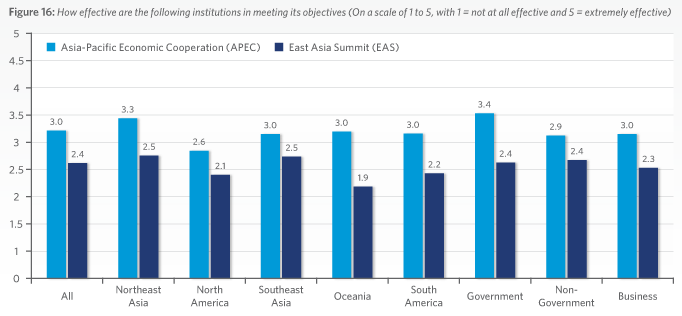

When APEC was founded in 1989, there was no other inter-governmental institution dealing with transpacific relations. The ASEAN Regional Forum (ARF) was founded in 1994, which primarily deals with political and security cooperation in the Asia-Pacific. The ASEAN Plus Three grouping, though not transpacific, includes much of the membership of APEC and was established in 1997 as a response to the Asian financial crisis. More recently, the East Asia Summit (EAS) established in 2005 has included the United States and Russia since 2010 at the foreign minister level and will include the heads of state of those two new members at its upcoming meeting in Indonesia in Bali.

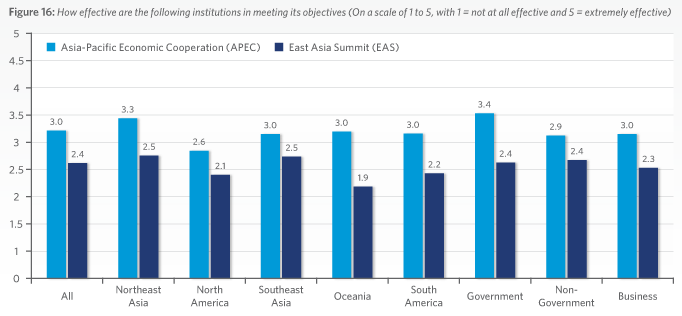

As a relatively well-established institution, APEC generally received higher ratings than other regional organizations. The results, however, are far from outstanding, with 23 percent of respondents giving APEC a low score of ‘1 – not at all effective’ or ‘2’ the next lowest. Only 10 percent of respondents gave APEC a score of ‘5 – extremely effective.’

Respondents from Northeast Asia were the most enthusiastic about APEC’s performance, while North Americans were the least impressed. In the case of the East Asia Summit, Northeast and Southeast Asians gave higher scores, whereas respondents from Oceania were more downbeat.

