Chapter 2 - Benefits of services trade liberalization in the Asia-pacific

CONTRIBUTED BY DR. SHERRY M. STEPHENSON, SENIOR FELLOW, INTERNATIONAL CENTRE FOR TRADE AND SUSTAINABLE DEVELOPMENT (ICTSD) / PECC SERVICES NETWORK

In the context of the slower growth that is being experienced by the world economy and by the Asia-Pacific that was underlined in the overview chapter, new drivers of economic dynamism are being sought out. Of the three new drivers of growth that APEC member economies have identified, services are at the top of the list, together with digital trade and increasing the participation of women in the work force. A great deal of potential is still to be derived from achieving more efficient services economies. It is estimated that reducing supply chain barriers, many of which entail services liberalization, would bring about gains much larger than the full elimination of tariffs in the Doha Round context. Reducing these supply chain barriers (aggregated in four categories: market access, border administration, transport and telecommunications infrastructure, and business environment) has the potential to increase world GDP by over six times more than removing all tariffs, thus resulting in an increase of 5 percent of global GDP and 15 percent of trade.

As services have become pervasive throughout the entire economy, achieving more efficient services should unlock economic potential not just in the tertiary sector but also across the board in all areas, including manufacturing and agriculture.

Around the world, services have gone from being viewed largely as a less important, non-tradable sector to a transformational force. Services are now key to economic performance both at the national level and in international markets. Advances in information and communications technology have made services increasingly tradable. However, the commitments undertaken in many trade agreements of the 1990s, including the WTO GATS, are very much out of date. According to the UNCTAD, roughly 50 percent of all services are now traded thanks to the Internet and constitute digital trade, the most dynamic form of trade flows at present.

The potential income and efficiency benefits that can be derived from services liberalization and reform are tremendous. A study by the Peterson Institute of International Economics estimated that a modest liberalization of services comprised of a 10 per cent reduction in the level of existing restrictions plus trade facilitation reforms in the Doha Round context would result in income gains for developing countries of US$135 billion, or 1.3 percent of their GDP, much higher than their OECD counterparts. Importantly, the potential gains from services liberalization and trade facilitation for developing countries are over six times larger than the gains from the proposed formula cuts in tariffs on goods and market access liberalization for agriculture in the Doha context (US$135 billion compared with US$21.5 billion). This is likewise true for trade, where services liberalization would result in export gains that are 3.7 times greater than liberalization of tariffs on goods and agriculture (US$132 billion compared with US$35 billion).

A more recent study looked at potential gains from services liberalization in the context of the Trans-Pacific Partnership (TPP) Agreement, once it is implemented, on the basis of a more ambitious liberalization scenario. Based on CGE modeling by Peter Petri, Michael Plummer and Fan Zhai (2012, updated in 2016) that assumed a 30 percent reduction in the tariff-equivalent restrictions to services, the authors find that the TPP would increase service exports by TPP members by about US$225 billion annually when fully phased in by 2030. This would mean an increase in two-way services trade of about US$450 billion annually over the 2015 baseline.3 As TPP countries account for just over one-third of world trade, very simple calculations suggest that a similar degree of worldwide liberalization of services (reducing restrictions by 30 percent) would increase two-way global services trade by around US$1.6 trillion annually over baseline. Resulting GDP gains would be around 25 percent of these trade gains, or around US$400 billion annually. If the share of developing countries were calculated as proportional to their respective share in world services trade (of 30 percent), then the increased services trade to and from developing countries on a global basis from a global partial liberalization of services restrictions would amount to US$480 billion annually.

The Centre for International Economics in Australia has also quantitatively estimated the benefits from services liberalization on a global basis. Taking a very ambitious liberalization scenario, they obtain striking results based on the complete removal of all barriers to Mode 1 and Mode 3 (cross border services trade and commercial presence, or foreign direct investment in services) in all countries and regions. Developing countries are the big winners in this liberalized scenario, experiencing a nearly 1 percent gain on average to real GDP over the long-term, while developed countries gain 0.2 percent on average. The cumulative gains over the period 2011 to 2025 are estimated to be worth over twice as much to developing countries as to developed ones (A$3.6 trillion compared with A$1.7 trillion). Putting this on an annual basis would allow developing countries to enjoy gains of A$238 billion per year in additional income.

These potentially very important gains in GDP and trade for developing countries will only come about through liberalizing existing restrictions on services and undertaking accompanying structural or regulatory reforms. This is because restrictions on services trade are much higher on average in the developing world, which has led to higher costs for trade in services. In fact, the trade costs of services are estimated to be two to three times as high (in ad valorem terms) as the trade costs of goods.5 While the latter have fallen about 15 percent over the last decade, the trade costs of services have remained high and relatively stable.6 A large number of studies indicate that those countries with the highest initial barriers to trade in services stand to gain the most from liberalization.

Enhanced productivity resulting from greater services efficiency can lead to better overall economic performance. In the case of the United States, services productivity growth has been the key for the overall economy growth since the early 1990s. Because services are a key contributor to innovation, they have been demonstrated to account for a major share of such productivity growth in many advanced economies.

Services contribute to a more diversified and stable economy through generating more diversified and differentiated goods. But also can also determine the level of human capital through their critical impact on the quality of education, R&D and health services, among others.

More efficient services enhance the competitiveness of the whole economy due to the extensive role that they play as inputs into all other economic activities. Achieving a more efficient services sector results in better internal and external competitiveness, measured as a share of services in GDP and the share of services exports in GDP, respectively. Research has shown that services are the only sector of the economy where improvements to both internal and external competitiveness take place simultaneously.

The increased use of telecommunications and the applications of ICT have vastly increased the scope for services trade by reducing the costs of delivering many cross-border services to virtually zero. This has made the possibilities of e-commerce accessible for small and medium-size firms in developing countries. The potential beneficial impacts of engagement in e-commerce are considerable. Results from a study of several European economies show that an increase in participation in e-sales over the period 2003-2010 accounted for 17 percent of the increase in their labour productivity. The impact is shown to be stronger on small than medium-sized firms and to be stronger for services than for other firms.

Policies affecting services competitiveness encompass regulatory policies, trade barriers (that affect cross-border trade, investment and labor mobility in services) and domestic enabling factors that include human capital, infrastructure and the quality of institutions, among others.12 Services liberalization and regulatory reform comprise two of these three areas and are thus vital in terms of outcomes.

SERVICES ARE OF CRITICAL IMPORTANCE TO THE ASIA-PACIFIC REGION

Services are critical important for the Asia-Pacific region for a number of reasons, which are starting to be appreciated fully now that better statistics are available.

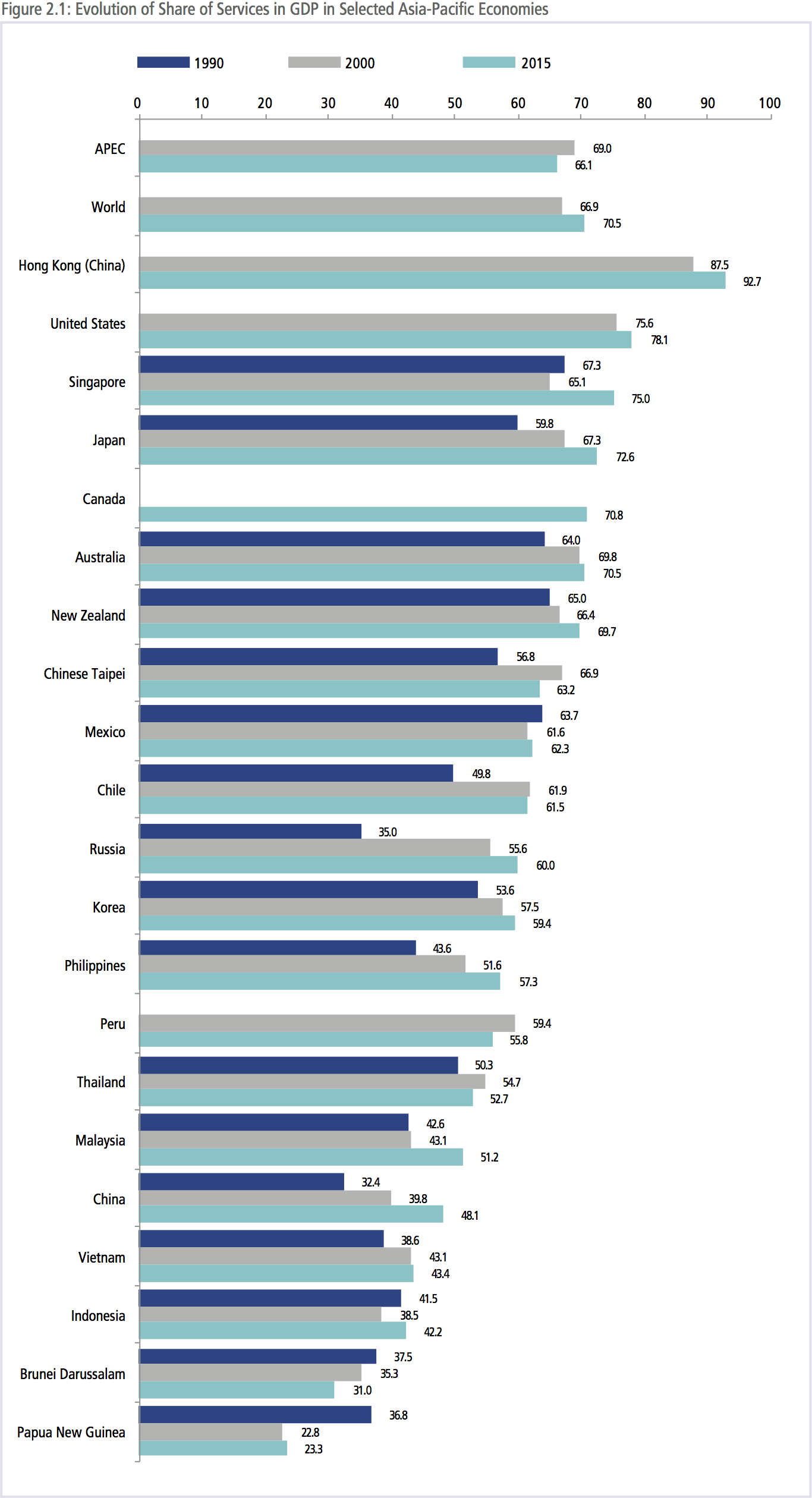

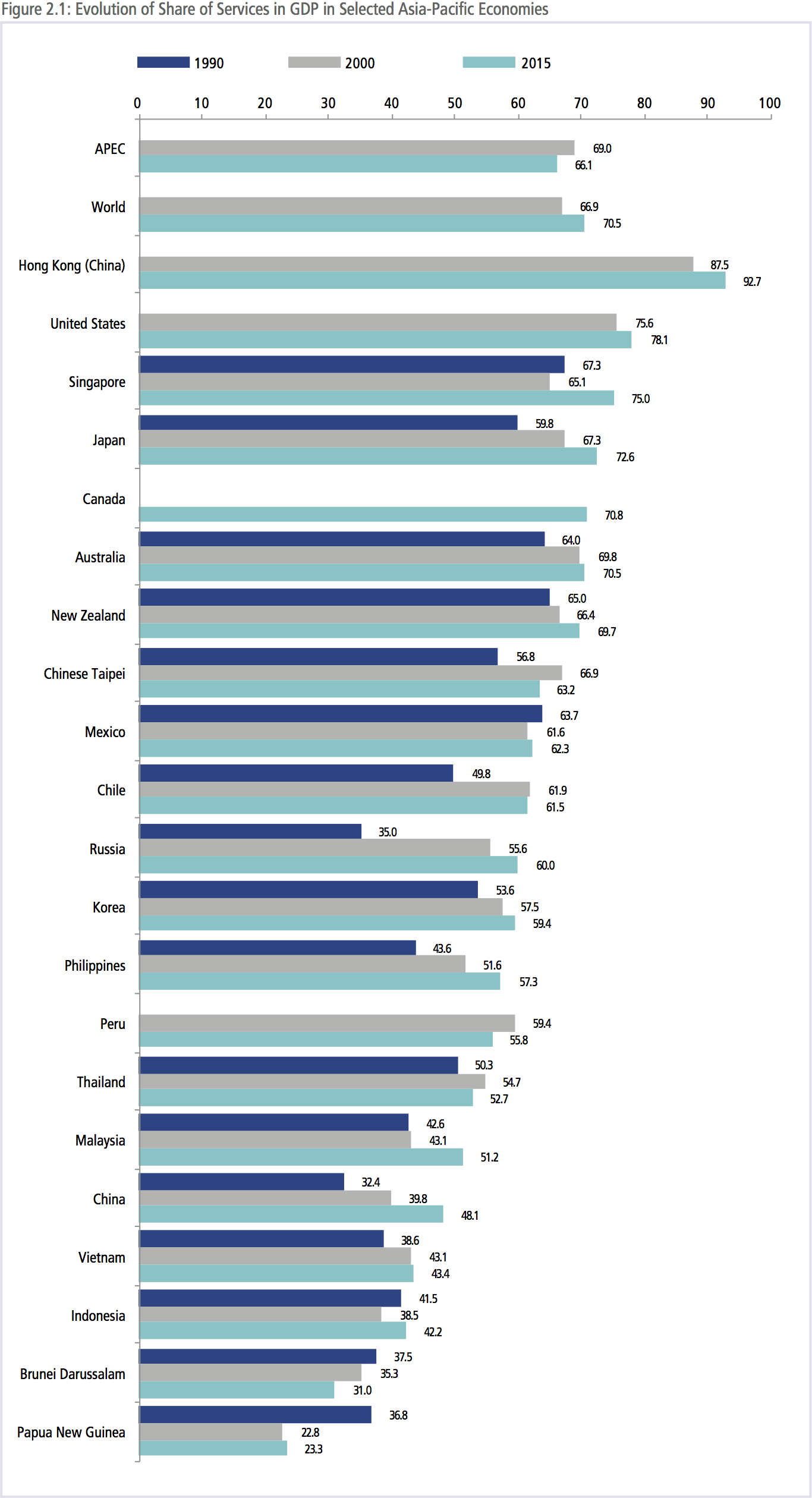

• Services are the most important economic component of most economies in the region and account for the majority of GDP, employment and new investment flows. The share of services in GDP has consistently evolved over the past 15 years for Asia-Pacific economies, as shown in Figure 2.1, The APEC average at around 67 percent is still lower however than the world average for the share of services in GDP, which reached 70 percent in 2015. For emerging economies of the region, services are still less important than agriculture and manufacturing combined, but their share continues to increase steadily.

It is well known that as economies progress in their level of development, services take on increasing importance in all realms of economic activity. This phenomenon has been labeled as ‘servicification’, which denotes the increasing importance of services in both the inputs and output of manufacturing and agriculture, as they are embodied and embedded in goods and natural resource products, along with the increasing proportion of services in consumption baskets and investment flows.

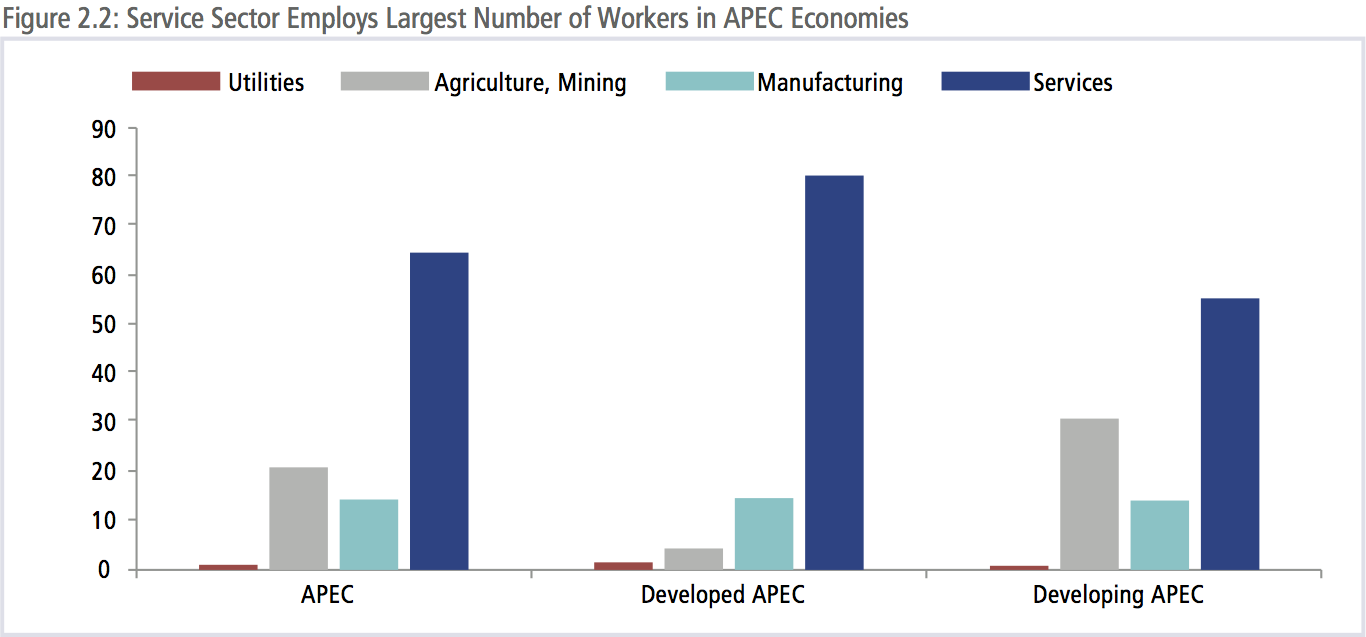

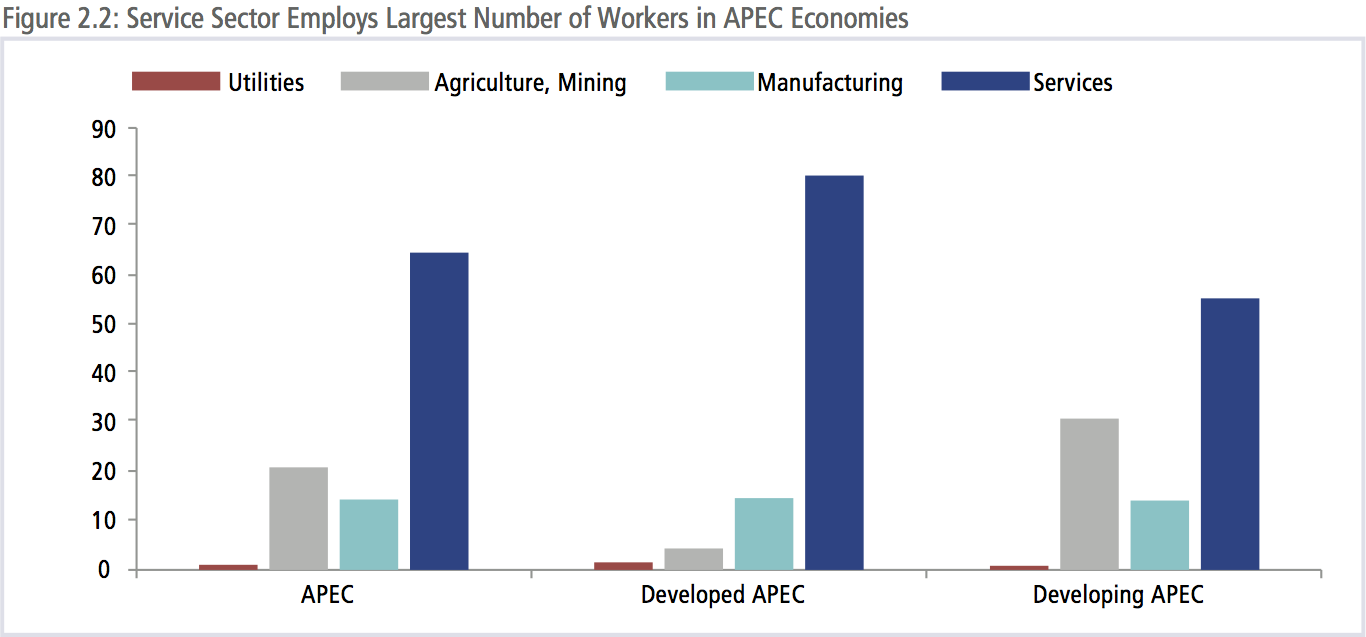

• The services sector is also the biggest employer, engaging the largest number of workers on average, in the Asia-Pacific. In fact, as shown in Figure 2.2, the services sector employs twice as many workers as the agriculture and manufacturing sectors combined within APEC. Services employment in many economies also offers better paid than jobs in other sectors.