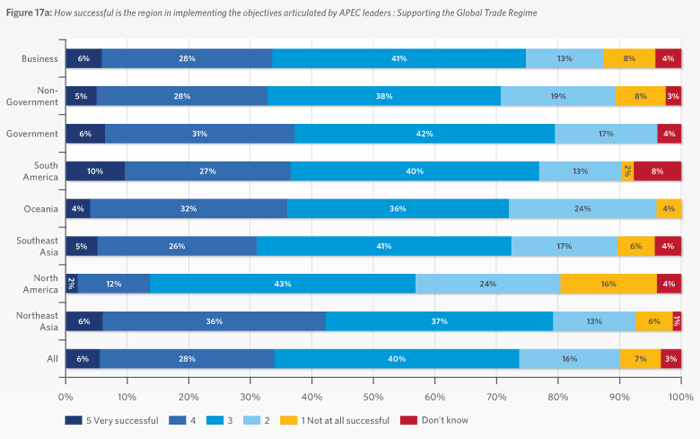

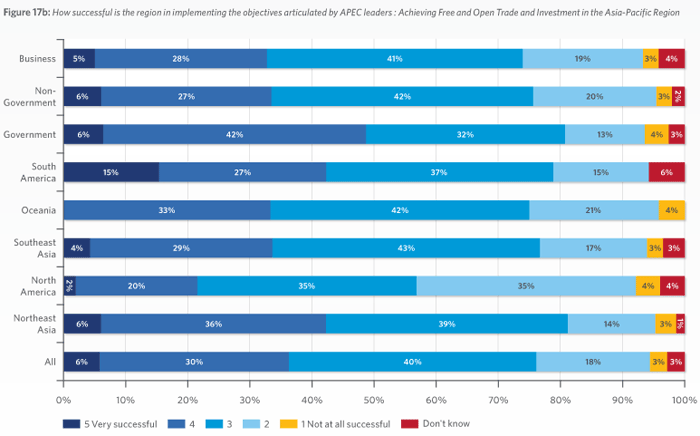

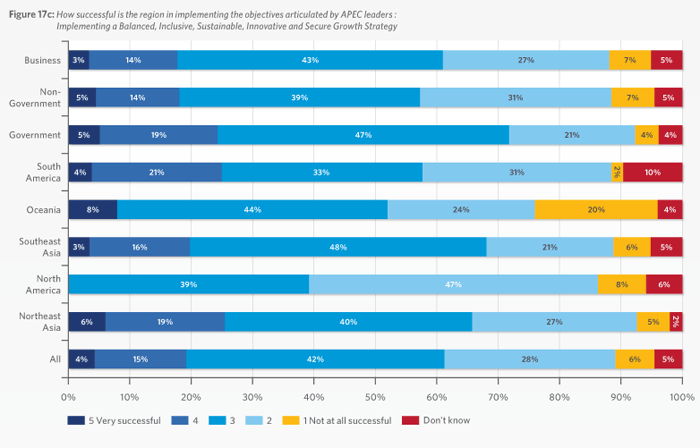

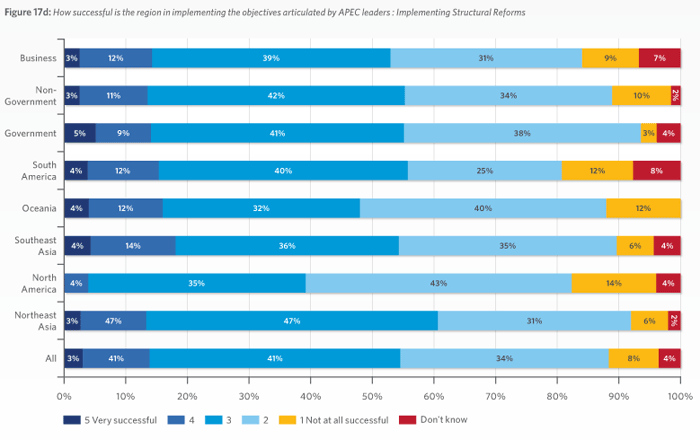

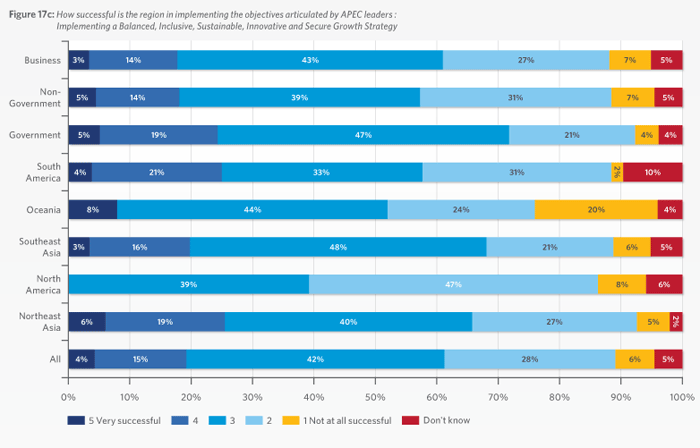

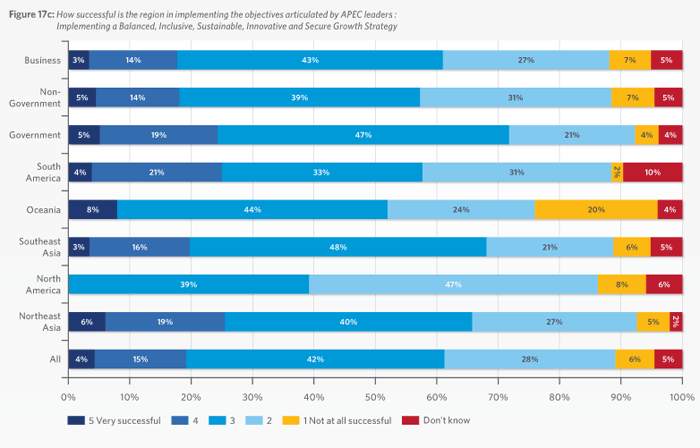

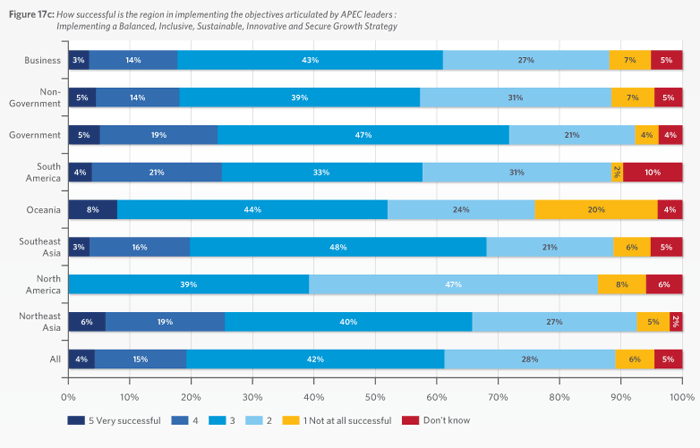