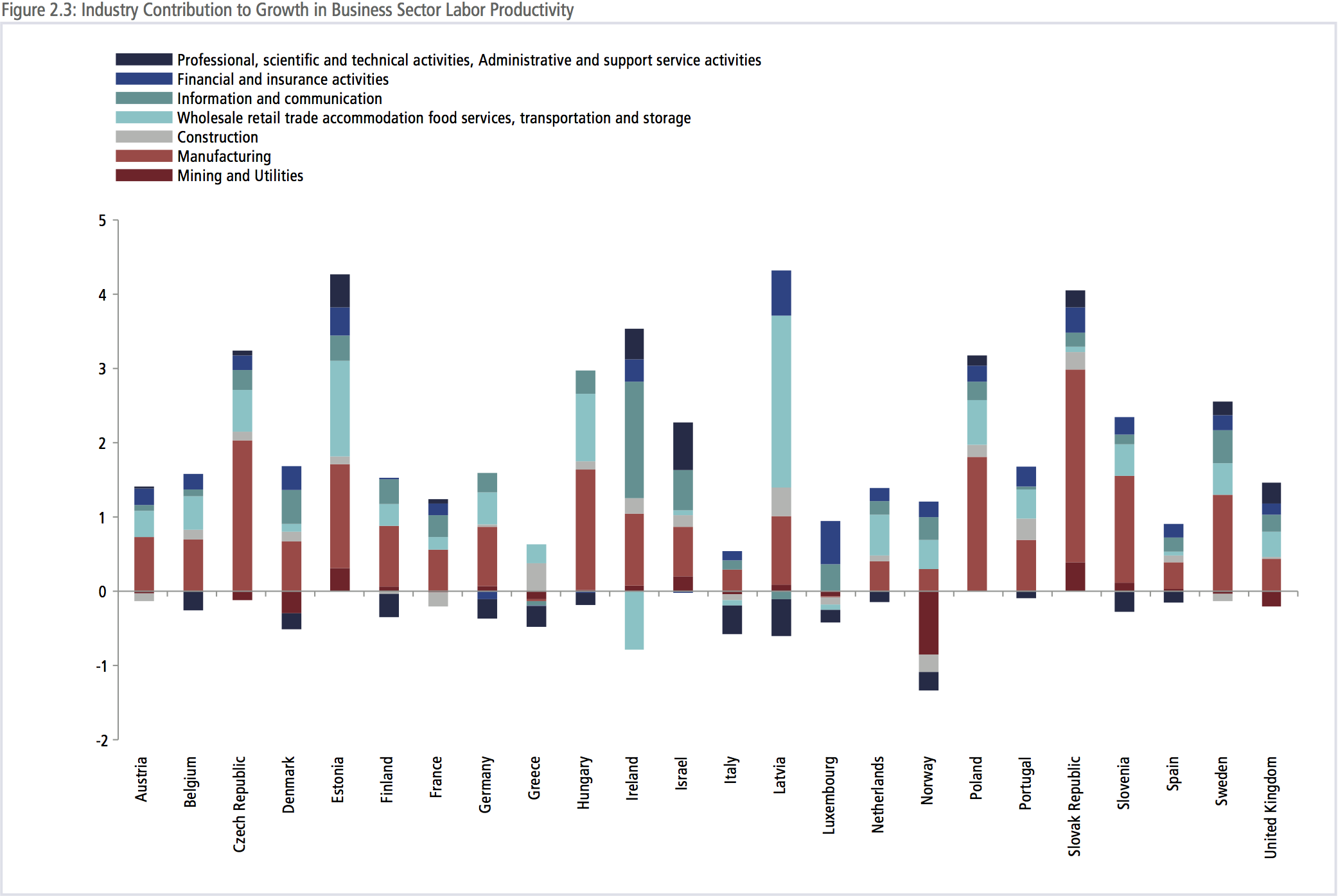

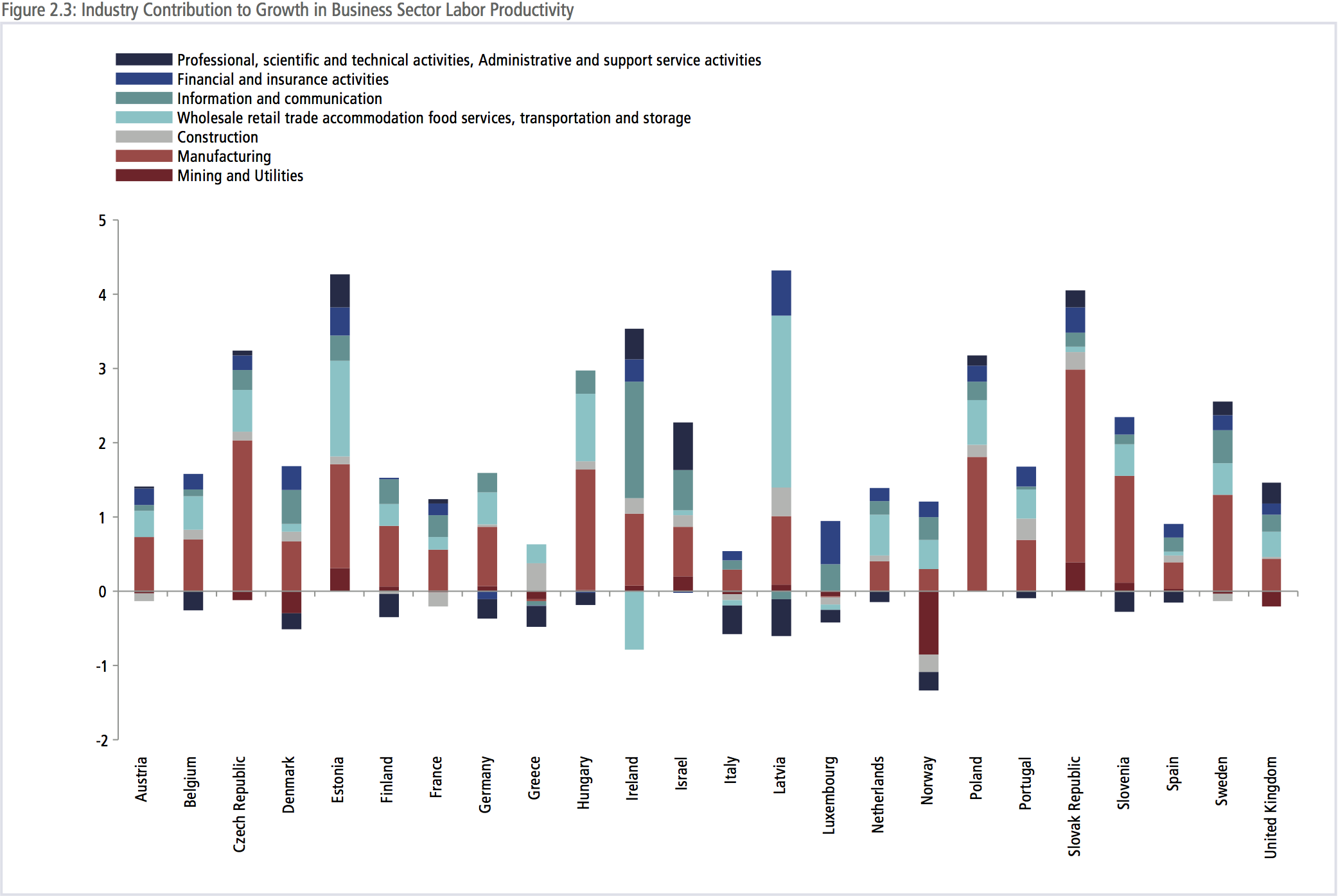

• Services are key to innovation and productivity increases in the region. The productivity component of economic growth is often difficult to measure, but for those economies with databases that allow for this, it can be observed that services provide a significant boost to productivity growth.

Figure 2.3 shows that for several OECD member economies, services account on average for 42 percent of labor productivity growth (including construction as a service).

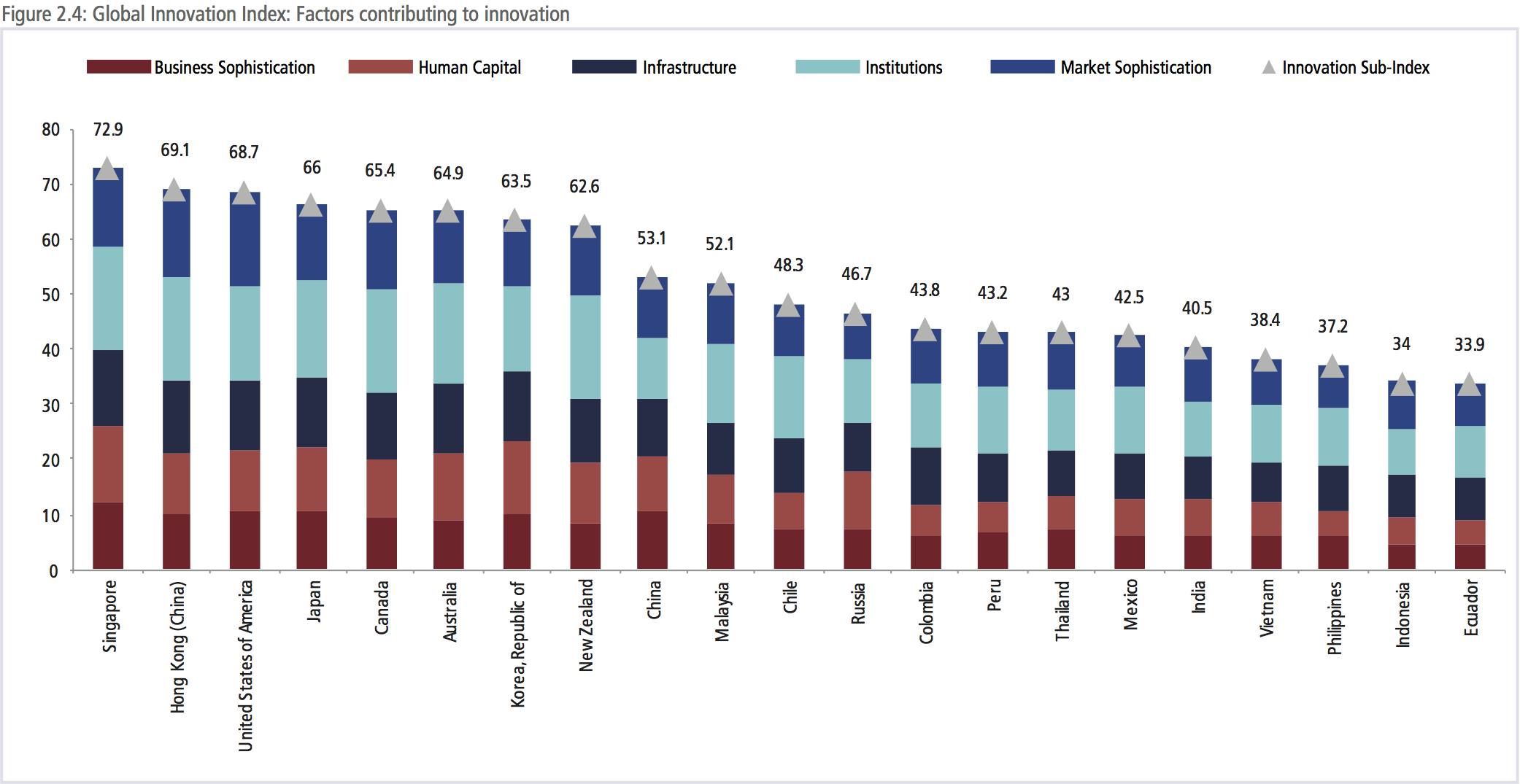

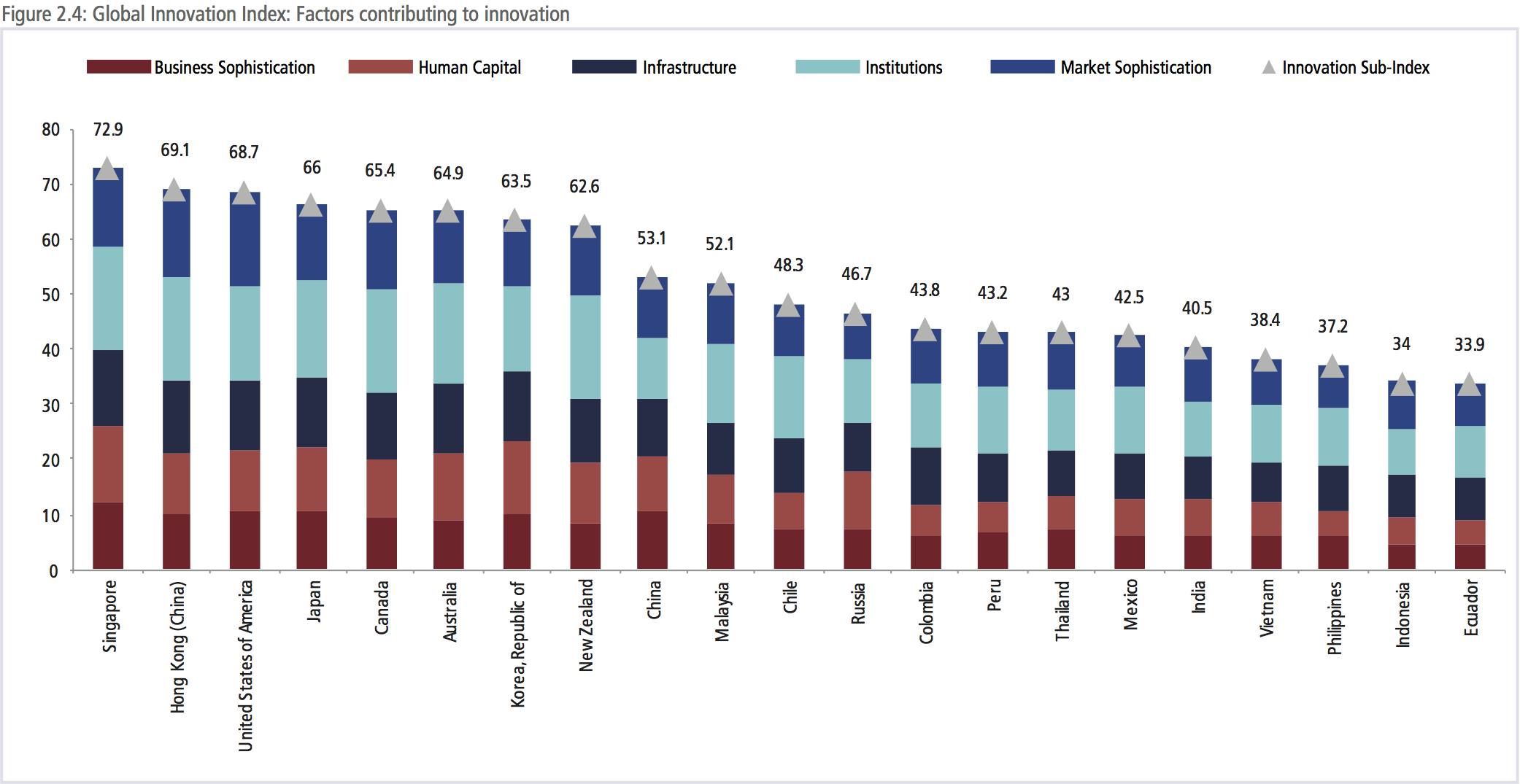

Examining results from the Global Innovation Index (GII) gives an idea of how important the services sector is to innovation. The economies in the Asia-Pacific region show quite a variety in their ratings in the GII, as shown in Figure 2.4. Much of the data on institutions and market sophistication cover the same indicators that measure services restrictiveness, especially the regulatory environment. Notably, many economies in the Asia-Pacific do relatively well in terms of the institutions index.

• Services are inputs into all other economic activities. They are often embodied into manufacturing products during their production cycle and embedded into final products at the time of sale. Embodied services thus create part of the value of the final output, which can either be sold at home or exported across borders. “Add-on” or embedded services are linked and related to the sale of a good or another services, in for example, after-sales support, technical assistance and/or finance. These embodied and embedded services tend to be on the higher value-added end of the scale, in the form of business services, ICT services, engineering services and R&D services. Such high value and technologically sophisticated services help firms to differentiate products and develop ‘niche’ markets, allowing them develop a comparative advantage in a particular product area, often an input into a global value chain network. Such services inputs help to raise the productivity of firms and increase their competitiveness on world markets.

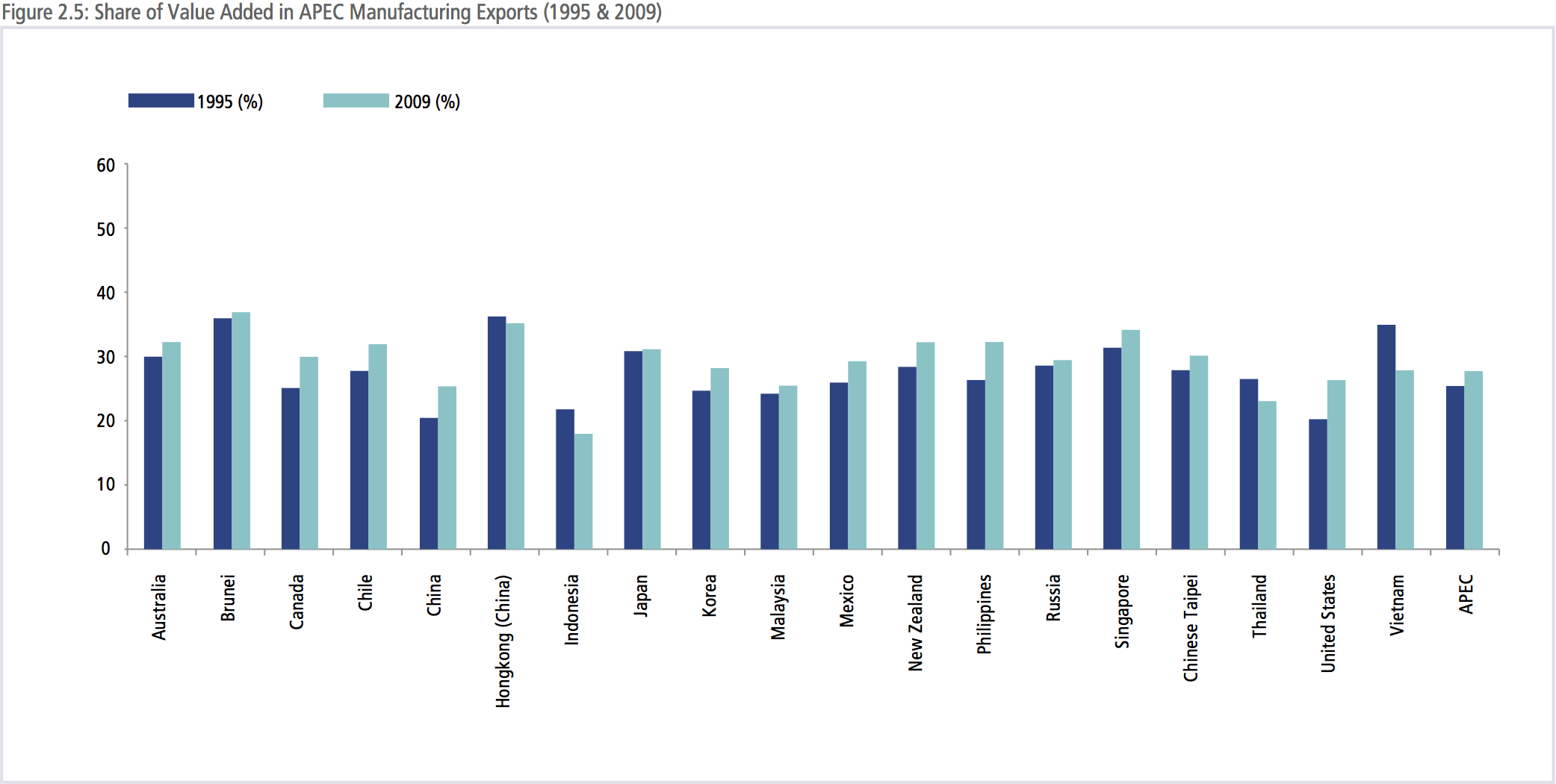

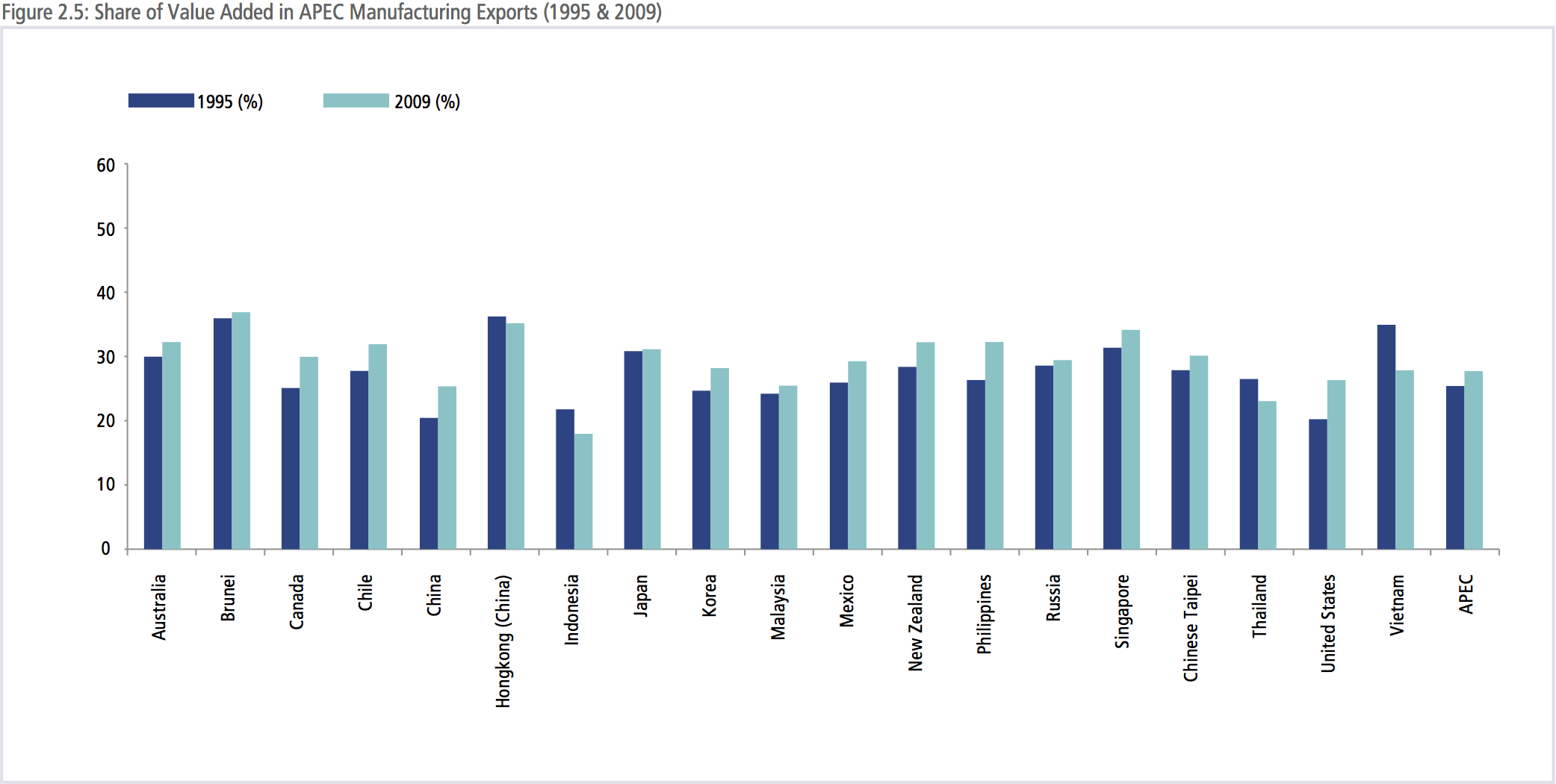

The prevalence of embedded and embodied services is particularly marked for trade in manufactured products for APEC economies and has been growing slowly over time as illustrated in Figure 2.5 showing the evolution of the share of value-added in APEC manufacturing exports over a 15-year period. A series of 22 case studies of products and firms from various Asia-Pacific economies carried out under the direction of the APEC Policy Support Unit during 2013 and 2015 illustrates how extensively services are used in the output of manufactured products and how services are essential to the operation of integrated production networks. The type and function of these services is mapped in the case studies, which show that on average, the number of services entering the value chains of each of the product in each of these case studies ranges from 37 in the case of automotive components to 74 in the case of power plant equipment and that the share of total value (cost) attributable to services inputs ranged between 30 and 90 percent of the manufacturing product in question.

The importance of services inputs into economic output continues to grow. A study from Australia has shown that services used as inputs to the production of goods and services were worth almost as much as crossborder services exports in 2011.15 Services industries thus play a critical role in sustaining and growing other parts of the economy, including manufacturing, construction, agriculture and mining. Services are particularly dominant in downstream industries and act as essential links in integrated production networks, allowing for components of production to be dispersed around the world and brought together into final products in a cost-effective, timely manner.

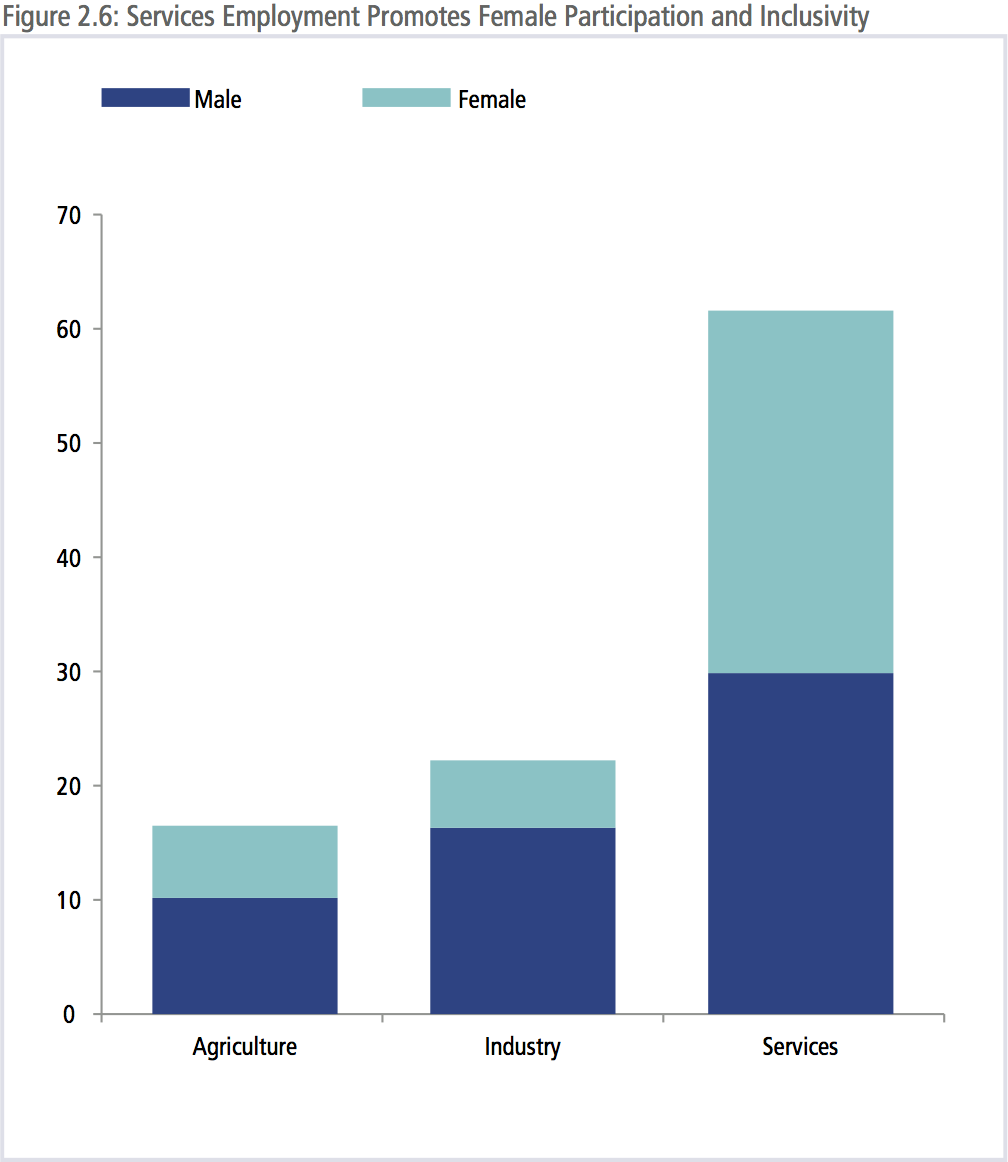

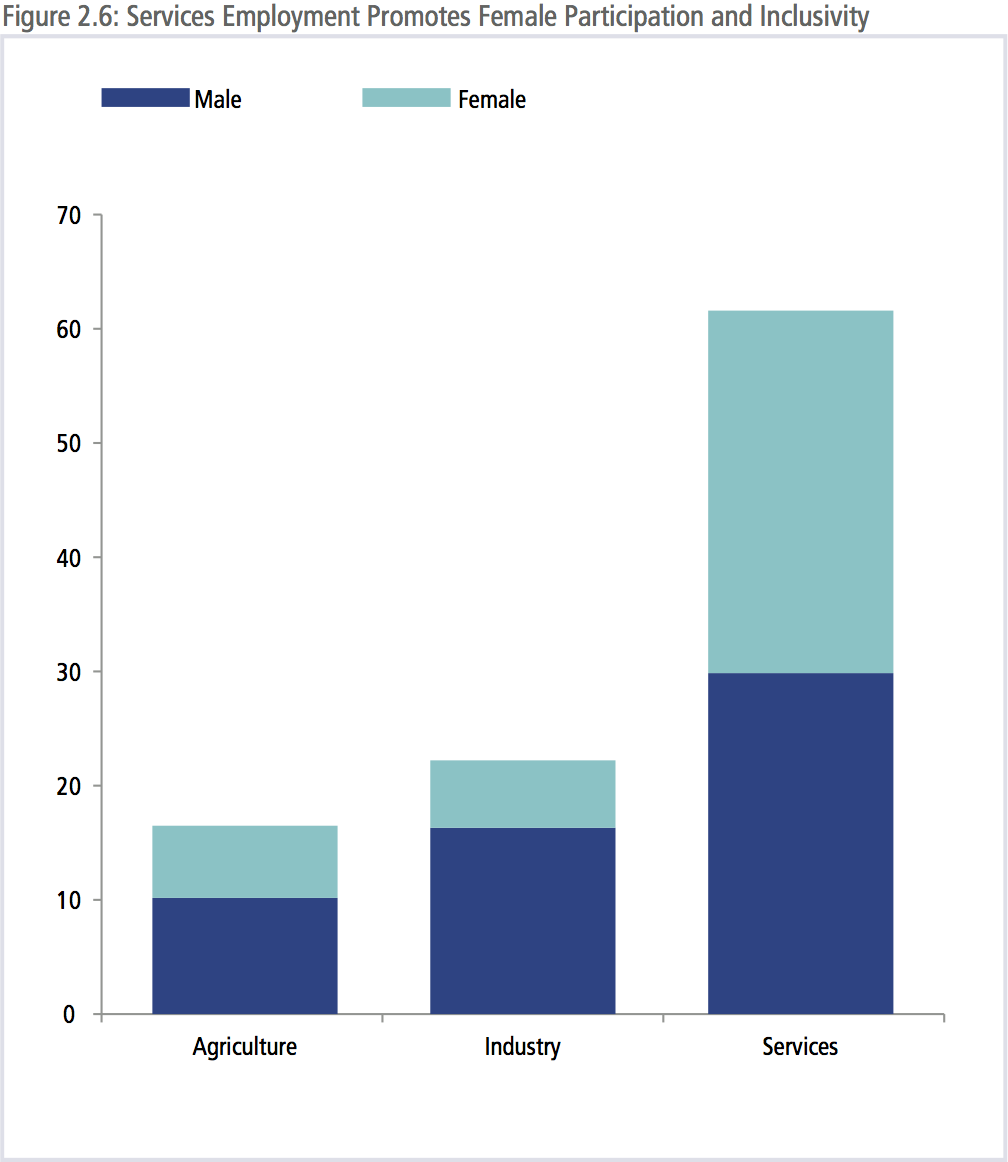

• Services sector participation promotes inclusivity and helps to bring more women into the work force. Services have traditionally attracted a greater percentage of the female work force, as shown in Figure 2.6. In the APEC region the services sector constitutes more than half of female employment. Thus, as the services sector continues to grow in importance as the process of ‘servicification’ advances, Asia-Pacific economies should become more inclusive in their employment patterns, which should enable both greater inclusivity as well as greater gender equality in the labor market.