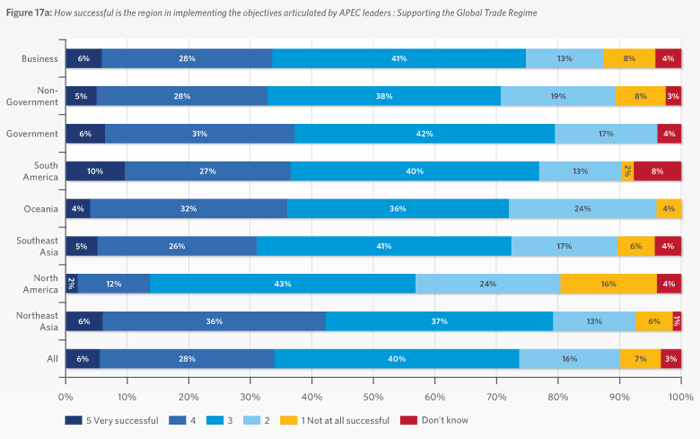

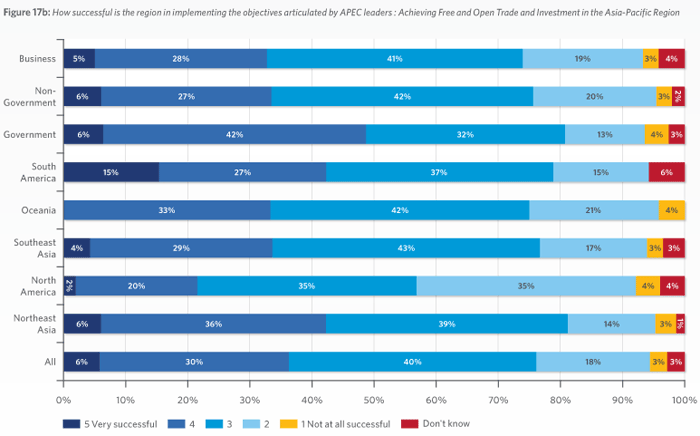

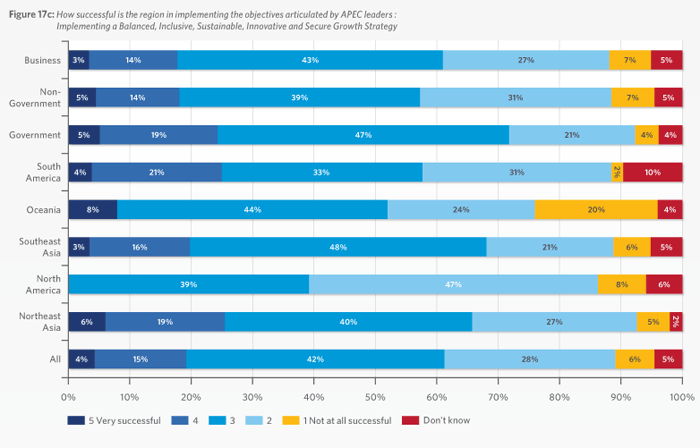

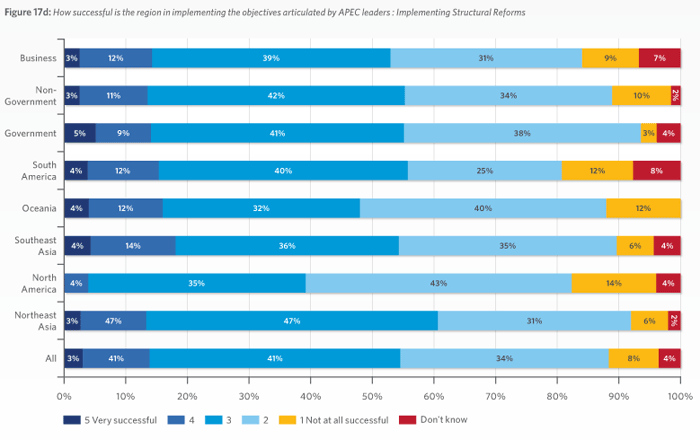

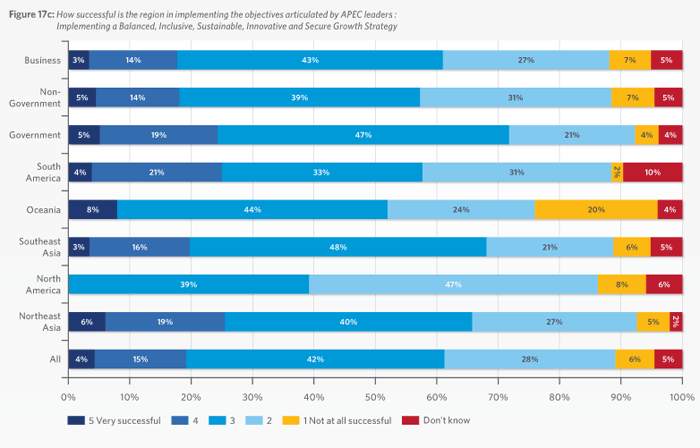

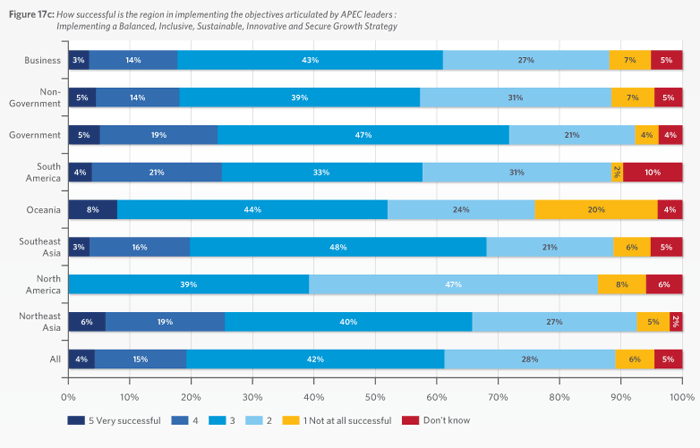

Respondents were also asked to evaluate APEC’s performance in achieving its goals, as articulated at various leaders’ meetings. APEC ranks reasonably well in its core trade and investment focus. However, the assessment is somewhat mixed, with feedback from North American respondents generally less favorable across all dimensions compared to other sub-regions.

<< Previous

Next >>