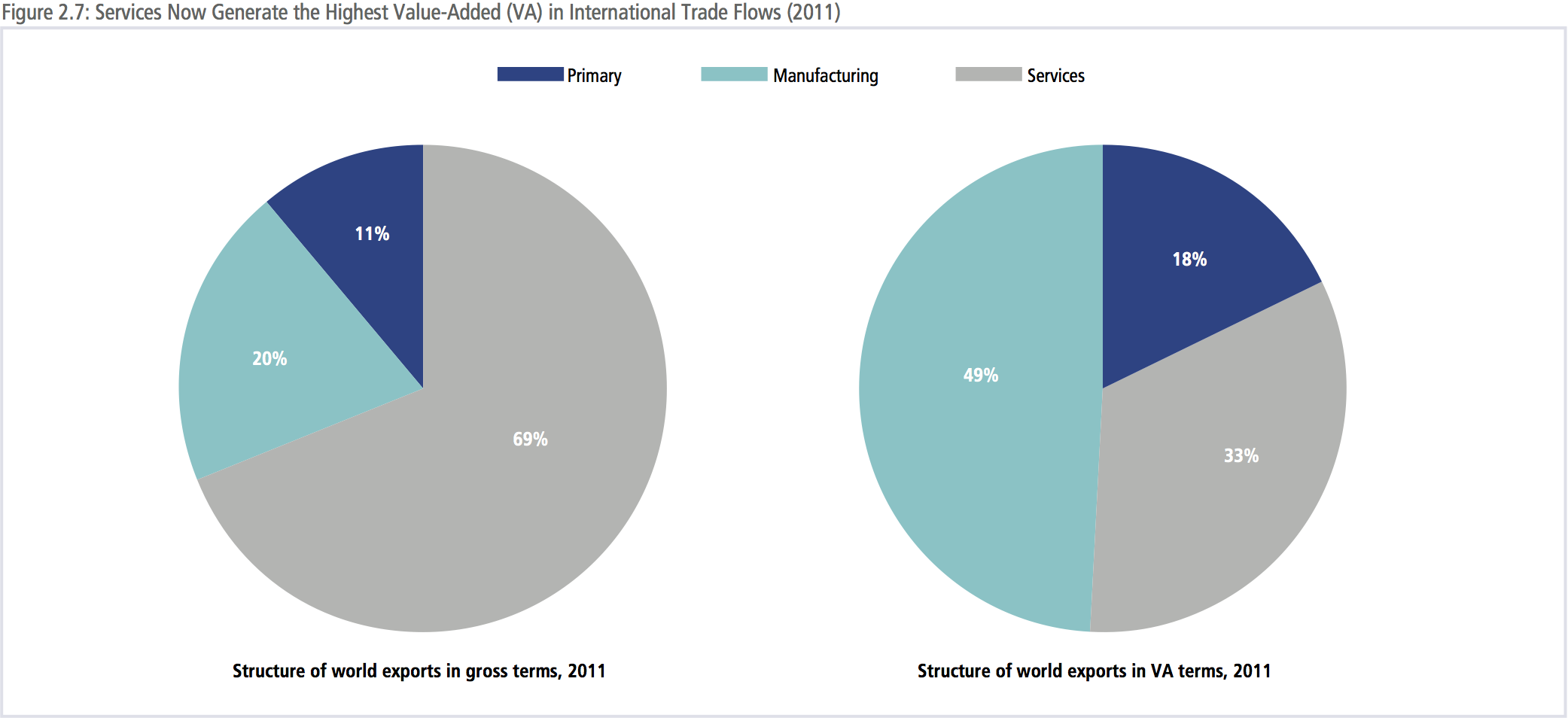

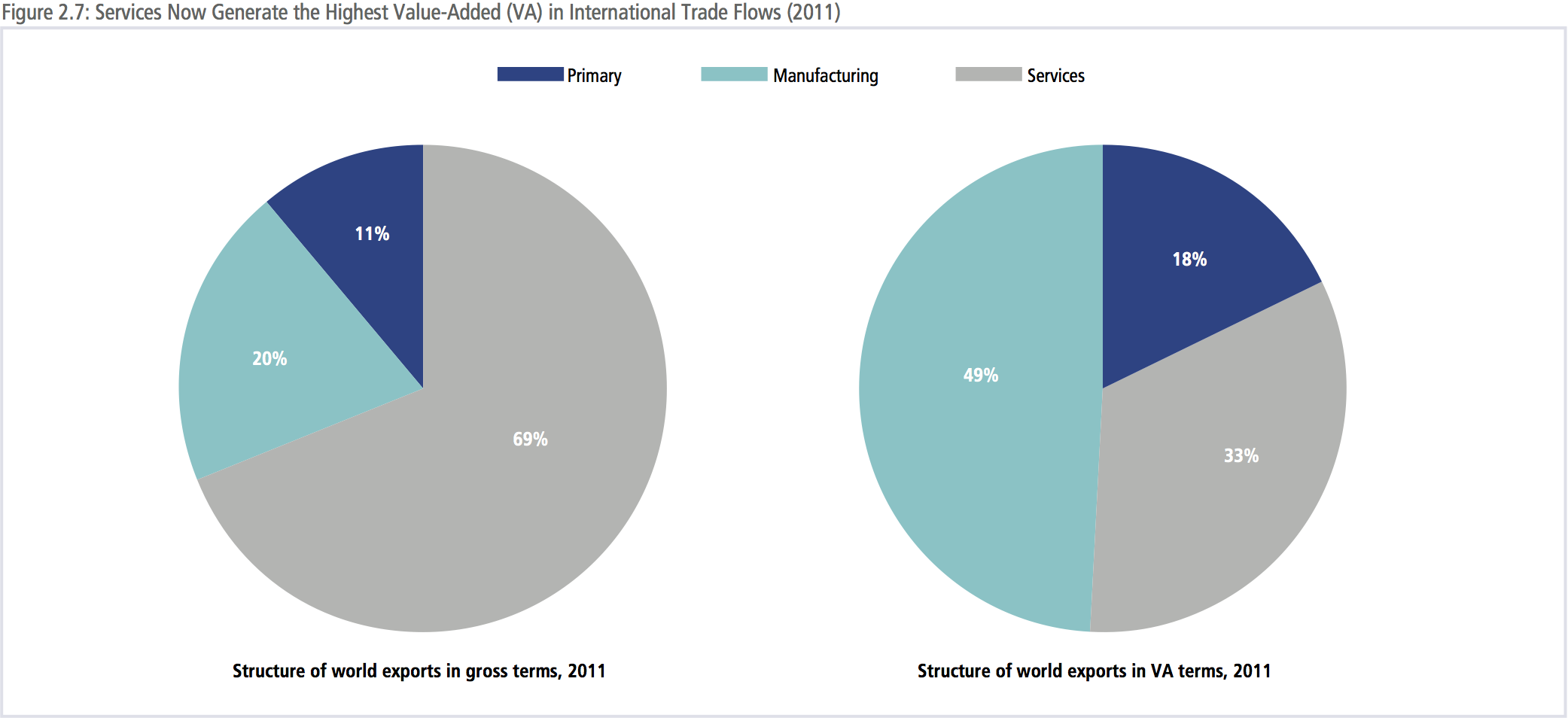

• Services are now more important than goods in international trade when measured in value-added terms. On a global basis and in gross terms, services are reported to account for around 23 percent of world exports, with manufacturing products taking up 65 percent and primary products 12 percent.16 However, these figures are not accurate when embodied and embedded services are taken into account and when trade is measured on a value-added basis.

• A more detailed understanding of services exports comes from the analysis of input-output tables. These can be used to calculate the value of an economy’s embodied services in its exports. This highlights those services sectors that are embodied in the production of goods and services, as well as which goods contain more intermediate services inputs. Using this valueadded approach, the importance of services in world trade increases dramatically, rising to 49 percent of world exports, as shown in Figure 2.7, while the share of manufacturing falls to 33 percent. This also mirrors the heightened importance of investment flows into the services sector, which now receive nearly two-thirds of all new FDI. Much of this investment is destined for services that are used in exported goods and services. The importance of measuring trade in value added terms instead of in gross terms has become particularly important with the emergence of global value chains GVCs) and the increased importance of intermediate products in trade flows (now nearly three-fourths of total trade). This makes it imperative to use more accurate statistical methods in order to avoid double counting of trade flows as well as to obtain a better understanding of the actual contribution of each economy and of each component (services, manufacturing, agriculture).

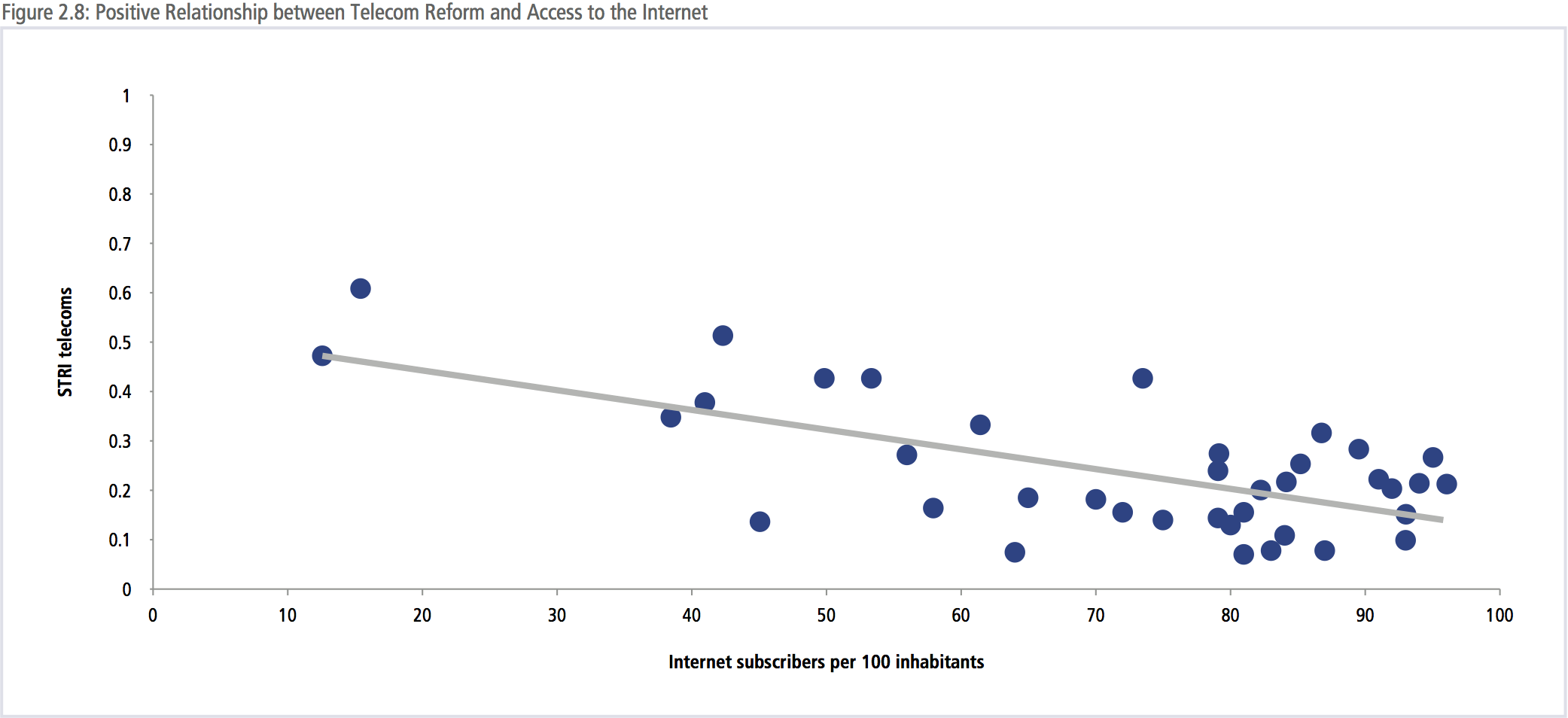

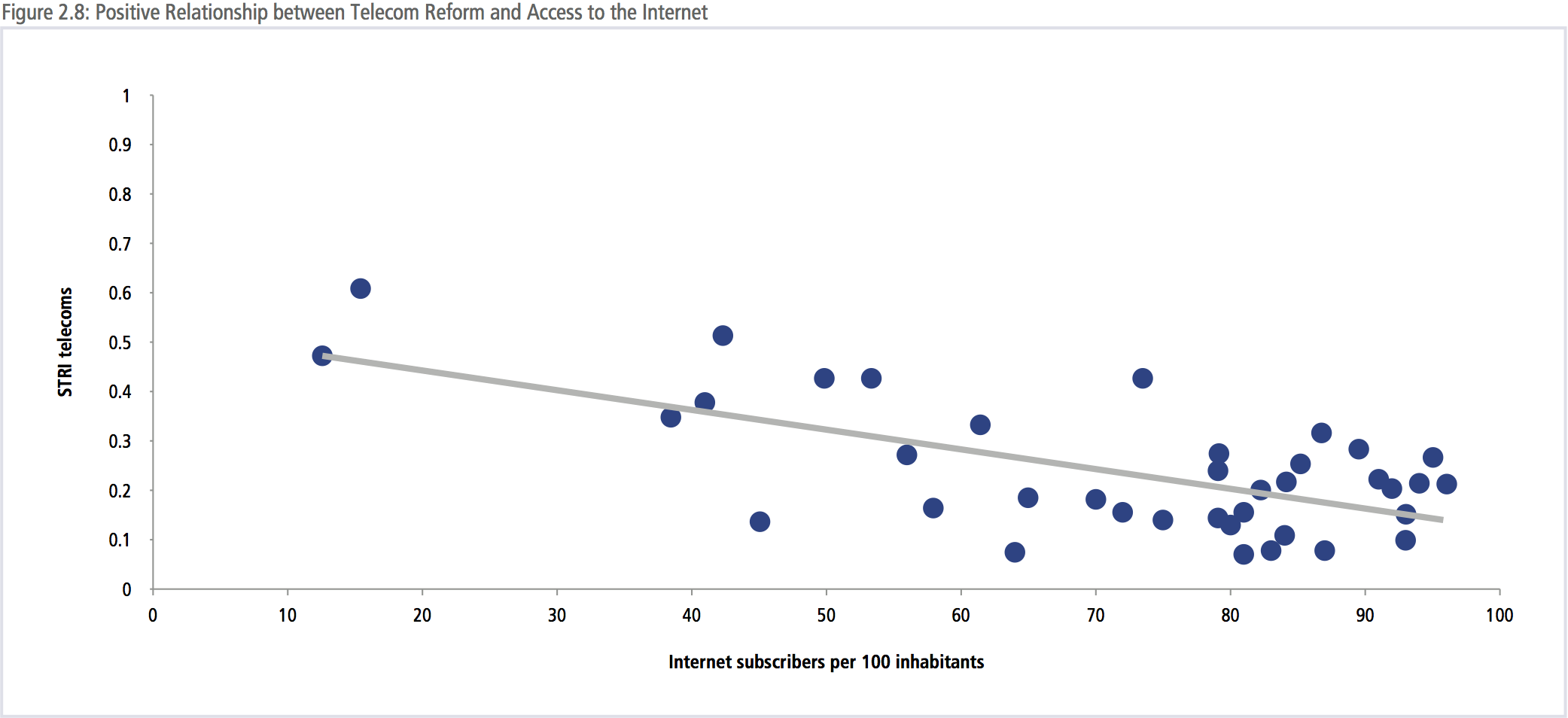

• Services reform can bring about tremendous economywide benefits for Asia-Pacific economies. These potential gains are highlighted later in this chapter in a section that discusses what types of transformations and benefits structural reform in services could bring about. Such potential on the part of services is now being recognized within APEC and has become a key issue for policy makers, the private sector and consumers. Structural reforms in the services infrastructure sectors of transport, energy and telecoms have been projected to generate US$175 billion a year in additional real income for APEC economies.17 These projected gains would be nearly twice as large, region-wide, as would further liberalization of merchandise trade. As shown in Figure 2.8, the less restricted the telecoms sector, the greater the percentage of the population with access to the Internet. Asia-Pacific economies have begun to focus on the needed reforms in services that could provide such a long-term boost to their economic growth trajectories.

SERVICES ARE NOW RECEIVING MORE POLICY ATTENTION IN THE ASIA-PACIFIC

Despite the fact that technological developments and globalization have transformed services into powerful economic forces for change and growth, their role was consistently under-appreciated by policy makers for many years.

Services were often viewed as the ‘poor cousin’ within government ministries and thus often missing from planning programs and development strategies in the Asia-Pacific.

This situation has changed in the last couple of years. Both within individual Asia Pacific economies, in preferential trade agreements, and at the regional level in APEC, services have been brought to the forefront of policy priority. In trade agreements, services now constitute a major component of disciplines. Within the Trans- Pacific Partnership (TPP) Agreement, signed in February 2016 by 12 APEC members, services and services-related topics represent fully one third, or 10 of the 30 chapters in the agreement. Services are a major component of the ongoing Regional Comprehensive Economic Partnership (RCEP) negotiations, and of the ASEAN Economic Community’s framework.

During the Philippines APEC Year 2015, services were brought to the forefront in APEC’s agenda. Services received a prominent place in the APEC Leader’s Economic Declaration of November 2015, when they committed to develop the services sector within APEC and stated:

We acknowledge that international trade in services facilitates cross-border business activity, reduces costs, spurs innovation, boosts competition and productivity, raises the standard of domestic services suppliers, and widens the range of choice for consumers. We also acknowledge that trade in services has an enormous potential for creating jobs, and for increasing competitiveness in the global market, providing wholeof- economy benefits. Inclusive growth cannot be achieved without addressing services-related issues, as many MSMEs operate in this sector.

During 2015 several steps were taken to remedy the lack of focus on services at the top policy levels within APEC. These included notably, the adoption of the APEC Services Cooperation Framework (SCF) at the APEC Economic Leaders Meeting in November 2015, an umbrella document that provides a common strategic direction and coherence to APEC’s broad-based approach to services competitiveness. The Framework ensures that APEC’s multifora and multi-stakeholder services agenda remain dynamic and responsive to economic, market, and technological developments. It is designed to better enable the region’s economies to address trade-related services restrictions and review the progress of agreed action plans to liberalize services trade in light of APEC’s Bogor Goals, namely free trade and investment in the Asia-Pacific region by 2020. The Framework will ensure that attention remain focused on services by APEC Senior Officials, Ministers and Economic Leaders on a continuous basis, over the next five years, until the Bogor Goals’ deadline of 2020.

Four ambitious and innovative objectives that are set out in the APEC Services Cooperation Framework should be highlighted, namely:

- Development of an APEC Services Competitiveness Roadmap with an agreed set of qualitative and quantitative indicators and targets;

- Establishment of the APEC Services Knowledge Center, which would be a virtual knowledge-sharing platform on information and best practices of services-related policies and programs of APEC economies; and

- Creation of the APEC Services Regulators Forum – a knowledge-sharing platform that would bring together sectoral/regulatory officials responsible for trade, investment and competition policies; and

- Development of a mechanism for reporting, review, and updating of the ASCF beginning in 2016, on the basis of specific quantitative indicators, to be incorporated into a stand-alone report on APEC’s progress towards free and open trade and investment in services.

As mandated in the APEC Services Cooperation Framework, the APEC Services Competitiveness Roadmap is being developed in 2016 to provide a strategic and long-term vision for APEC’s work on services. The Roadmap should set out a concerted set of actions and mutually agreed targets for services to be achieved by 2025. The draft Services Competitiveness Roadmap document has been extensively discussed during the APEC Peru Year 2016 and should be finalized with a view to adoption by APEC Economic Leaders in November 2016.

The Services Competitiveness Roadmap will not only guide APEC’s work on services but will also include indicators through which progress along this path toward greater liberalization and regulatory reform will be evaluated. Such indicators will likely include some of the types of indices discussed in the next section.

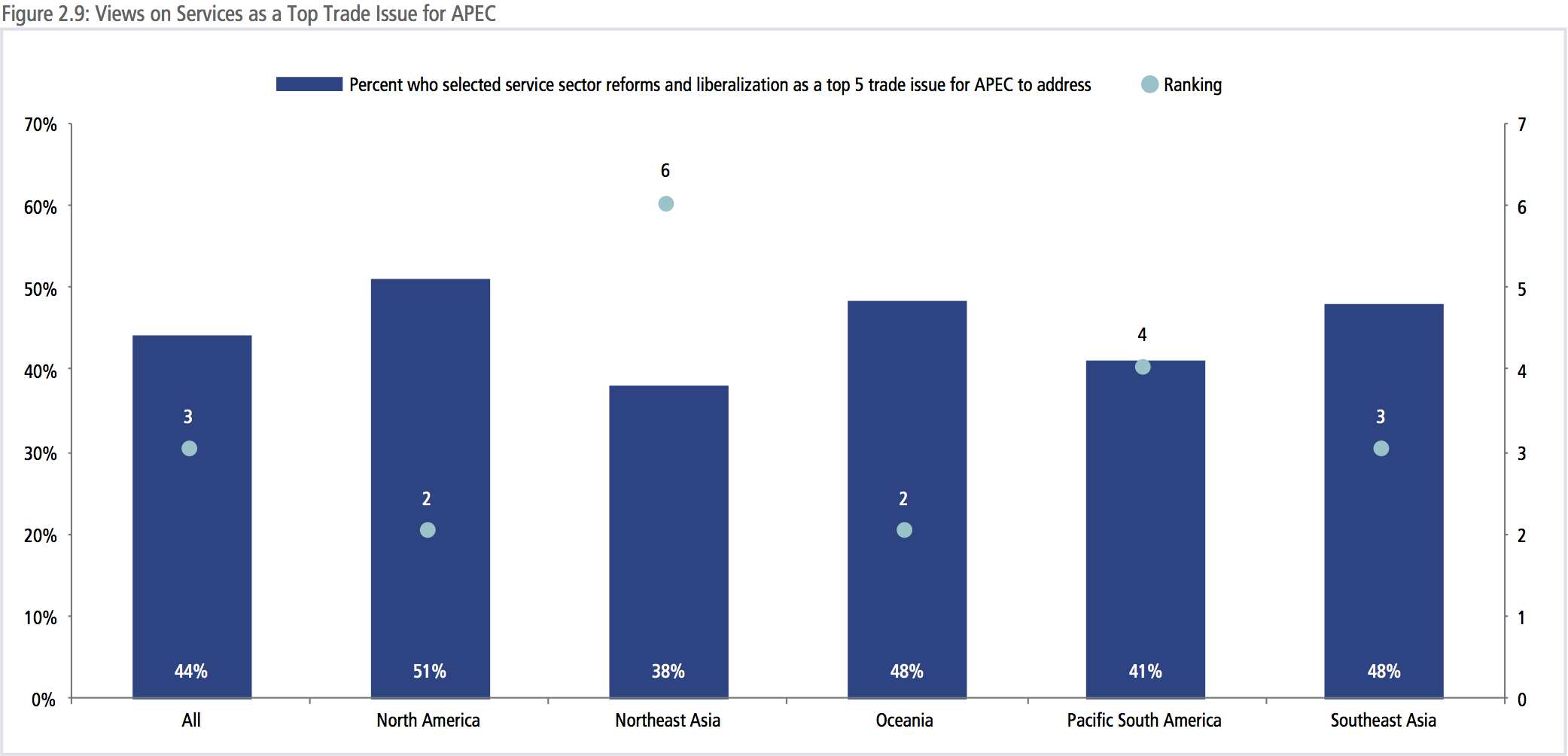

SERVICES ARE STILL HIGHLY RESTRICTED IN THE ASIA-PACIFIC

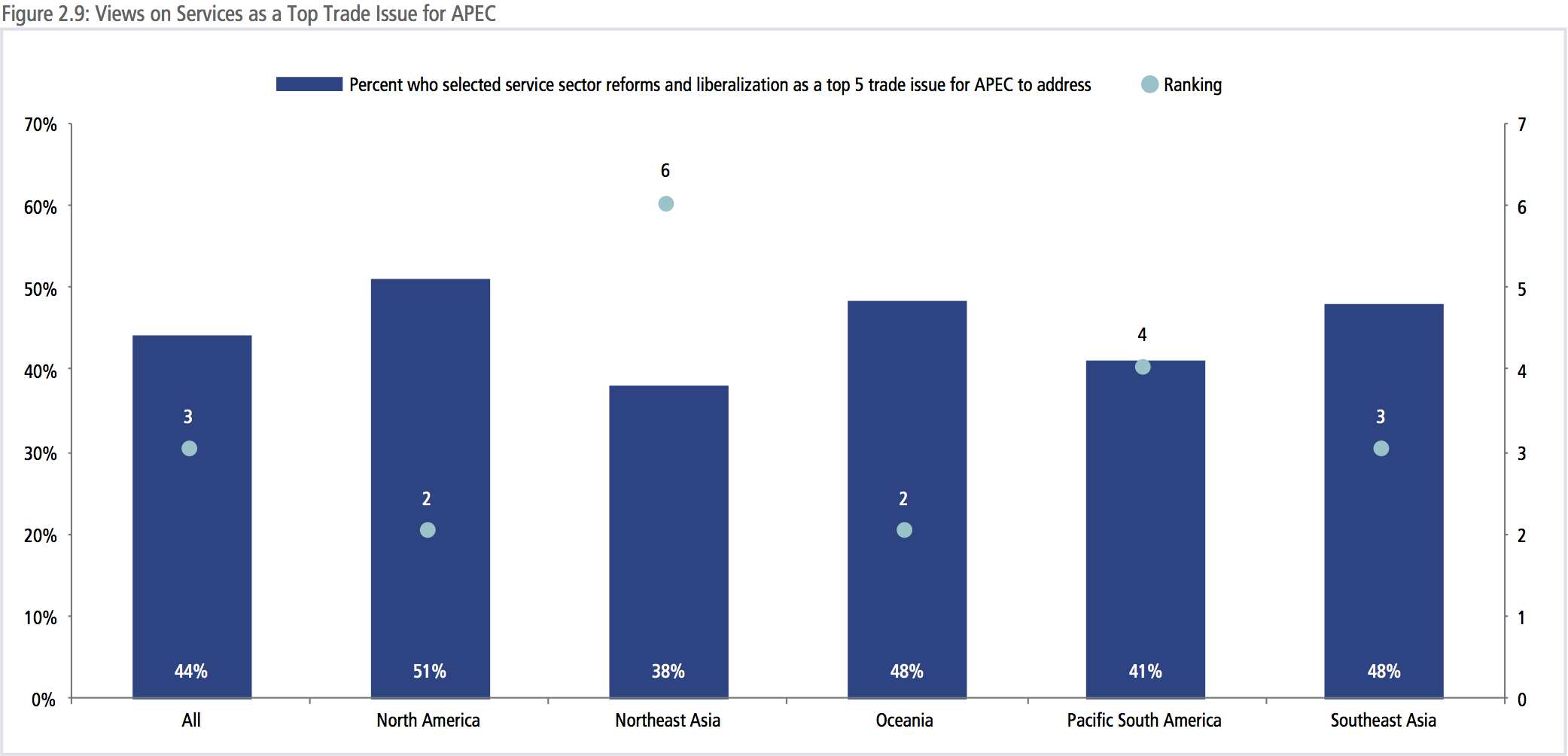

The importance of taking action and concrete steps towards greater services liberalization in the Asia-Pacific is underlined by the high levels of services restrictiveness that still exist across the region. While tariff and at-the-border barriers have been reduced significantly through unilateral steps of autonomous liberalization and within preferential trade agreements, services trade barriers have remained more elusive to policy makers. These impediments to services trade are standing in the way of greater regional integration as they block the ability of services providers and consumers to export and import services. In fact, the restrictive impact of services regulations was highlighted by the PECC State of Trade in the Region Report for 2015 as the top impediment cited by respondents to their ability to trade in the Asia-Pacific and as one of the top priorities for APEC to address.18 Notably, the importance of services sector reforms and liberalization was a view broadly shared across all APEC sub-regions, as highlighted in Figure 2.9. For example, among respondents from Southeast Asia, 48 percent rated it a top 5 trade issue for APEC to address as did 51 percent of respondents from North America and 44 percent on average for all respondents.

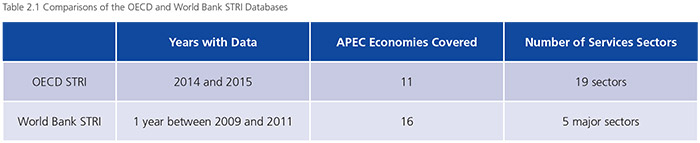

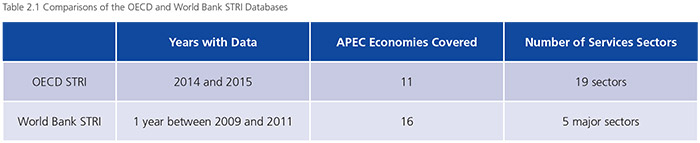

Measuring the extent of services restrictiveness has become easier with the availability of the two databases published by The World Bank and the OECD detailing the restrictive impact of services regulations. While the country and sector coverage of these two Services Trade Restrictiveness Index (STRI) databases vary as seen in Table 2.1, as well as the methodology used for obtaining and assessing the information, both of them show interesting and worthwhile results of concern, which the APEC Policy Support Unit has put together for those APEC economies included in the databases.

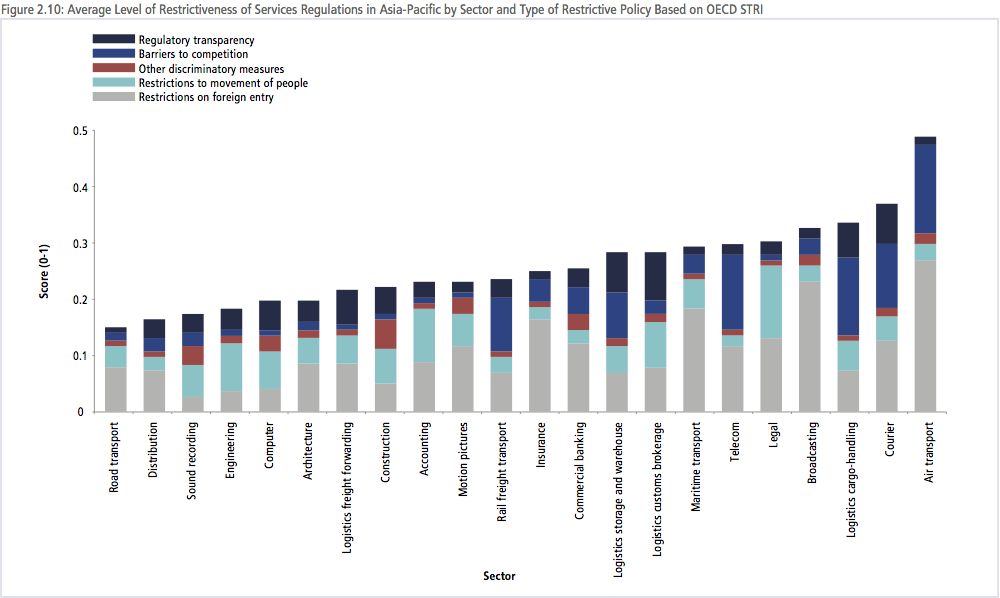

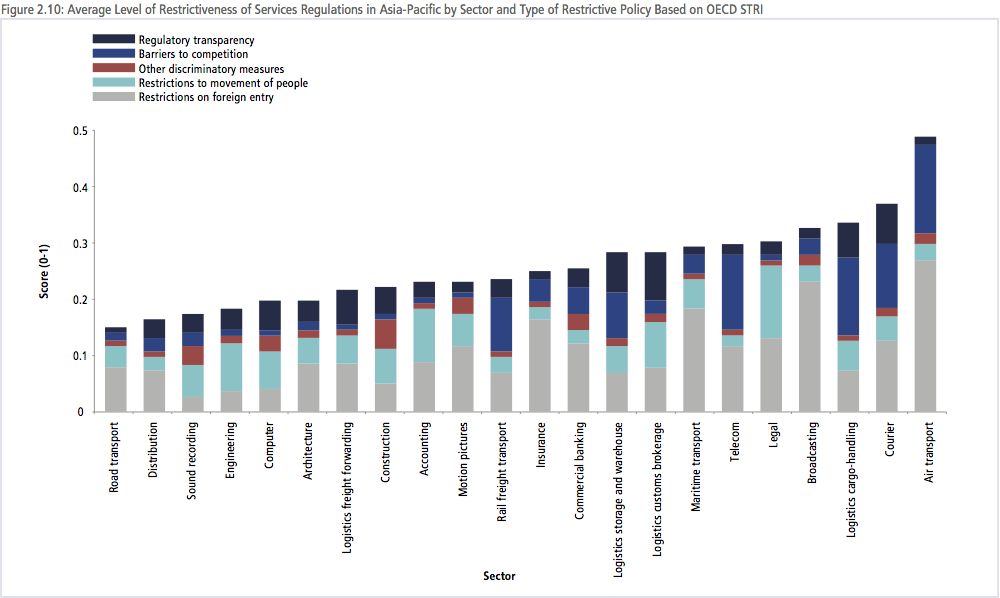

Figure 2.10 gives an indication of the average level of restrictiveness of services regulations in 11 APEC economies for the various sectors covered in the OECD STRI database (2015 data). The chart divides up the overall level of restrictions into five categories according to the way they affect services, namely:

- Restrictions on foreign entry;

- Restrictions to movement of people;

- Other discriminatory measures;

- Barriers to competition; and

- Regulatory transparency.

The highest levels of restrictions shown on the right hand side of the chart are found in the sectors of transportation (air, maritime and rail), logistics (courier, cargo handling, customs brokerage and warehousing), broadcasting, telecoms and legal services. The type of regulations affecting these service sectors varies, although barriers to competition together with restrictions on foreign entry (investment) appear to be the most prevalent.

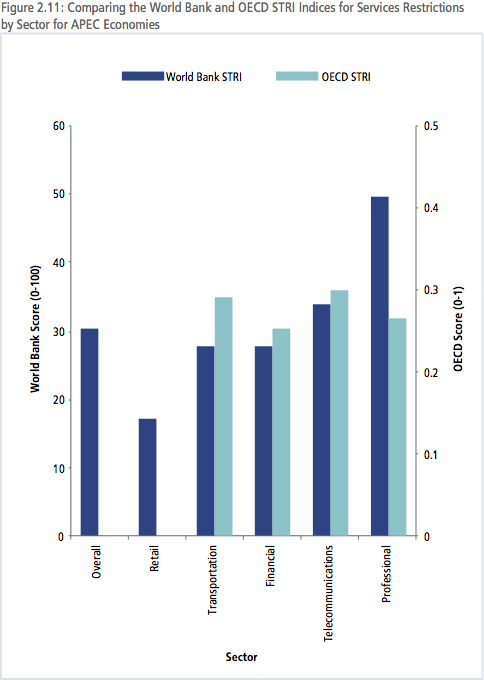

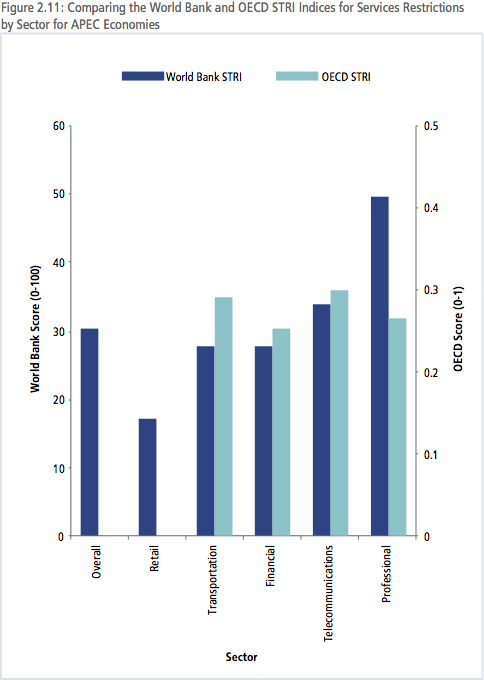

Figure 2.11 shows the APEC average for the five sectors covered in the World Bank STRI database compared with the OECD STRI database, as calculated by the APEC PSU. In the cases of transportation, financial services and telecoms, the restrictiveness indices are fairly similar. However, the level of services restriction on professional services is shown to be much higher in the World Bank STRI, while the retail sector was not included as such in the OECD STRI and thus cannot be compared.

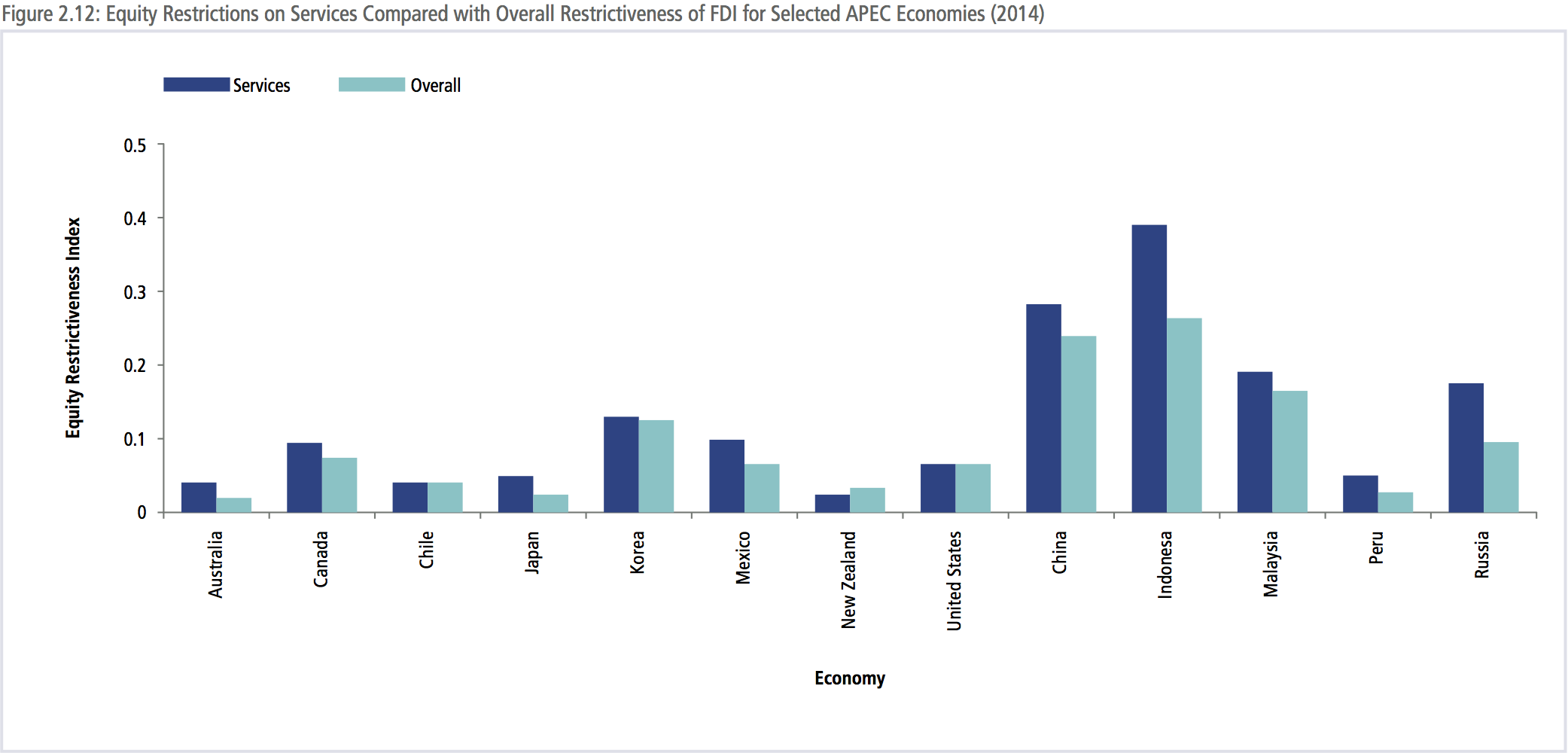

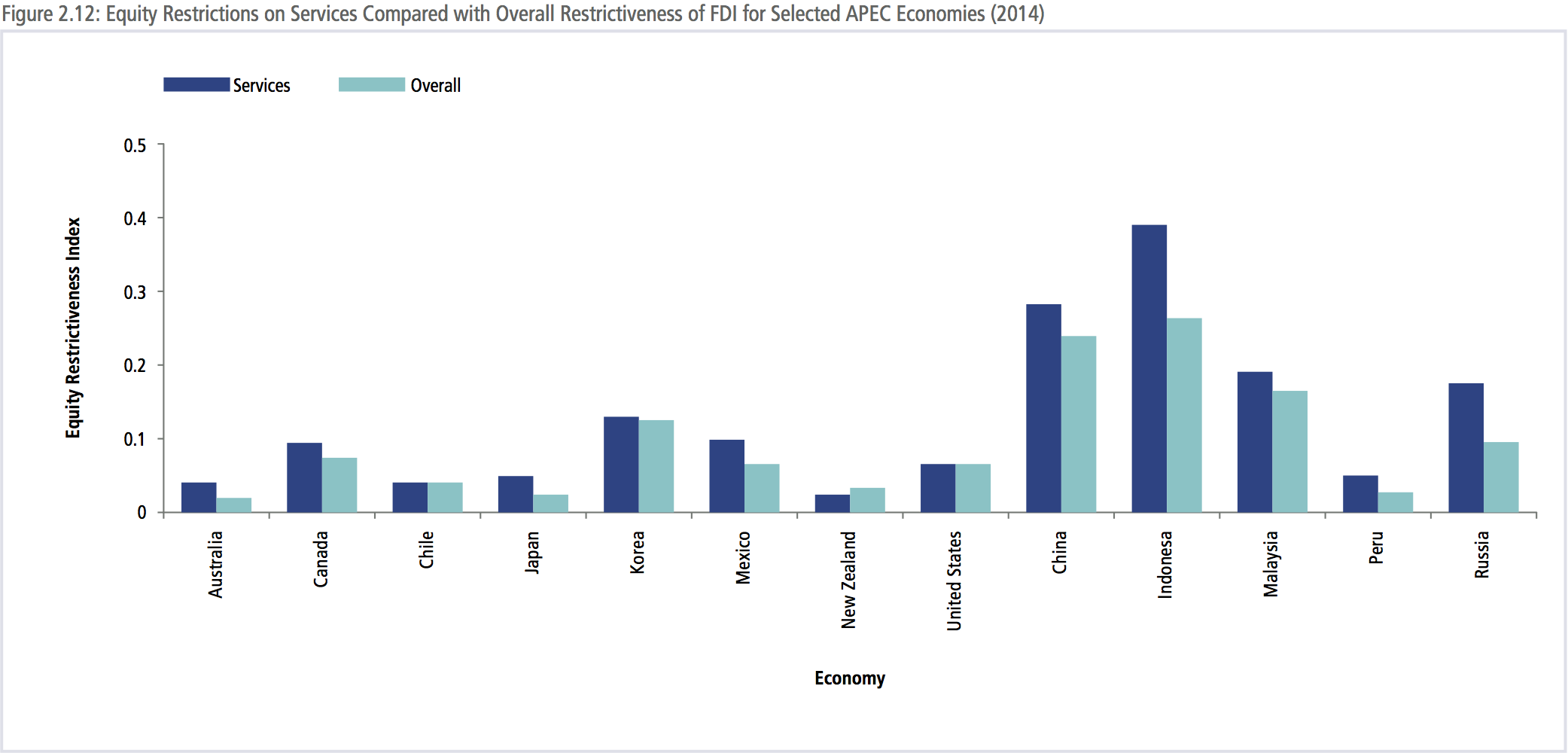

An index has also been developed by the OECD to assess the restrictiveness of policy on foreign direct investment. The FDI Regulatory Restrictiveness Index covers 13 APEC economies in the database with information on FDI restrictions over eight years, stretching from 1997 to 2014. Foreign direct investment in services is included in this database and thus services are also covered. In recent years the majority of FDI flows have been directed to the service sector, so commercial presence as a form of services trade continues to be very important. FDI restrictions are assessed in four areas on the basis of policies in place (gleaned from Investment Codes and Investment Agreements):

- Foreign equity limitations

- Discriminatory screening or approval mechanisms

- Restrictions on the employment of foreign personnel

- Other operational restrictions

The information in Figure 2.12, calculated by the APEC PSU, shows that investment restrictions are higher on services than overall in nearly all the economies shown, and in many cases by a very significant amount.

Currently not all of the economies in the Asia-Pacific are covered in these various databases that help us to assess the restrictiveness of regulations affecting services and investment, and many data gaps exist as well. APEC economies are considering steps to increase the number of member economies with STRI and FDI restrictive indexes so that there could be baseline measures against which existing policies on services and investment could be evaluated and reviewed at present and in the future. Such indicators would also help to relate services reform with outcomes. However, what is clear from the existing information available is that the level of restrictive regulations affecting services is quite high both on average and on specific sectors in the Asia-Pacific that are critical to economic competitiveness and boosting regional integration.

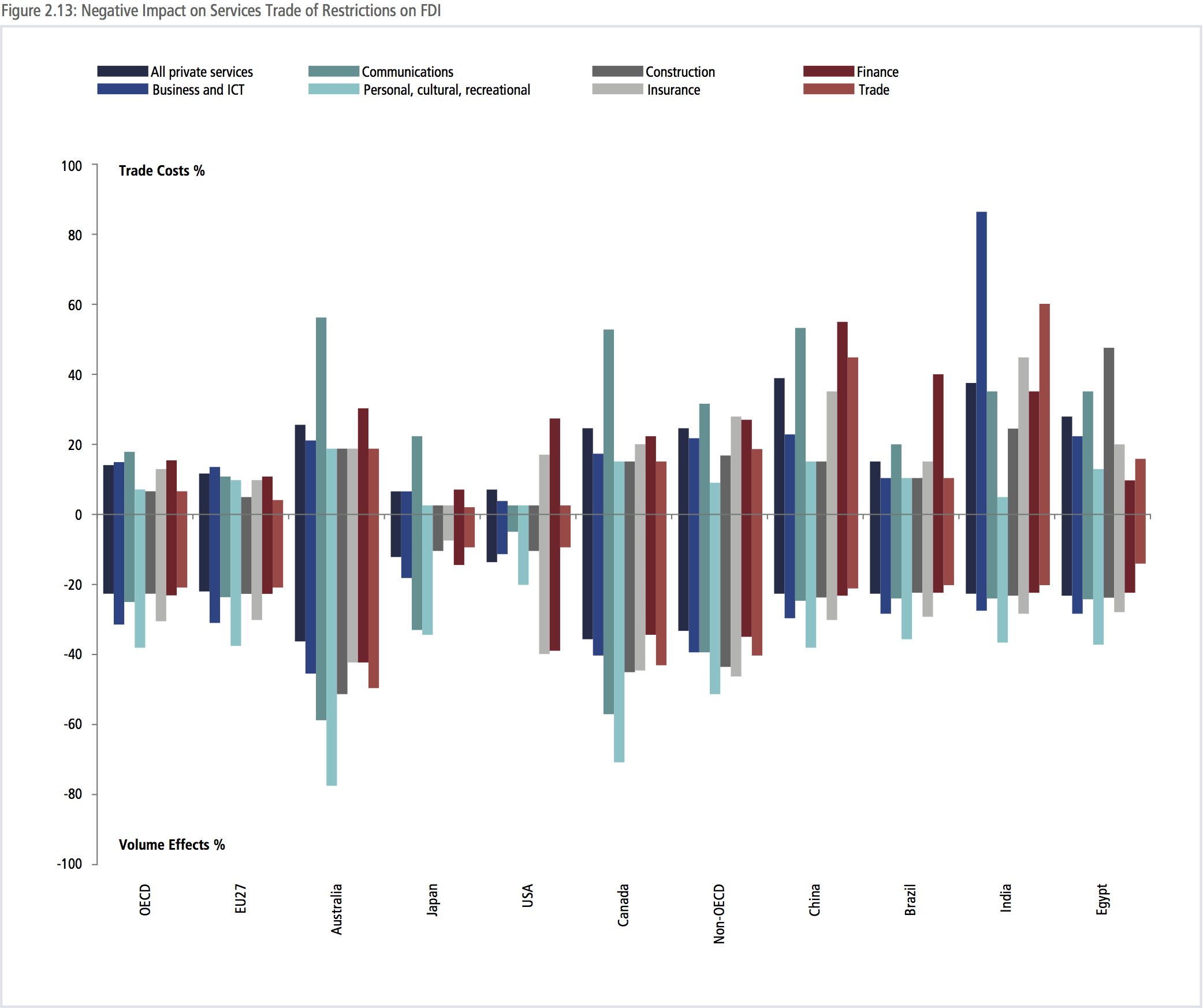

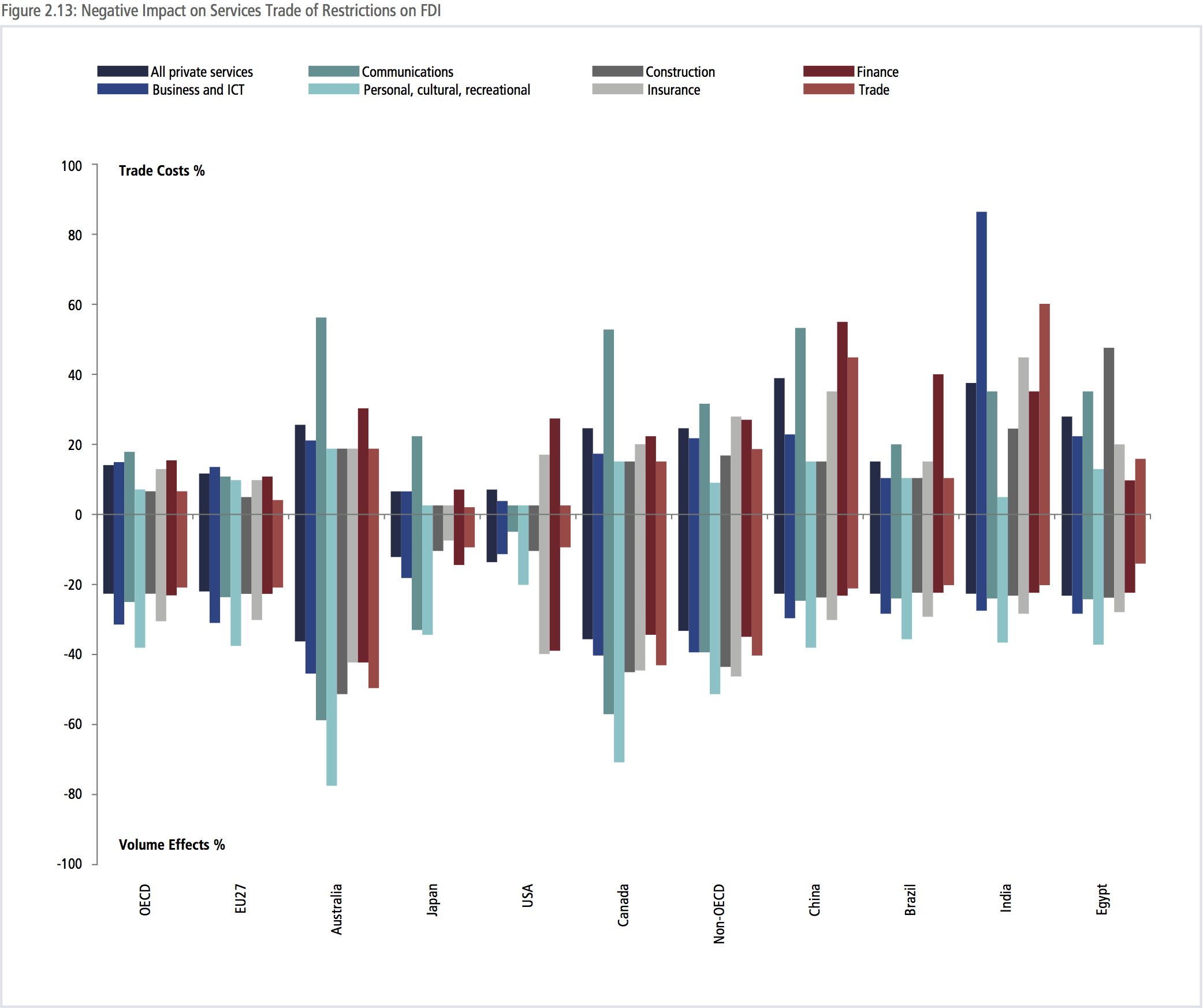

Source: PECC & ADBI, Services Trade: Approaches for the 21st Century, 2011 The 2011 Policy Brief by PECC and ADBI (Services Trade: Approaches for the 21st Century) underlines the impact that restrictions on foreign direct investment (FDI) impose on diverse services sectors, showing how both the cost of trade as well as the volume of trade is affected as a result. As could be expected, restrictions on FDI impose positive and often very high trade costs, depending upon the sector, and result in negative volumes of trade. As shown in Figure 2.13, the services sectors and countries most impacted in cost terms by restrictive FDI policies are: communications (Australia, Canada, China and India), finance (Australia, USA, China and Brazil), trade-related services (China and India), business and ICT services (India), and construction (Egypt). However, the services sector that is most negatively affected in volume terms by restrictive FDI policies is personal, cultural and recreational services (Australia, Canada), followed by communications (Australia and Canada).

SERVICES LIBERALIZATION AND REFORM WOULD PROVIDE TREMENDOUS BENEFITS TO ASIA-PACIFIC ECONOMIES

There is no better way to unleash economic potential in Asia-Pacific economies than to focus on improving the quality and performance of the service sector. Box 1 summarizes the potential gains to be derived from regulatory and structural reform in services. These are multiple and far reaching, extending beyond trade and contributing to broader development objectives.

BOX 2.1: BENEFITS DERIVING FROM SERVICES LIBERALIZATION

- Export competitiveness. Reducing trade costs deriving from services results in an increase in overall productivity as many sectors use services inputs intensively. Therefore, the reform will also enhance export competitiveness.

- Private sector development and foreign direct investment. Lower trade costs and entry barriers in services attract foreign direct investors, thus creating jobs and providing local producers and consumers with more and better products. This is particularly true for services, which account for over 60 per cent of global FDI stock, according to the UN World Investment Report 2016.

- Market integration. As trade costs fall, it is easier for economies to integrate regionally. If services reform is undertaken through regional trade agreements and reform of services regulations is founded on reasonable and objective criteria, the result will be not only positive for those in the region but also for those outside. In this case, such reform will not imply any welfare lose or artificial trade diversion.

- Economic growth and employment. Services liberalization has the potential to boost economic productivity and employment due to the significant contribution that the sector enjoys in GDP and employment and taking into account the fact that services is the most dynamic sector in the world economy

- Other positive spillover effects. Improvements in services can contribute to help attain overall development objectives, including many of the sustainable development goals (SDGs), in particular SDG 1 to end poverty, SDG 3 on good health and well-being, SDG 4 on quality education, SDG 6 on clean water and sanitation, SDG 7 on affordable and clean energy, SDG 8 on decent work and economic growth, SDG 10 on reduced inequalities within and between countries, among others.

UNTAPPED POTENTIAL FOR SERVICES CONTRIBUTION IN THE ASIA-PACIFIC

The relevance of the services sector in the Asia-Pacific in terms of its contribution to GDP, employment, trade and inclusive growth is already significant. However, there remains a huge potential to be untapped through services liberation and reform.

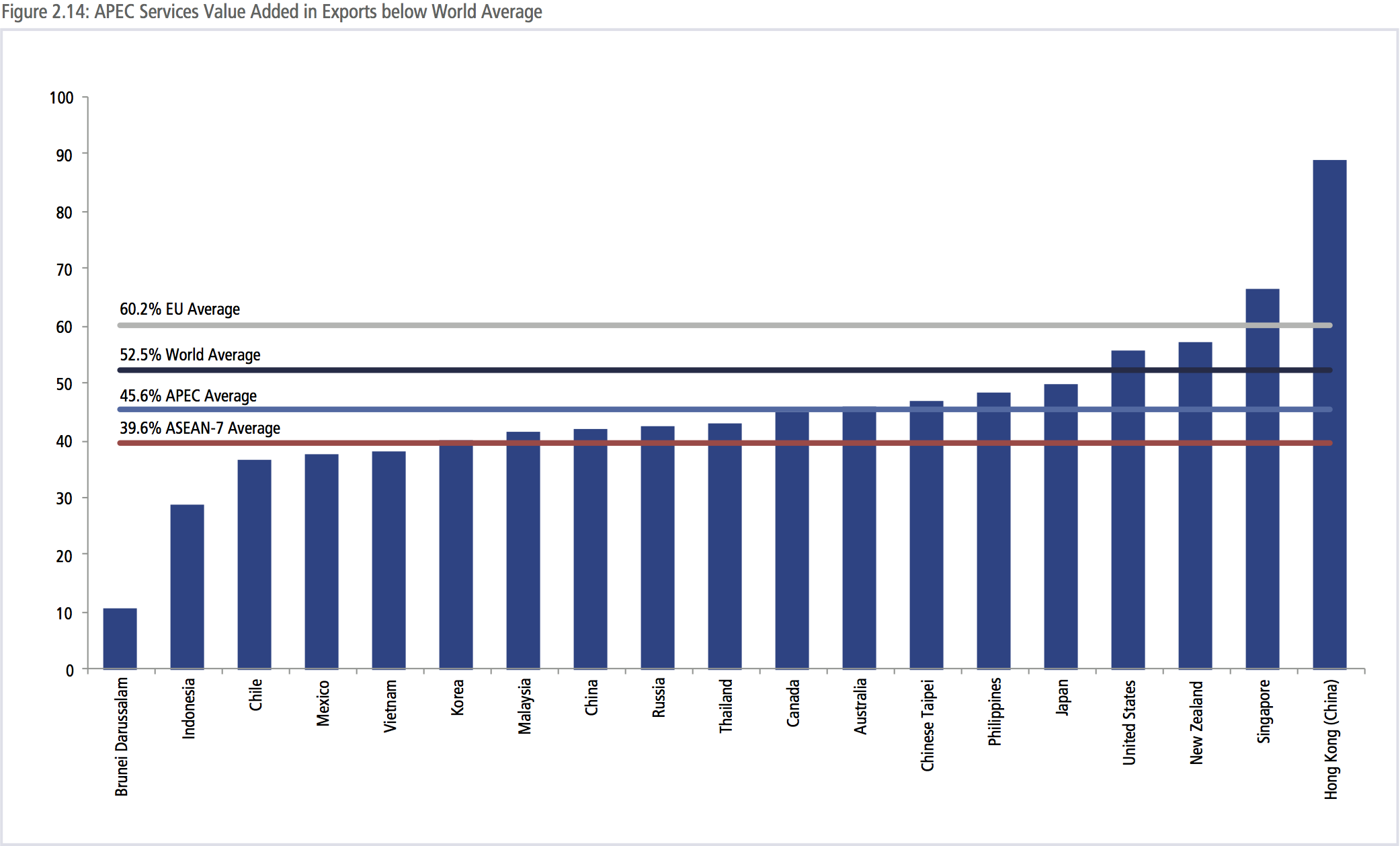

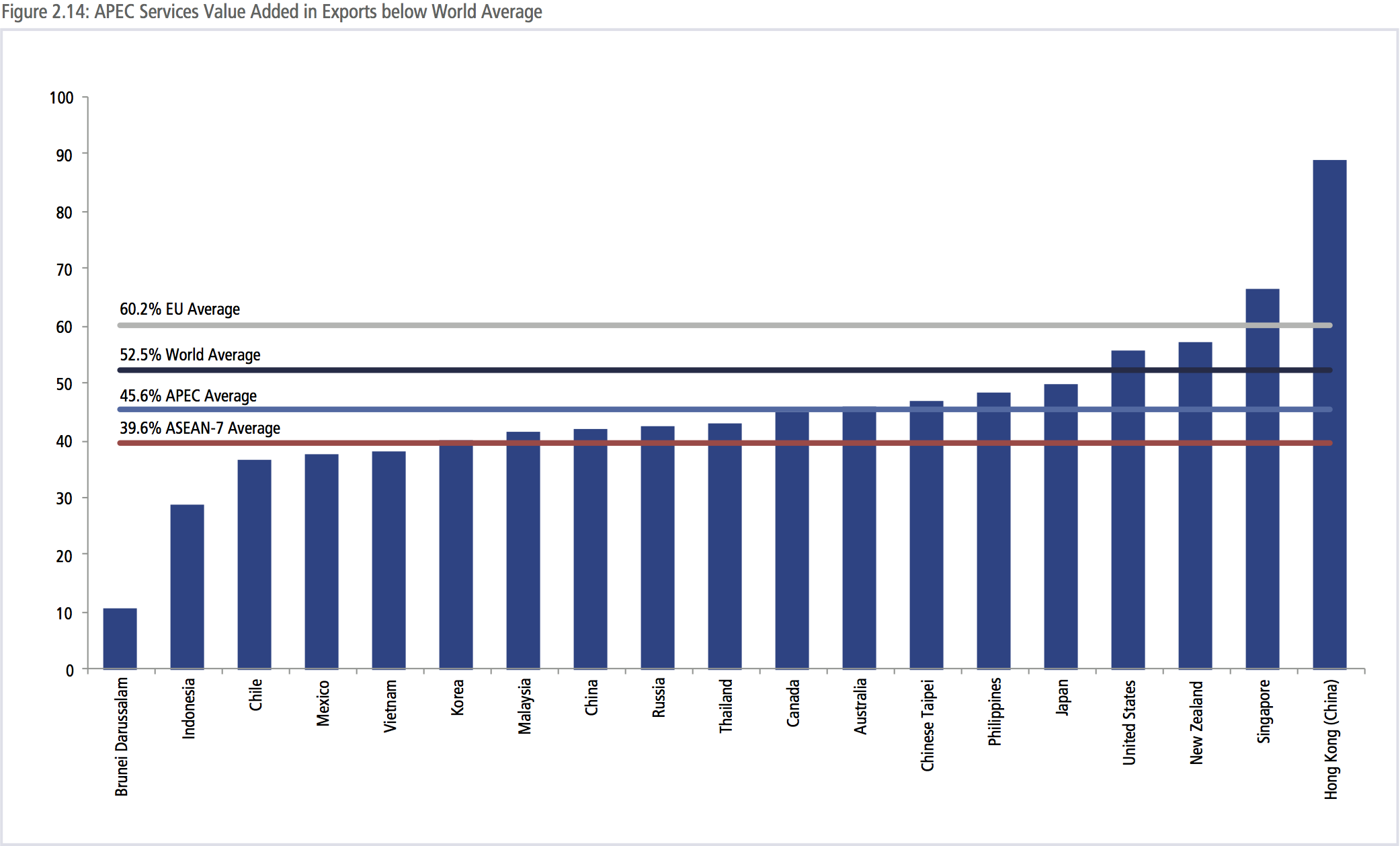

One of the indicators of this shortfall between current performance and potential is the gap between APEC’s average engagement in services value-added in trade and the average for the world economy, as shown in Figure 2.14. The services value-added share of gross exports for 15 of the 19 APEC economies included lies below the world average of 49 percent (based on the most recent data available in the TiVA database for 2011) while the average for APEC runs around 45 percent. Only four economies in the Asia- Pacific region display shares of services in value-added trade higher than the global average (United States, New Zealand, Singapore, and Hong Kong (China)). At the national economy level, services value incorporated in exports differs widely within the region, ranging from just 10 percent services value-added contribution in trade for Brunei Darussalam to almost 90 percent for Hong Kong (China). The potential for the economies of the Asia-Pacific region to intensify their services content of exports, even as they deepen the services component of all economic activities, is very high. There is clearly considerable room for the Asia-Pacific to increase the services value added in exports both as a region as well as at the national level.

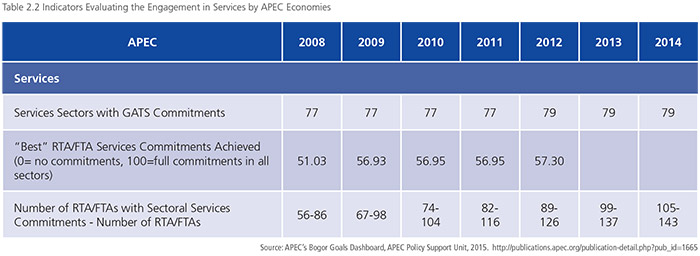

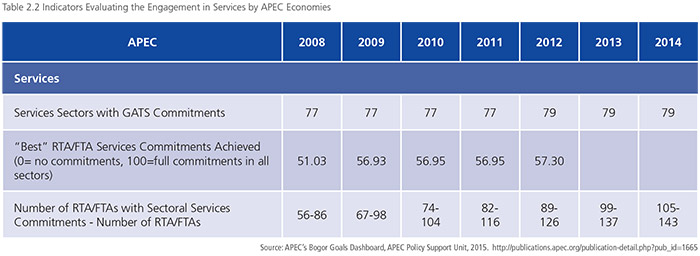

At the APEC level, there is a need to move services liberalization forward in order to comply with the commitments undertaken in the Bogor Goals to reach free and open trade in goods, services and investment by the year 2020. The information in Table 2, taken from the APEC’s Bogor Goals Dashboard 2015, shows the evolution of services liberalization in the region between 2008 and 2014, based on three indicators: the services sectors with GATS commitments, the depth of services commitments in FTAs and the number of FTAs covering services.20 These are taken to be very rough indicators of how the region has progressed in the services area. The Dashboard shows the following:

- When considering the number of services sectors with GATS commitments, APEC economies have made commitments in only half of the services sub-sectors available in the WTO GATS Classification List (79 out of a total of 160 sub-sectors).

- Regarding the depth of services commitments achieved in FTAs, APEC economies still have a long way to go, having been ranked at just over half (57.30 on a scale of 0 to 100) by the APEC Policy Support Unit in their evaluation of the depth of services commitments of FTAs in force by each APEC economy for modes 1 (cross-border trade) and 3 (commercial presence).

- Lastly, since 2008 the number of FTAs concluded by economies in the region that cover services has increased significantly over time, with nearly three fourths of FTAs containing services provisions and commitments (105 out of a total of 143 FTAs in 2014). This number is significantly higher than what is found among the FTAs included in the WTO RTA database, where 141 FTAs/RTAs out of a total of 281 cover services trade (or around 50 percent).21 A word of caution is in order here, though, as the mere increase in the number of FTAs does not necessarily imply an actual improvement in services liberalization. This will depend upon the depth and quality of the commitments that are contained in the agreements. A larger number of FTAs may also play the role of complicating the task of services exporters through overlapping sets of commitments and obligations.

GAINS TO BE DERIVED FROM SERVICES LIBERALIZATION AND REFORM

Several authors have estimated the economic gains that the benefits that services liberalization and reform could bring to the Asia-Pacific region.

The 2011 study presented by the APEC Policy Support Unit (PSU) addressed the improvement of competition (both domestically and internationally) in the infrastructure service sectors of transport, energy and communications, estimating the impact of reforms in these sectors and related downstream sectors, as well as the corresponding adjustment costs.

Policy recommendations from the study focus on improving competition in these sectors domestically and internationally through trade in services. Box 2 presents these recommendations by sector.

BOX 2.2: POLICY RECOMMENDATIONS TO IMPROVE COMPETITION BY SECTOR

| Air Transport |

Improve competition through reforms to air services agreements, to entry conditions for domestic and foreign carriers, and ownership; |

| Maritime Transport |

Introduce competition by dismantling remaining entry restrictions, quotas and cargo sharing arrangements and by the granting of domestic-vessel treatment to foreign-owned carriers located domestically; |

| Rail transport |

Improve competition through free entry in freight operations; |

| Electricity and gas |

Competition could be enhanced by providing third party access, unbundling, wholesale prices set through market arrangements and/or retail competition; and |

| Telecommunications |

Competition will improve through the removal of remaining foreign equity limits. |

The study estimated that such a package of reforms has the potential to generate US$175 billion a year in additional real income (in 2004 dollars) across the Asia-Pacific region after a 10- year adjustment period. According to these estimations, gains from more competition in these sectors alone would be almost twice as large as those deriving from further liberalization of merchandise trade. Major gains are projected to occur in the services sectors undertaking reform as well as in those that use services inputs more intensively. This clearly indicates the relevance of the services sector in the generation of income in the region.

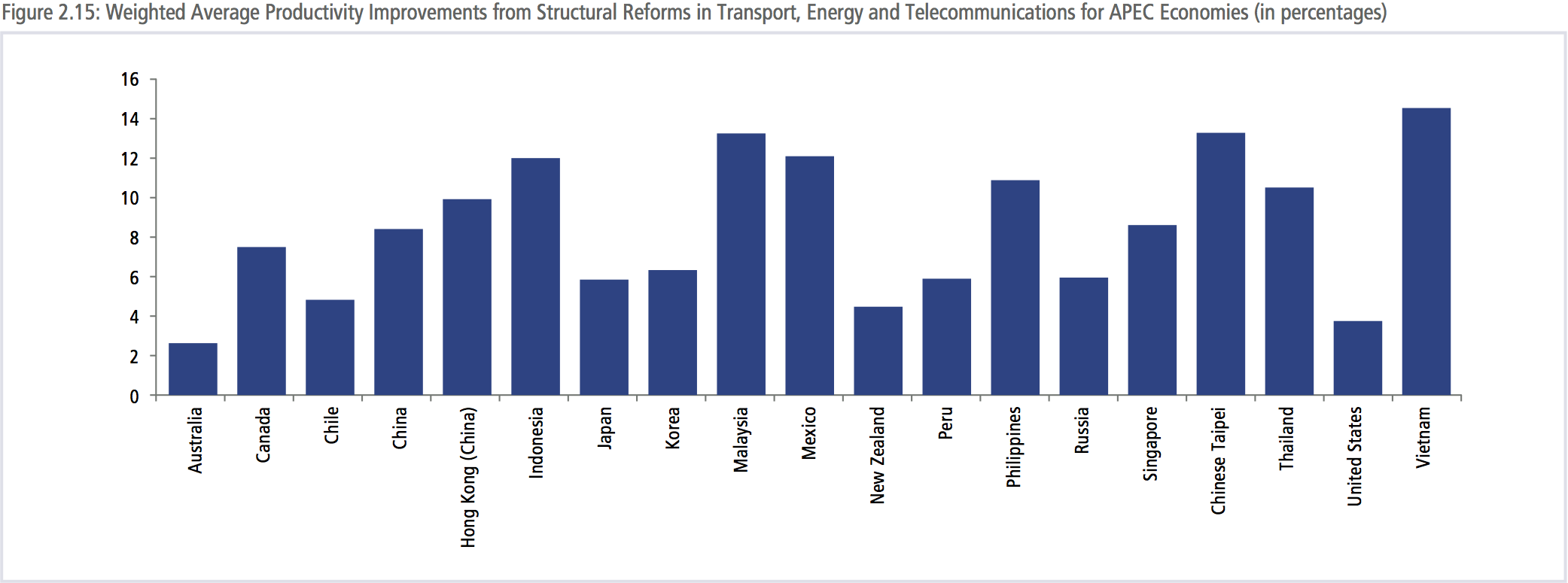

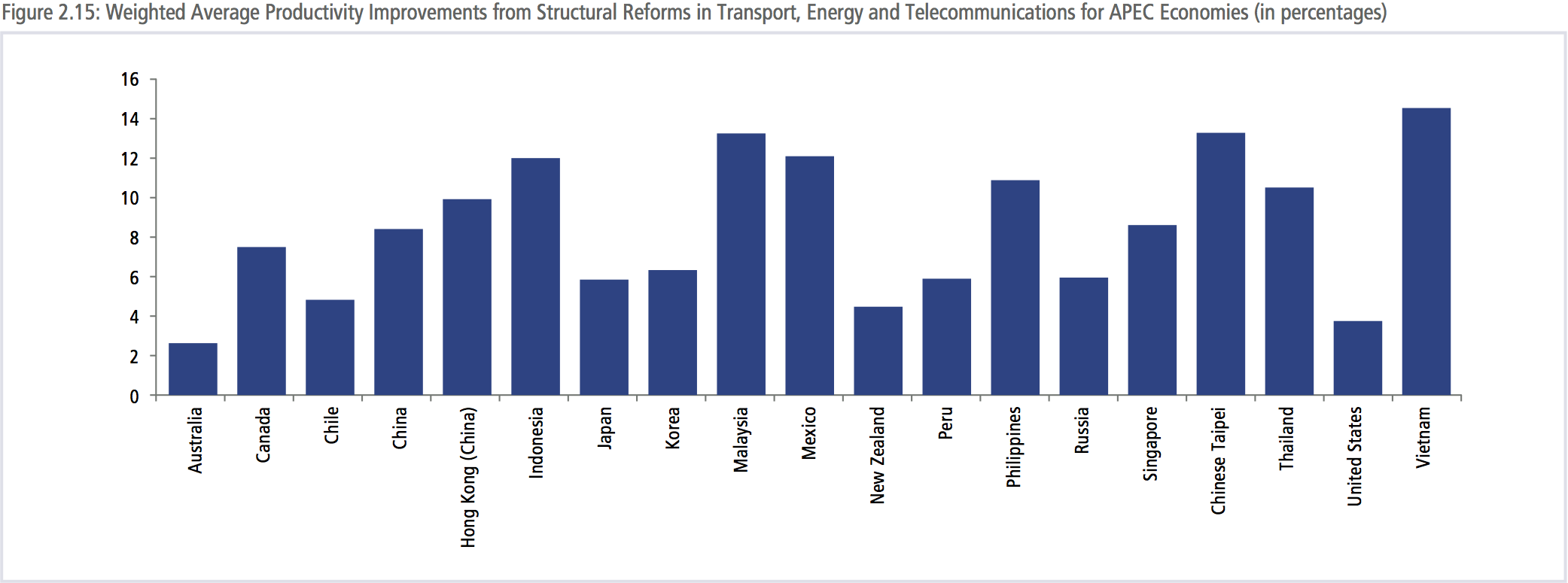

Another study carried out by Philippa Dee focusing on these same infrastructure services sectors within APEC, shows that the weighted average productivity improvement from reform would be between 2 and 14 percent.22 As Figure 2.15 indicates, the most extensive reforms but also the major gains are expected to take place in Indonesia, Malaysia, Mexico, the Philippines, Chinese Taipei, Thailand and Vietnam. These gains will be all the more 22 Philippa Dee, Services Trade Reform: Making Sense of It, World Scientific Studies in International Economics, Volume 28, 2014, ISSN 1793-3641. important as they would remove the welfare losses caused by sub-par productivity on the part of services, which has a greater negative impact than the actual application of tariffs. Structural reforms in these infrastructure sectors can come from the increase in competition in the segments that are not dominated by ‘natural monopolies’, even when keeping current ownership structures. The appropriate level of competition depends on the specific sector.

There have already been several success stories in the Asia-Pacific region that confirm the importance of enhancing competition in services. The APEC Services Competitiveness Roadmap highlights some of these, as reproduced in Box 2.3.

BOX 2.3: SUCCESS STORIES IN APEC AS A RESULT OF ENHANCING COMPETITION IN SERVICES

- Airfares in Korea fell by 20-30 percent as a result of increased competition from low cost carriers in 2006;

- Rail fares in Chile were 40 percent lower after the governmentowned rail corporation divested some of its operations;

- Freight rates between Thailand and Laos fell by 20-30 percent when quotas on cross-border freight licenses were removed;

- Retail competition reduced electricity prices in the United States by 5-10 percent for residential customers and by 5 percent for industrial customers;

- In Vietnam, a transparent and predictable regulatory environment to foster competition in telecommunications reduced prices and increased mobile phone penetration to 80 percent;

- The number of mobile subscribers rose by 700 percent after the introduction of competition in Papua New Guinea. Charges also fell by 11 percent during peak times for local calls and 51 percent during off-peak periods.

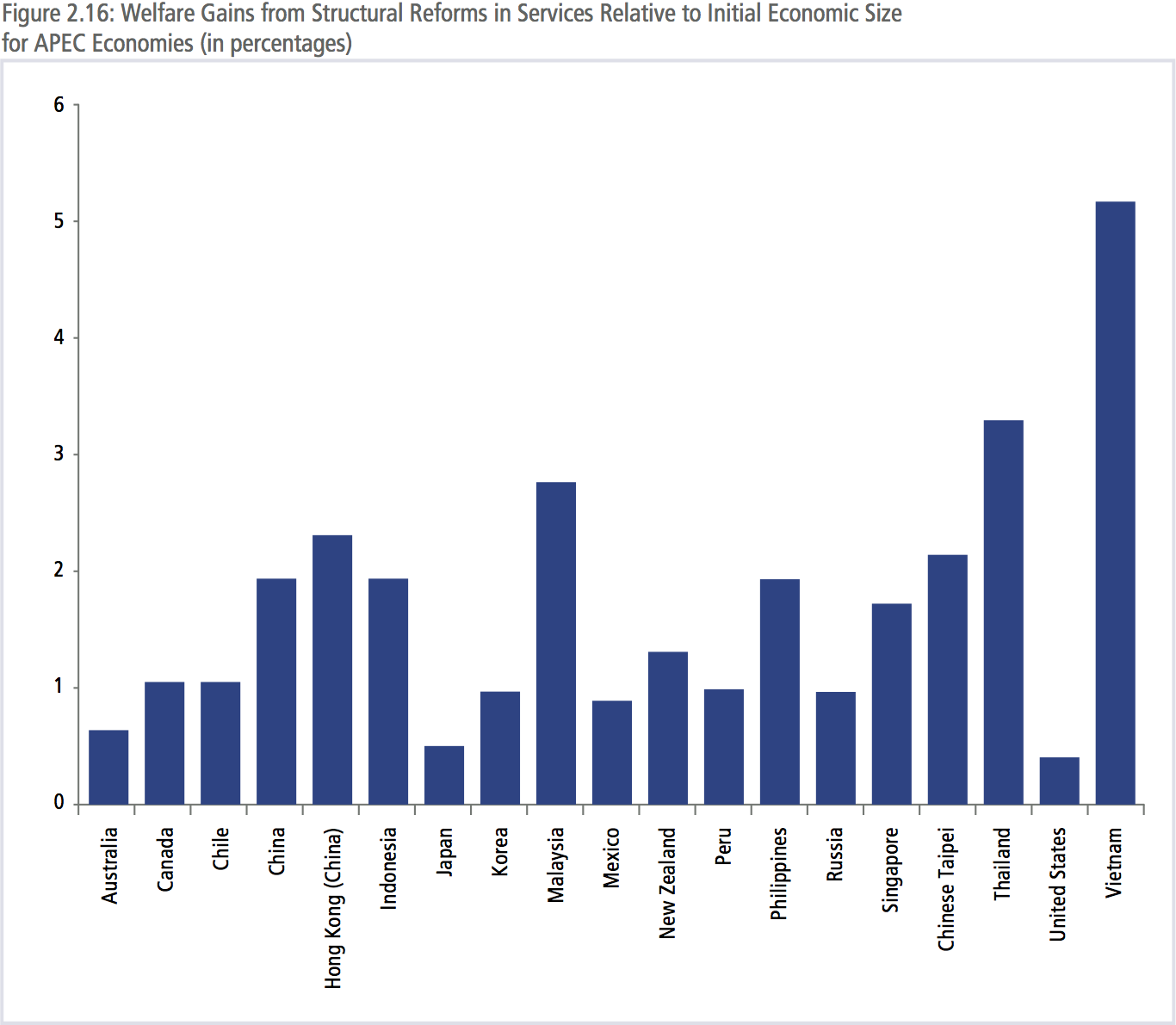

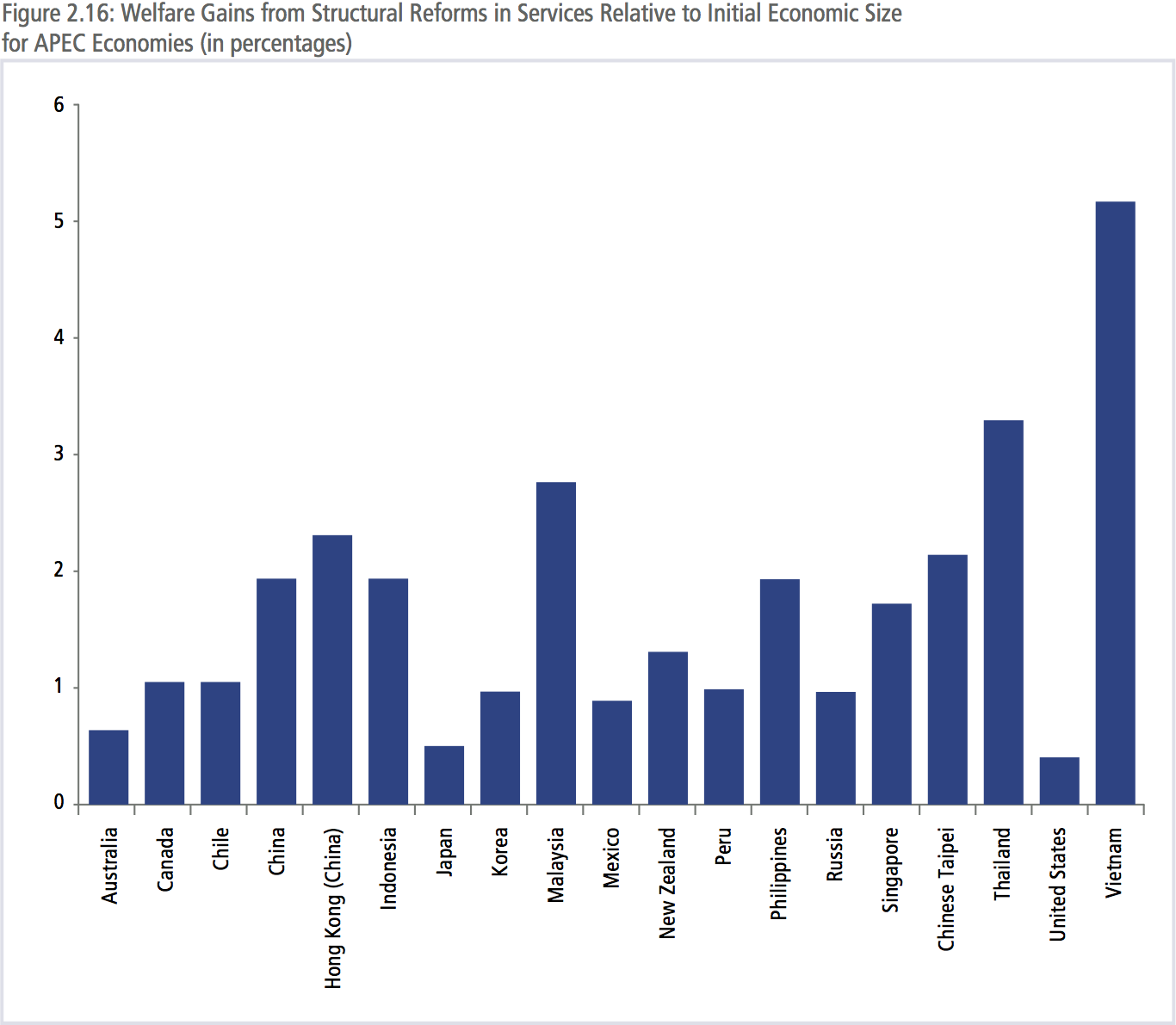

The expected welfare and real GDP gains from structural reforms in services for the different economies in APEC are expected to vary. Figure 2.16 presents the welfare gains from structural reforms relative to each economy’s initial GDP, suggesting a correlation between the expected gains and the extent of the services reform to be undertaken. The economy that would have to undergo the most extensive reform but that would also derive the largest benefit would be Vietnam, with welfare and real GDP gains of around 5 percent. Thailand and Malaysia would also realize significant gains of around 3 percent of GDP after undertaking structural reforms in services, with several economies showing potential gains of around 2 percent of GDP (China, Hong Kong (China), Indonesia, Philippines and Chinese Taipei).

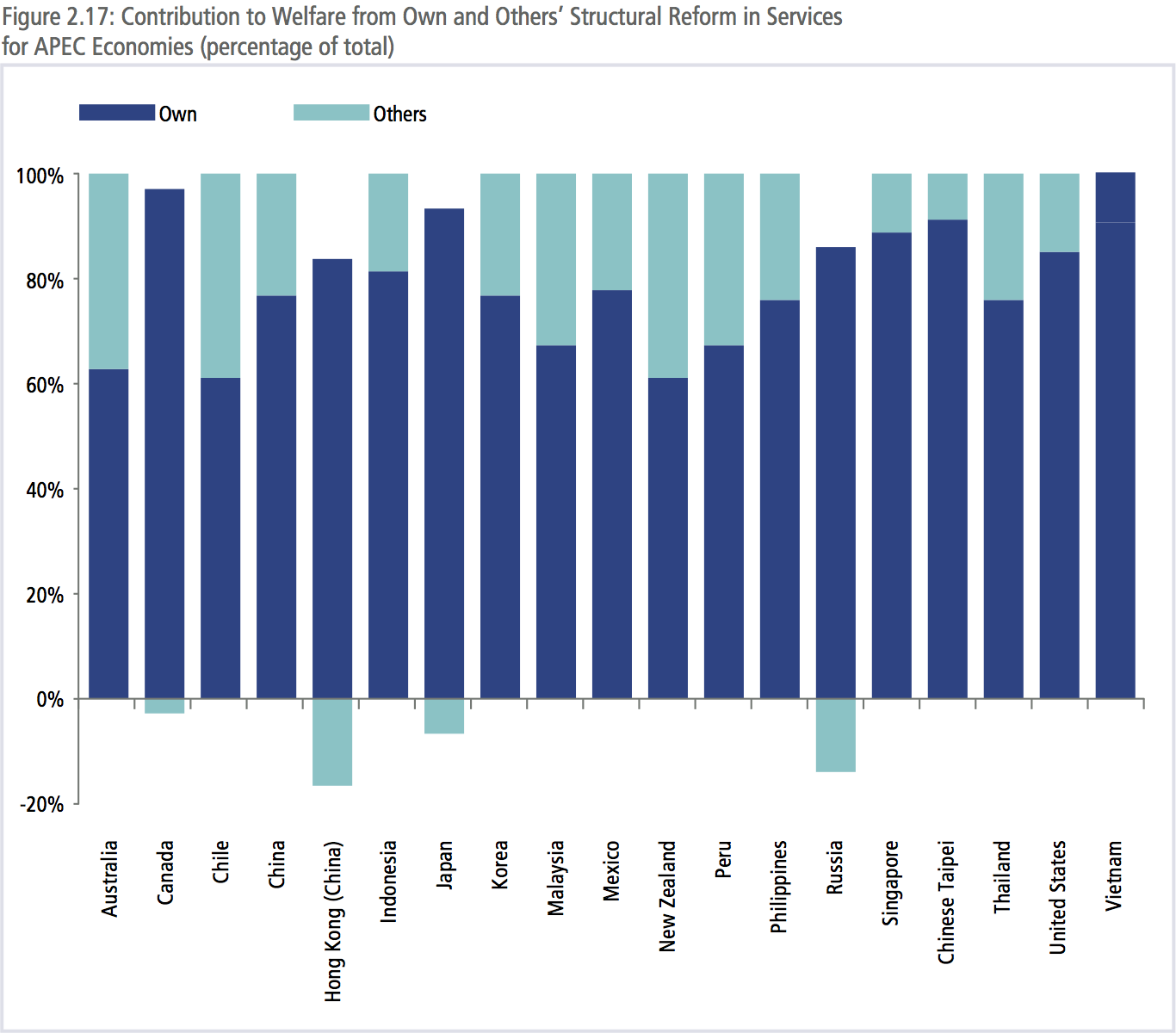

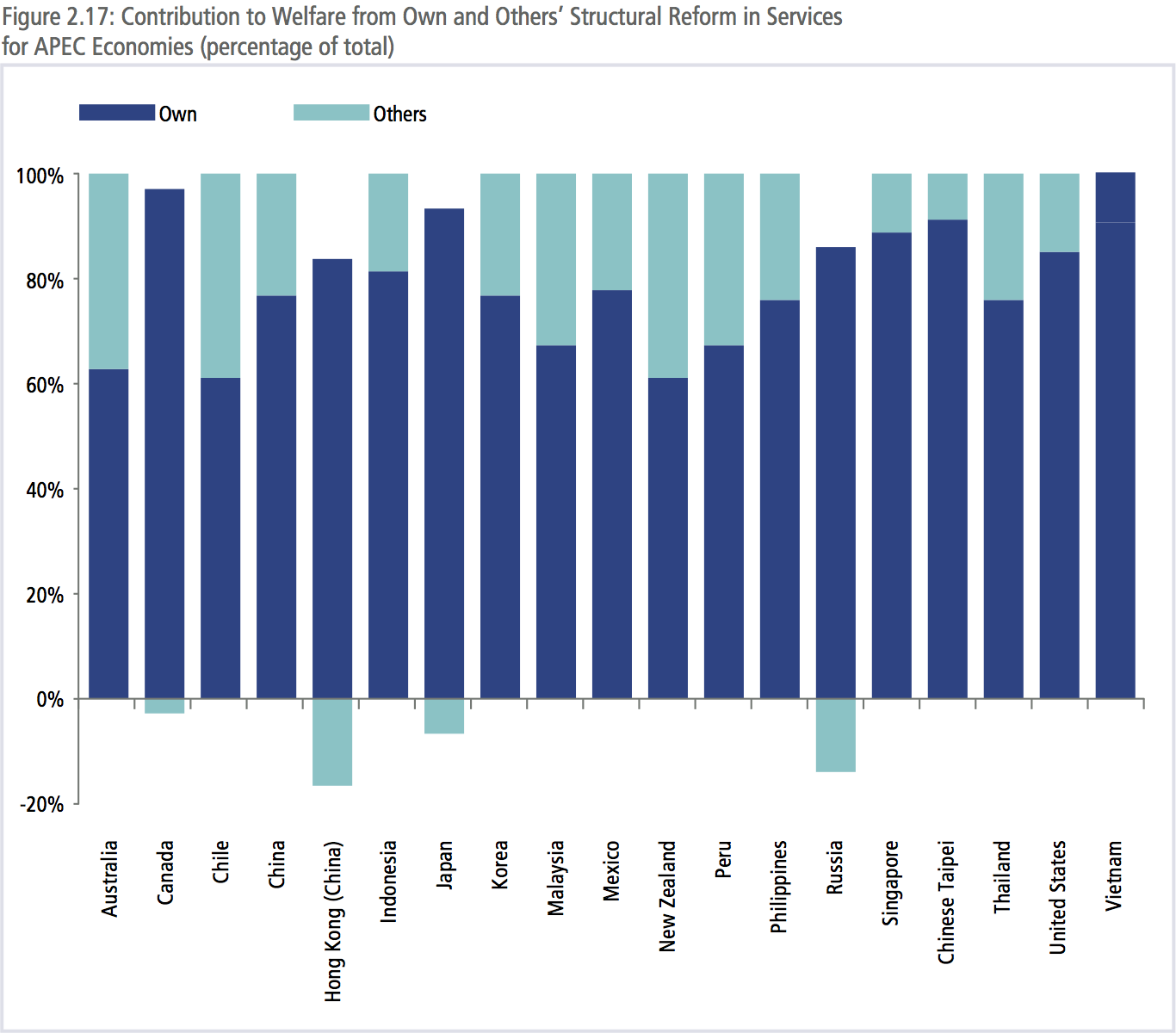

Of direct relevance to policy makers, it is key to observe that the vast majority of the potential gains to be derived from structural reform in services is realized from unilateral action. Figure 2.17 breaks down total gains into two parts: those deriving from domestic reform and those deriving from others’ reforms. For all APEC economies, more than 60 percent of the gains derive from their own reforms. Thus, it is clear that the primary urgency for action on structural reform lies with national governments and not with collective decision-making, though this can also help to provide emphasis to unilateral policy decisions. But to generate benefits, there is actually no incentive for governments to wait for others to make the first move.

FUTURE CHALLENGES

Due to the highly restrictive content of services regulations and the lack of policy focus that was the case for many years, services are still not providing the potential they could and should for economies in the Asia-Pacific to enhance their growth and improve their competitiveness.

To advance on this path it will be critical for APEC to progress the targets contained in the Services Competitiveness Roadmap in order to move closer toward the Bogor Goals of free and open trade in services and investment by 2020 and beyond. Many future challenges remain for the Asia-Pacific in the area of services liberalization and structural reform that need to be met through well-targeted work in this context.

In moving forward towards more open and efficient services economies, the Asia-Pacific region can think of addressing the challenges of services liberalization and reform along a threepronged path: continuing with the autonomous services opening that has been a driving force in recent years; setting and monitoring targets for services liberalization and structural reform within APEC within the APEC Services Cooperation Framework and the Services Competitiveness Roadmap at both the economy and regional level; and negotiating supportive trade agreements with strong services components. While the concluded or future potential megaregional trade agreements (TPP, TTIP and RCEP) offer important benefits in terms of making the policy environment for services trade more predictable, they also risk dividing the world into separate blocs where different rules apply. The plurilateral Trade in Services Agreement (TiSA) that is under negotiation offers yet another pathway forward that may be more acceptable to a larger number of economies and more inclusive, depending upon how it is applied once finalized (on an MFN or non-MFN basis) and whether or not its deeper disciplines for services can be incorporated in some form into the WTO framework so that those WTO members applying it can have access to the dispute settlement mechanism.

Given the potential benefits that services can generate in terms of employment, more efficient outcomes in all sectors of the economy, enhanced productivity and innovation, and achieving more inclusive growth patterns, services should and must remain a high priority focus of the Asia-Pacific.